The reporting season has come right up here! Australia enters the earnings season to report the corporate results of ASX-listed companies for the fiscal year ended 30 June 2019.

There is a lot of excitement in the global financial landscape with Wall Street gaining strength on the robust earnings of the technology companies, Federal Reserve likely to cut interest rate in the July meeting and the fresh developments in que on the Sino-US trade conflict.

Now, Australia reaches close to add flavour to the macro-economic environment on the fruits of its corporate world. Its reporting calendar marks the start of financial resultsâ announcement from the last week of July 2019 while most of the Australian companies are expected to report their FY 19 or HY 19 results in the month of August.

The reporting season outlines the most crucial time in the financial market, factoring-in to the stock price momentum in the markets live. It leads to a lot of volatility where investors take the entry or exit positions based on the fundamental picture of the company, i.e. the revenue and profit margins, latest developments in business, and the future outlook for growth.

In such a scenario, itâs not an easy task to skim through the results of all the companies and plan the next move. Therefore, its always advisable for investors to have an investment strategy in hand before reacting to any earnings report.

Favourite Sectors- Classifying investment portfolio on the basis of different sectors provides cushion to investorsâ money. There are times when a specific sector gets knocked down due to a common event, regulation or other factors impacting the entire industry like it lately happened in the financial industry reflecting the royal commissionâs reforms coupled with the global crash in the sector.

In such a case, the investment in diversified sector sets off the possible losses of investors. One should select the sectors they want to invest in and the sectors that pose attractive growth opportunities in future.

What are the numbers telling? To have a clear understanding of the companyâs financials, one should look at the financial metrics and analyse how much strength do the company holds behind those numbers. Therefore, it may be a prudent option for the investors to shape their understanding of NPAT (Net Profit After Tax), EBIT (Earnings Before Interest and Tax), Gearing ratio, Current ratio, Gross Margin, and Price to Earnings multiple, among other financial metrics.

Calculate your risk appetite- The reporting season fuels the volatility in the market that leads to high market risk in the face of unexpected active market sentiments. If you are a risk-averse investor, look for the companies that have positive announcements and reports that could confirm the fundamental qualities of the company.

But to the contrary, if your risk appetite is high, you can take advantage of going against the market sentiments and taking positions when the news is not that good about the company, but the fundaments are strong.

Look at the revised guidance of the companies- The ASX-listed players just had the confession period some time back where most of the companies downgraded their profitability outlook for the fiscal year/half year ended 30 June 2019. Letâs have a look at the revised guidance of some companies:

Costa Group Holdings Limited (ASX: CGC)- Consumer staples company, Costa Group Holdings recently downgraded its earnings guidance for the full calendar year 2019 which are expected to be above the results of the prior year but below its previous outlook.

Costa now expects its CY2019 EBITDA-SL to range within $140 - 153 million and NPAT-SL to be between $57 â 66 million. This is in comparison to CY2018 EBITDA-SL of $125 million and NPAT-SL of $56.6 million.

The underperformance of Costaâs citrus business coupled with weaker demand for mushroom and the softening in its prices due to warm weather have contributed the most to the companyâs downgraded guidance.

Costaâs half-year results for the six months ended 30 June 2019 are scheduled to be announced on Friday, 23 August 2019.

CGC is trading at $4.140 as at 24 July 2019 (1:41 PM AEST).

The Reject Shop Limited (ASX: TRS)- Owner of several discount variety stores in Australia, The Reject Shop Limited disappointed investors after it confessed that the company is expected to report a full-year FY2019 net loss of $1.0 million-$2.0 million, contrary to the initial outlook of reporting a net profit after tax of $3.1 million-$4.1 million.

The retailer blamed the competitive environment and below-than-expected benefits derived from Sales and Merchandise related initiatives as the reason for downgraded guidance (May 2019 Report).

TRS is trading at $2.120 as at 24 July 2019 (1:55 PM AEST).

Flight Centre Travel Group Limited (ASX: FLT)- A billion-dollar travel group, Flight Centre downgraded its profit guidance for fiscal 2019 from $390million-$420million range to the revised range of 335million - $360million profit before tax (PBT).

In the guidance update to the market, Flight Centre told that due to the challenging trading environment in Australia, the total transaction value (TTV) in the second half had been negatively impacted.

Flight Centre is expected to release its full-year FY19 results on 22 August 2019. FLT stock price is trading at $45.290, up 1.343%, as at 24 July 2019 (2:41 PM AEST).

P2P Transport Limited (ASX: P2P)- P2P Transport Limited, an industrial sector company that operates as a fleet manager and taxi owner, suddenly announced the decline in its earnings expectation for Fiscal 2019. While the reporting season was around the corner, P2P stated that it expects its pro forma underlying EBITDA to range within $5.6 million to $5.7 million, well below the previously announced earnings outlook of $7.8 million to $8.2 million.

The decision came in the last week of June 2019 amid its ongoing strategic review. P2P explained that one-off costs and non-recurring costs relating to the acquisitions of Non-Stop Media has been one of the principal factor contributing to the downgraded guidance.

P2P shares last traded at $0.115 as at 24 July 2019.

Empired Limited (ASX: EPD)- Information Technology company, Empired Limited confessed its lower earnings outlook after Main Roads reduced the scope of services under its existing contract with Empired.

As a result, the company evaluated a negative impact on its financials and announced downgraded guidance that eyes EPDâs FY2019 underlying EBITDA to range within $1.5 million-$2.0 million, below the previously announced outlook.

The earnings expectation were also impacted by the bidding outcome where government agency Main Roads Western Australia did not select Empired Limited as its preferred bidder for ICT Infrastructure and Systems Services.

EPD stock price last traded at $0.300 as at 24 July 2019.

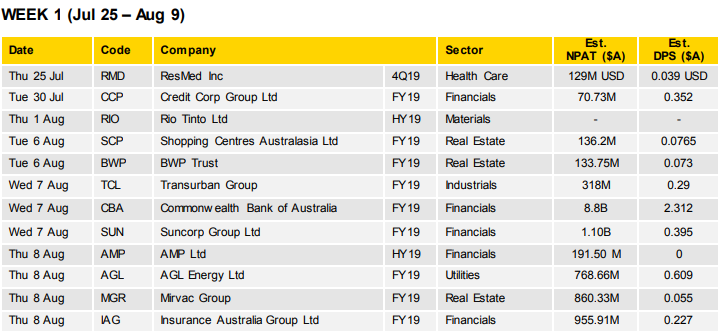

The Australian reporting season is slated to begin with some big shots, like ResMed Inc (ASX:RMD), Rio Tinto Ltd (ASX:RIO), Commonwealth Bank of Australia (ASX:CBA) and Credit Corp Group Ltd (ASX:CCP), among others. These companies are expected to report their earnings in the first week of reporting season. To have a more detailed view of the reporting calendar and estimated profit and distribution of the companies, look at the following chart:

Reporting calendar of first two weeks (Source: CommSec)

Since Reserve Bank of Australia (RBA) has brought the interest rates to the historically low level of 1.00%, the market participants expect this reporting season to take the stock exchange to the record high not seen since 2007. RBA made the rate cuts back-to-back in June and July meeting by 25 basis points in each meeting.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.