August is round about the corner, which indicates that the reporting season is almost here. Post the close of annual books in June end, companies pace up to release their earnings update. Amid the vitality of this period, experts believe that the time is just right for some stock indulgence. No one guarantees the fruits of it, as we thrive in a dynamic business environment where one day can be drastically different from the previous or interestingly, the next.

2019 has been a year of reflective change, on the global level and closer to home in Australia as well. We are currently witnessing a slump in the global economy with trade wars, soared debts and high valuations. Triggering this is the section of experts who believe that this phase is likely to witness a market return on levels that have not hovered over since the record high of 2007.

Optimistically for Australia, the historic and consecutive rate cuts are likely to be beneficial for business, promising sturdy dividend returns. In The Royal Commission Era, economic reforms and financial policies are bound to result in a positive business culture. Moreover, the tech-savvy Aussie land has taken significant leaps in developments and is thriving well and hard to be in sync with a world that is pacing towards advancements in the name of Artificial Intelligence, Cultured Meat, Electric Vehicle Revolution, Satellite Sector, 5G Boom and Virtual Business forms.

In this backdrop, let us look at the recent performance of the share market indices and understand the trends that investors should be wary about:

S&P 500 soars high, All eyes on Earnings

The close of business on 22 July 2019 marked it to be a historic day for the S&P 500, which climbed toward a record high of 2985.03, just to lag by 1 per cent to break its record high close marked recently. It should be noted here that in the last decade, the S&Pâs annual total return has been approximately 12.08 per cent.

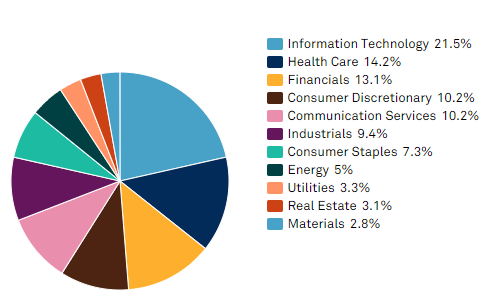

Sector Breakdown of the S&P 500 (Source: S&P Dow Jones Indices)

The trend has been hinting on the return of the bull market in the trading space, with major players like Facebook Inc. being 2 per cent up, followed by two other Big Four Tech Players- Amazon.com Inc and Google-parent Alphabet Inc, rallying up the ladder by approximately 0.7 per cent. The fourth participant of the Big Four Tech Group did not fall behind, as Apple Inc added on a 2.3 percent to $207.22 post the Morgan Stanley target raise to $247 from $231. Adding on to the technology space, S&P 500 Information Technology index, SPLRCT, was up by 1.2 per cent.

Interestingly, the market is awaiting the quarterly earnings of these companies, and the soared performances would be a boost in the broader market. Along with these giants, around 30 per cent of S&P 500 companies would be releasing their respective second-quarter results later this week.

Moreover, market experts believe that the hope of an interest rate cut has helped the main indexes of the Wall Street to hit record levels this month, post a slowdown in May that had escalated due to the US and China trade chatter. There is an anticipation of a 10-basis-point cut in interest rates post the European Central Bank meet this week, which might lead to lowering of the rates by at least 25 basis points. The Federal Reserve declaration of the rate cut is due in the end of this month.

Current Performance and Returns:

As on 23 July 2019, the annual return of the S&P 500 Index was 6.54 per cent, and the three and five-year annual returns (CAGR) were 11.13 per cent and 8.52 per cent, respectively.

The below chart depicts the 6-month total return of the S&P 500 Index. The absolute price change return is 13.37 per cent, whereas the total return up until 23 July 2019 has been 14.28 per cent.

6-month return of S&P 500 Index (Source: Thomson Reuters)

Also Read: The S&P 500 Hits A Record High â How About ASX 200?

The ASX Update Amid the Wall Street surge:

Post the buoyant performance of technology stocks on the US indices, The Aussie shares are expected to be on the higher side of trade and records.

After the close of business on 22 July 2019, the Australian shares had dipped, with the S&P/ASX 200 Index closing down 9.1 points, slightly lower by 0.1 per cent at 6691.2, compared to its previous close. Experts state that the slump was a result of the slid of the previous expectation for a 50 basis point cut.

Post the close of trade hours on 23 July 2019, the S&P/ASX 200 Index was recorded at 6724.6, up by 0.5 per cent. The S&P/ASX 200 Energy Index surged by 1.34 per cent to 10,834.9 while the S&P/ASX 200 Consumer Discretionary Index was up by 0.88 per cent to 2,552.0.

Letâs look at the Top Gainers, who drove this surged performance, directing the index straight into the good books of investors:

- Topping the chart was Bellamyâs Australia Limited (ASX: BAL), with its stock up by 4.89 per cent, at A$9.86, post the trade hours of 23 July 2019. The stock has delivered a YTD return of 23.85 per cent and has maintained a P/E ratio of 37.75x.

- Following the footsteps of BAL in the upswing was technology software and services provider Afterpay Touch Group Limited (ASX:APT), with the stock surging by 4.26 per cent and closed at A$24.68. With a YTD return of 97.25 per cent, the company has a market capitalisation of A$5.98 billion.

- The third best gainer of the day was industrial player and pioneer of geospatial map technology, Nearmap Limited (ASX: NEA), with its stock trading up by 4.14 per cent, relative to its last trade and closed at A$3.270. The YTD return of the stock is 105.23 per cent.

- Following NEA was New Hope Corporation Limited (ASX:NHC), with a stock price of A$2.65, which traded up by 3.9 per cent relative to its last close.

- The 5th player in the surge game was Real Estate player, Aveo Group Limited (ASX:AOG), with its stock priced at A$2.010, up by 3.34 per cent. The YTD return of the stock has been 27.96 per cent.

Current Performance and Returns:

As on 23 July 2019, the annual return of the S&P/ASX 200 Index was 7.98 per cent, and the three and five-year annual returns (CAGR) were 6.94 per cent and 3.81 per cent, respectively.

The below chart depicts the 6-month total return of the S&P/ASX 200 Index. The absolute price change return is 15.07 per cent, whereas the total return up until 23 July 2019 has been 17.54 per cent.

6-month return of S&P/ASX 200 Index (Source: Thomson Reuters)

With 2019 being tagged as a year of transformation and reforms, it would be a stimulating sight to watch the trade activities unfold their outcomes, while investors await good returns and the hunt for profitable investments stays on.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.