The new record high:

The S&P 500 had hit a new record high on 20 June 2019 in a broad market rally, post the Federal Reserve revealed its probable intention to cut interest rates in the next month. It gained 0.95% to 2,954, breaking its previous record of high close in the first week of May.

Interestingly, all the 11 S&P 500 sector indexes showcased gains in this record, with the oil prices up by over 5 percent, the energy stocks rolling up by 2.21 percent and the technology space surged up by 1.43 percent.

Exchanges across the globe:

In the light of the record set by S&P 500 at 0.95%, let us look at the performances of other global indices in the same time period. The Asian shares woke up to a modest beginning on 21 June 2019, but the Mainland Chinese stocks were up by nearly 0.45% (Shanghai composite). The Hong Kong index (Hang Seng index), however, plunged by 0.12%. Close by in Japan, the Nikkei 225 was lower, and the Topix index traded down by approximately 0.20%. Following suit, the Kospi in South Korea was down by 0.13%. The S&P/ASX 200 in Australia was slashed down by 0.28%.

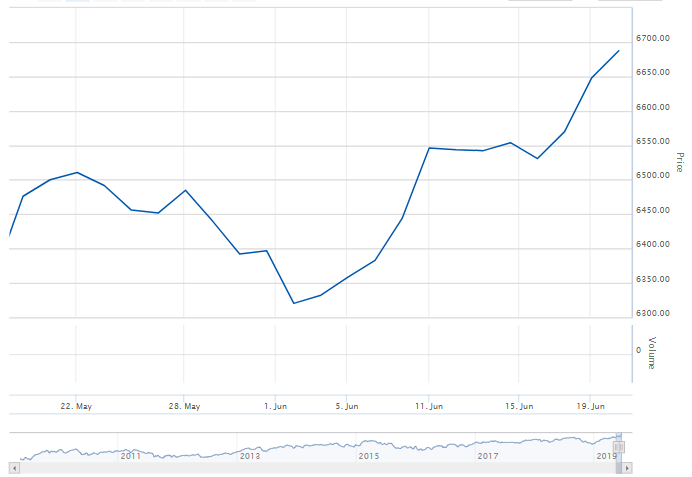

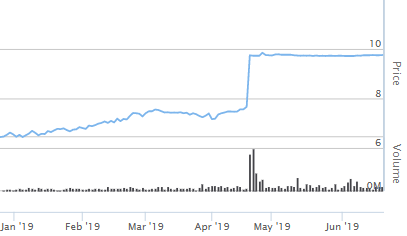

The S&P/ASX 200:

On 21 June 2019, the S&P/ASX 200 witnessed a flat opening wherein the ASX futures had slipped 4 points, or by 0.1%. The ASX was recorded to be down by 0.3% at mid-day, and this put an end to the continuous positive streak of 3 days to an end.

A hot stock and mining giant Rio Tintoâs (ASX: RIO) shares plunged by over 4%, given the challenges being experienced at the companyâs prime mine in the Pilbara region.

However, the gold prices surged up by 3.6%, recording the yellow metalâs five-year high.

Amidst this, the bets for the rate cuts from the RBA, jumped to almost 70% probable in the next month.

The S&P/ASX 200 performance graph, 20 May 2019- 20 June 2019 (Source: ASX)

Let us now look at few stocks listed on ASX and their performance as on 21 June 2019:

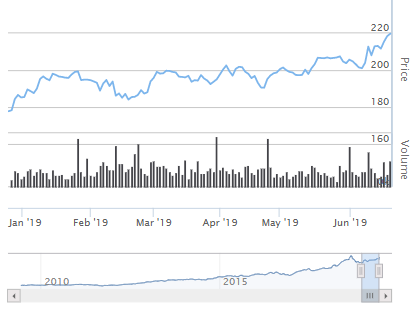

CSL Limited (ASX:CSL)

A pharma and bio tech player working towards the development, production and marketing of pharmaceutical and diagnostic products, cell culture media and human plasma fractions, CSL was listed on ASX in 1994.

