The technologies powered by Artificial Intelligence are transforming the industrial landscape as AI has the potential to improve efficiency, accuracy and productivity across an organisation. Artificial intelligence emphasizes on the creation of intelligent machines that react and work like human beings. It is believed that under the influence of AI, many sectors including healthcare, financial and transportation would undergo an immense transformation. Artificial Intelligence would enable the provision of more cheap and productive services by these sectors.

The Australian government has recognized the importance of innovation in the technological space and has taken some significant moves in recent months. The government set up the Office of Future Transport Technologies in late 2018 to help prepare Australia for the upcoming arrival of automated vehicles and few other innovations in the transport sector. The federal government also allocated $29.9 million for enhancing the efforts of the country in artificial intelligence and machine learning over four years in the countryâs 2018-19 budget.

How Are Different Sectors Using AI technology?

Artificial Intelligence technology has been witnessed as an emerging asset by the business leaders and has already transformed the way of operation across different sectors. Let us have a look at some of these sectors below:

Healthcare Sector: AI technology enables the collection of more in-depth data of patients in the healthcare industry related to different diseases like Parkinsonâs tremors, asthma management etc. Besides this, the health sector is using the technology for intelligent emergency triage, virtual nurses, intelligent emergency triage, among others.

Finance Sector: The finance sector is at the forefront of investment in AI currently. The finance companies are using machine learning technology to determine which companies to fund. Also, the companies are using AI to collect financial data and anticipating changes in the stock market using predictive analytics. The companies are adapting automatic learning, automation, adaptive intelligence and bots at high speed.

Retail Sector: AI technology is deployed in the retail sector as autonomous robots that scan shelf inventory and help store personnel with metrics, inventory data and shelf intelligence. The technology also assists in expert advice on purchases, customer service and operations related to multiple channels. The retail sector is expected to surpass the finance sector in deploying AI technology.

Education Sector: Artificial Intelligence is allowing the automation of administrative tasks in the education sector so that the institutions can reduce the time required to complete complex tasks and focus more on students. Besides this, the technology enables the provision of smart content to the students by digitizing textbooks and creating new learning interfaces.

Transportation Sector: It is another major sector where AI technology has progressed a lot. The self-driving cars, autonomous bus service, intelligent search for route optimization and free parking spaces, and radars to detect obstacles and pedestrians are all the advances made by AI technology in the transport sector.

ASX-Listed Artificial Intelligence Stocks

Several information technology firms are transforming the way of living by providing AI technology services across the world. Let us have a look at three of such companies that are also listed on the Australian Stock Exchange:

LiveTiles Limited

A New York-headquartered global software company, LiveTiles Limited (ASX: LVT) offers intelligent workplace software for the education, government and commercial markets. The company operates across many cities like San Francisco, North Carolina, Seattle, London, Amsterdam, Melbourne, Sydney, among others. The companyâs products include LiveTiles Intelligent Workplace, LiveTiles for SAP Software, LiveTiles Design, Hyperfish, LiveTiles Intelligence and a lot more.

Operational Performance: In June this year, the company announced the official launch of LiveSmiles, intelligent corporate wellness solution, in collaboration with Microsoft, the companyâs global launch partner. The product was introduced with the help of Deloitte Australia at the head office of the company in Melbourne. The company informed that LiveSmiles would incorporate key features like AI-powered Bot Assistant, real-time recommendations to managers and data analytics and insights.

The company also launched its AI-driven, data-centric security solution across Microsoftâs collaboration channels in conjunction with its alliance partner Nucleus Cyber in June.

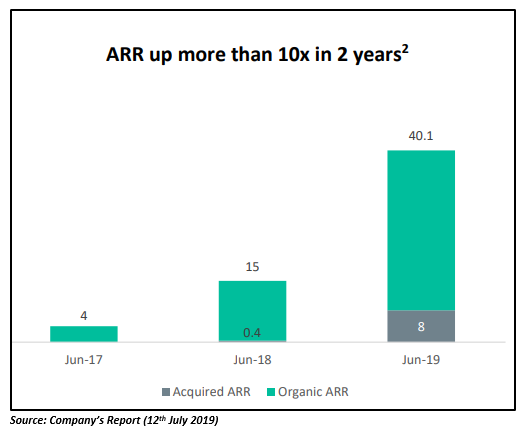

Financial Performance: Recently, the company reported that its ARR (Annualised recurring revenue) reached $40.1 million as at 30 June 2019 against the ARR of $34.5 million as at 31 March 2019. LiveTiles notified that it was a record quarter of annualised recurring revenue (ARR) growth as ARR was ten times up in comparison to the figure reported two years ago.

