As anticipated by the market experts, the S&P/ASX 200 index closed in the positive territory today amid highly expected rate cut by the Federal Reserve in the 30-31 July meeting. The likelihood of a 25 basis-point rate cut by Fed boosted the traction in Australian equities market as investors are flocking to riskier assets like equities. The S&P/ASX 200 ended the dayâs trade at 6825.8 points, with a rise of 0.5 per cent or 32.4 points. The All Ordinaries index also closed 0.5 per cent higher at 6911.4 points.

Anticipations of Rate Cut

The rate cut expectations have strengthened in the wake of rising economic risks from existing trade war between the US and China. With neither country showing an urge to compromise, the International Monetary Fund (IMF) has downgraded its forecast for U.S. economic growth to 1.9 percent in 2020. The IMF has also cautioned that there is a possibility of more U.S. tariffs on China that might lead to sluggish global growth and âprecariousâ 2020. This week, the Chinese and the U.S. negotiators will also meet in Shanghai to improve their trade relationships.

Recently, the Reserve Bank of Australiaâs Governor, Mr Philip Lowe had also signalled for further rate cuts by the central bank to support the ailing economy. While addressing the Anika Foundation Luncheon, he mentioned that the Australian economy is likely to experience an extended period of low interest rates.

Mr Lowe also defended the countryâs current inflation targeting regime, sticking to the existing target band of 2 per cent to 3 per cent.

With a recent reduction in rate cut in July 2019, the current interest rate in the economy stands at 1 per cent. Economists are expecting further rate cuts by the RBA before the end of this year if the upcoming inflation data turns out to be discouraging.

The Australian Bureau of Statistics is expected to announce the CPI data for the June quarter on 31st July 2019.

Let us have a look at the upcoming announcements that can possibly affect the Australian equities market:

Upcoming US-China Trade Talks

As already discussed above, the US and China are expected to hold trade talks in Shanghai this week. The restoration of talks between the two economies is expected to be a welcoming step for the global economy. The expectations of any major progress are very less, but the continuation of the talks after months of halt has spurred little hope. A favourable outcome of the trade talks will probably give a boost to the equity market.

Fed Rate Cut Scenario

A major factor that has already been discussed is the expectation of a 25-basis points rate cut by the Federal Reserve. The Australian dollar is likely to face some pressure in the coming days with the Fed reducing the interest rates lower rates.

Australian Inflation Data

A major cause of concern for the Reserve Bank of Australia, that had already convinced it to take the interest rates to a historic low level of 1 per cent, is likely to affect the equities market further.

The expected inflation data this week could further fuel the rally in equities. In March quarter, the headline CPI remained steady with an annual increase of only 1.3 per cent from March 2018 quarter to March 2019 quarter.

Full Year Result Announcements

The Australian companies listed on the ASX are likely to release their full-year financial results in the near future. There are high chances that if the companiesâ profits or future outlook will be disappointing, the Australian stock market will be majorly affected. Amid a lot of uncertainty in the Australiaâs economy, investors might keep a close watch on the upcoming results.

Building Approvals Data

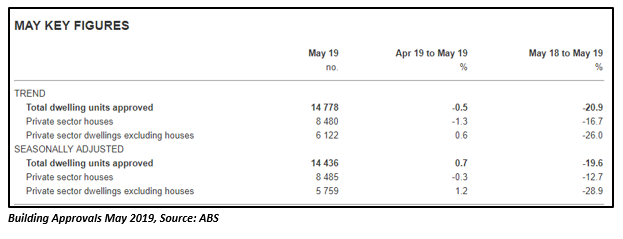

The Australian Bureau of Statistics (ABS) will release the building approvals data for the month of June in the comping days. It will be an important factor determining the state of the Australian housing market which is giving signs of recovery after a long period of stagnation.

The property market of the country has witnessed declining housing prices in the past few months, resulting in falling consumer confidence. However, a modest growth has been observed in the property prices recently amid rising auction clearance rates and modifications by the Australian Prudential Regulation Authority in mortgage lending rule. A property consultant, Corelogic is also likely to release the property prices data for July 2019 on 1st August 2019.

As per the ABS data, the number of total dwellings approved in seasonally adjusted terms also increased by 0.7 per cent in May this year. This created an optimistic outlook for the property market, raising expectations of further recovery.

China Manufacturing PMI

China will soon release its Manufacturing and Non-manufacturing PMI data for July 2019. The Chinaâs PMI data for the month of June was not so promising and was affected by the trade conflicts with the United States. The Caixin PMI for June 2019 was reported at 49.4, demonstrating a contraction in the countryâs manufacturing sector activity. The market experts are anticipating a modest rise in the Manufacturing PMI of the country from 49.4 to 49.6 for July 2019.

Retail Sales Data

ABS is also anticipated to announce the retail sales data for the month of June 2019 this week. ABS reported weaker retail sales data in May this year, adding to the signs of an underpowered economy. The weaker data also raised speculations of a further rate cut by the central bank for the third time this year. Investors are keenly eying the upcoming retail sales data that will provide a better image of the current state of the Australian economy.

Investors are likely to closely monitor the Australian equities market in the next few days with a series of important announcements expected to come up. Among all the factors discussed above, the chances of the market being affected by the anticipated Fed rate cut is very high.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.