On 21 June 2019, the company announced that it would transition to its own Good Supply Practice License in China in FY2020, for the sale of its products in the Chinese market.

The companyâs stock traded down by 3.17% from the previous close, on the close of business and was valued at A$212.500. The stock has delivered returns of 6.34%, 12.87% and 24.94% in the past one, three and six months, respectively.

CSLâs stock performance (Source: ASX)

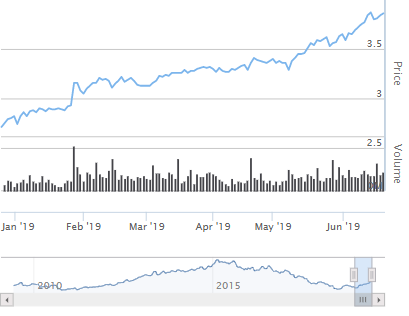

Brambles Limited (ASX:BXB)

A supply-chain logistics player, Brambles is operational in over 50 countries, primarily via the CHEP and IFCO brands. It was listed on ASX in 2006.

On 21 June 2019, the companyâs stocks hooked down by 0.845% on the close of business and was valued at A$12.910. The stock has delivered returns of 4.16%, 9.14% and 29.17% in the past one, three and six months, respectively.

BXBâs stock performance (Source: ASX)

Telstra Corporation Limited (ASX: TLS)

Catering to the telecommunications services, TLS provides information services as well including mobiles, internet, and pay television. Telstra was officially listed on ASX in 1997.

On 21 June 2019, the companyâs stock traded down by 2.073% on the close of business and was valued at A$3.780. The stock has delivered returns of 9.04%, 18.40% and 36.73% in the past one, three and six months, respectively.

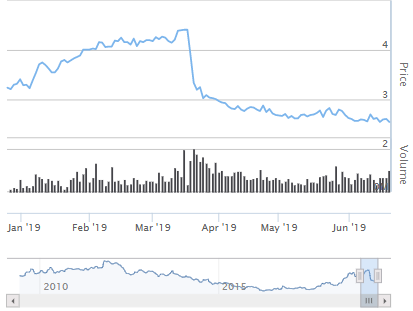

TLSâs stock performance (Source: ASX)

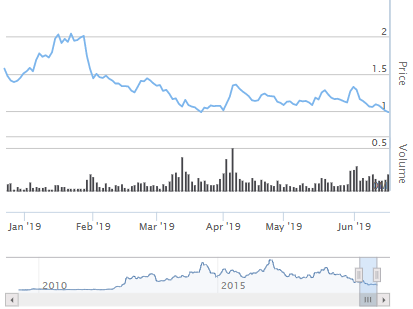

Syrah Resources Limited (ASX: SYR)

A major mining explorer, SYR produced over 100,000 tonnes of graphite at its operations at Balama to become its largest producer globally. Syrah was listed on ASX in 2007.

On 21 June 2019, the company announced that it had completed the institutional component of its 1-for-5 pro rata accelerated non-renounceable entitlement offer, which raised approximately A$25 million and had a take up rate of almost 82% amongst the companyâs stakeholders. The settlement of the new shares would take place on 28 June 2019 and their trading would commence on 1 July 2019.

On 21 June 2019, the companyâs stock slumped down by 11.67% on the close of business and was valued at A$0.870. The stock has delivered negative returns of 23.05%, 7.08% and 41.72% in the past one, three and six months, respectively.

SYRâs stock performance (Source: ASX)

DuluxGroup Limited (ASX: DLX)

Catering to Australia, New Zealand and Papua New Guinea, DLX is a provider of paint, coatings, adhesives, garden care and other building products and has niche market positions in China and South East Asia. It was listed on ASX in 2010.

On 21 June 2019, the companyâs stock skid low by 4.508% on the close of business and was valued at A$9.320. The stock has delivered returns of 0.41%, 31.36% and 50.39% in the past one, three and six months, respectively.

DLXâs stock performance (Source: ASX)

HUB24 Limited (ASX: HUB)

An Investment and superannuation platform services provider, HUB was listed on ASX in 2007 and is headquartered in Sydney.