Stock Performance: The companyâs stock is currently trading lower on ASX at AUD 0.480 (as at 3:47 PM AEST on 17th July 2019), down by 6.8 per cent relative to the last closed price. The stockâs market cap was recorded as AUD 353.08 million at the time of writing the report. LVT has delivered an enormous return of 58.82 per cent on a YTD basis and 22.73 per cent over the last one month.

Gooroo Ventures Limited

The Australian-headquartered company, Gooroo Ventures Limited (ASX: GOO) supports organisations in making better decisions and value generation by providing a new meaning to the organisationsâ data. The company applies its human thinking science and unique technology to empower every organisation to its true potential.

Operational Performance: In an announcement on ASX on 1st July 2019, the company informed that it has entered into a Master Licence Agreement with ManpowerGroupâs Australian operation to support major redeployment and reskilling initiatives. Under the agreement, ManpowerGroup would get the right to deploy the companyâs technology across its client portfolio.

The company also entered into a commercial licence agreement with Biz Group, which is a UAE-based company providing professional services, teambuilding and learning solutions. Under the agreement, Biz Group would be able to use and distribute the companyâs technology with its major customers.

Financial Performance: In February this year, the company released its interim financial report for the half-year period ending 31st December 2018. The company reported a rise of 331 per cent in its revenue from ordinary activities to $421,748 during the period. The loss of the company attributable to the owners of Gooroo Ventures Limited for the half-year was also 48 per cent down to $934,079.

Source: Companyâs Report (28th February 2019)

Source: Companyâs Report (28th February 2019)

Stock Performance: The companyâs stock is currently trading flat at AUD 0.060 (as at 3:47 PM AEST on 17th July 2019). The performance of the stock has been fairly well in 2019 to-date, delivering a YTD return of 25 per cent. In the last month alone, the stock has generated a return of 42.86 per cent.

Spectur Limited

An Australian-based company, Spectur Limited (ASX: SP3) owns the rights to its disruptive cloud based IoT and security systems and innovative hardware system operating in Australia. The company currently services the construction/building/civil industry and utilities/government sector. The companyâs core products include surveillance and solar powered deterrence systems and associated cloud-based platform.

Operational Performance: The company reported in June 2019 that it has reached an agreement with Westpac Banking Corporation (ASX:WBC) for a $1m debt facility that would support the company in securing operating cash flow for fluctuations related to higher value orders and continuing pursuing its strategy.

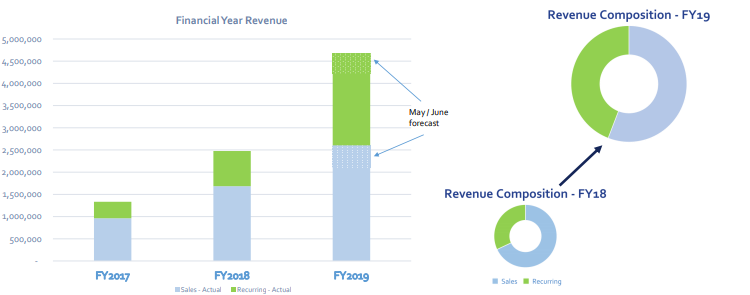

Financial Performance: Recently, the company announced its quarterly results for the three months ending June 2019 (Q4 FY19). Spectur delivered the strongest quarterly revenue to date in Q4 FY19 of $1.45 million, which was 23 per cent higher than the revenue in Q3 FY19. The company also achieved the strongest sales results of $627,000 in June 2019. The cash balance at the bank as on 8th July 2019 was reported as $2.16 million.

The company also delivered strong financial results during the half-year ending 31st December 2018 with its revenue improving 94 per cent.

Source: Companyâs Presentation (8th May 2019)

Source: Companyâs Presentation (8th May 2019)

Stock Performance: The companyâs stock is currently trading higher on ASX at AUD 0.125 (as at 3:47 PM AEST on 17th July 2019), up by 8.69 per cent relative to the last closed price with a market capitalisation of AUD 7.13 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.