On 21 June 2019, the companyâs stock dived down by 2.131% on the close of business and was valued at A$13.320. The stock has delivered a negative return of 0.22% in one month and positive returns of 3.11% and 18.45% in three and six months, respectively.

HUBâs stock performance (Source: ASX)

BHP Group Limited (ASX:BHP)

A minerals exploration, production and processing giant, BHP also deals with hydrocarbon exploration. The company is amongst the oldest listings and was listed in 1885 on ASX.

On 21 June 2019, the companyâs stock was up by 0.441% on the close of business and was valued at A$41.030. The stock has delivered returns of 6.91%, 9.81% and 30.61% in one, three and six months, respectively.

BHPâs stock performance (Source: ASX)

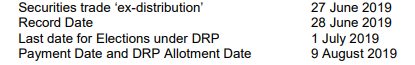

Transurban Group (ASX:TCL)

An owner, operator and developer of electronic toll roads and intelligent transport systems, TCL was listed on ASX in 1996.

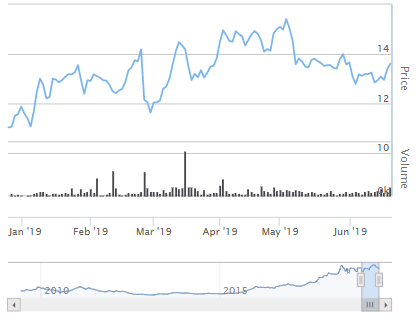

On 21 June 2019, the company notified that a distribution worth 30 cents per stapled security would be paid for the 6 months ending 30 June 2019, the extent of which would be confirmed in the Tax Statements that would come along with the final distribution in August this year. The key dates for the distribution of the DRP are as under:

DRP related dates (Source: Companyâs report)

The company also announced that it would be conducting its AGM on 10 October 2019.

On 21 June 2019, the companyâs stock was down by 0.522% on the close of business and was valued at A$15.260. The stock has delivered returns of 11.48%, 20.03% and 31.11% in one, three and six months, respectively.

TCLâs stock performance (Source: ASX)

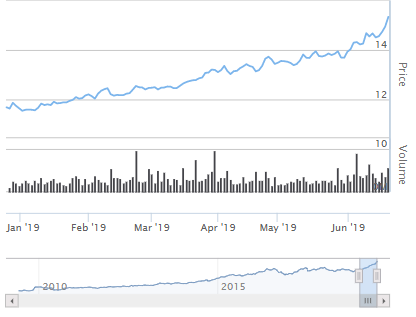

Lynas Corporation Limited (ASX:LYC)

A player of the materials group, LYC is into the production of rare earths concentrate at Mt Weld. Production and sale of Rare Earths products from the LAMP in Malaysia. The company was listed on ASX in 1986.

On 21 June 2019, the company provided an update to its shareholders stating that the market price for NdPr was up by almost 40% over the past 2 months, given the optimistic positioning of the company. LYC continues to work with the Malaysian government for renewal of the operating license, due on 2 September 2019.

LYC also notified that it had announced on 20 May 2019, about the MoU inked with the Blue Line Corporation, for a JV to develop Rare Earths separation capacity in the US. Further, both the companies would be working towards completion of the details.

The company also mentioned, that the relocation of C&L operations to Western Australia is in pipeline.

On 21 June 2019, the companyâs stock was down by 1.136% on the close of business and was valued at A$2.610. The stock has delivered returns of 33.67%, 59.52% and 70.87% in one, three and six months, respectively.

LYCâs stock performance (Source: ASX)

New Hope Corporation Limited (ASX:NHC)

An energy group player in Australia, NHC functions in coal mining, exploration, port operation, oil, agriculture and so forth. It was listed on ASX in 2003.

On 21 June 2019, the companyâs stock rose by 9.02% on the close of business and was valued at A$2.780. The stock has delivered negative returns of 8.27%, 23.65% and 23.42% in one, three and six months, respectively.

NHCâs stock performance (Source: ASX)

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.