Information Technology â Australia

One of the exciting industries you can enter is Technology. The Technology sector is booming nowadays, the role of IT Professionals has increased in the past ten years and there are still plenty of opportunities available. Government and businesses are constantly seeking out ICT IT professionals in order to develop advanced technology to enhance efficiency and productivity.

The Australian Jobs 2018 (predictions from the Department of Jobs and Small Business) suggested a rise in the number of jobs in the ICT or Information and Communication Technology sector. A significant research infrastructure and extremely skilled workforce, solutions-driven customer base makes Australia a strategic location for a range of Information technology activities with a domestic and international focus. There are many examples of the world topmost brands are taking advantage of the technology offered in Australia. Warner Bros and Google Maps have utilised their bases in the Australian region to develop global digital content for business and entertainment sector.

The Australian software industry has an advantage of low development costs and extremely skilled personnel which converts it into a target for strategic ICT Investment.

The S&P/ASX 200 Information Technology (Sector) was trading higher at 1381.5, on 19 September 2019, moving up by 1.02 per cent or 14.1 points. The Australian Benchmark S&P/ASX 200 was trading at 6713.6, up by 32 points or 0.5 per cent (at AEST 12:24 PM).

Letâs look at five such stocks from the Information technology sector having a positive change in their share price.

Afterpay Touch Group Limited

Afterpay Touch Group (ASX: APT) is one of the digital payment service providers. The Group offers two main products- Afterpay and Pay Now (Touch). The company offers a digital payment platform for its customers. The company has its presence in Australia, New Zealand, Europe, and the United States. It was listed on Australian Securities Exchange, under Information Technology sector in June 2017.

Stock Performance

The stock of APT last traded higher at $32.7 on ASX on 19 September 2019, up by 1.301 per cent from its previous closing price. The company has a market cap of $8.16 billion and approx. 252.64 million outstanding shares. The 52-week high and low value of the stock is at $34.280 and $10.360, respectively. The stock has generated a positive return of 56.70 per cent in the last six months and 169 per cent return on a year-to-date basis.

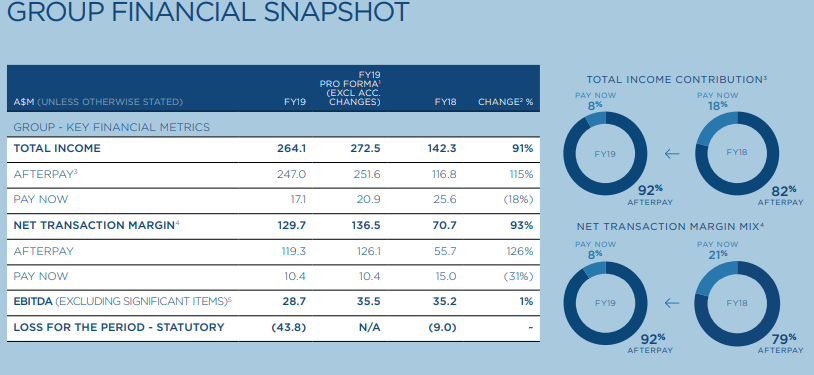

Financial and Operating Performance for the FY 2019

On 28 August 2019, the company has declared its financial results for the FY 2019, for the period closed 30 June this year. A few pointers from the results are as mentioned below:

- Afterpay active customers increased by 130 per cent to 4.6 million compared to the previous year.

- The companyâs underlying sales rose by 140% to $5.2 billion from last yearâs (FY 18) $2.2 billion.

- Total income (Pro-Forma) increased by 115 per cent to $251.6 million.

- Gross losses (Pro-Forma) dipped by 40bps.

- Underlying free cash flow stood at $33.3 million.

- The debt declined by $111.4 million or 69 per cent from the previous year.

- Active merchants surged up by 101 per cent to 32.3 k.

- APTâs cash in hand, on 30 June 2019, stood at 231.5 million

- Global merchant acquisition run rate was in excess of 1,900 merchants per month.

- No dividend was declared by the company for FY 2019 period.

Outlook

APT would continue to concentrate on, and make an investment in, innovation during FY20 period. The extent of addressable instore market in ANZ region, had been projected to be at the minimum of 5-8x of retail sales (online), instore would remain as the companyâs development focus area.

Bigtincan Holdings Limited

Bigtincan Holdings Limited (ASX: BTH) is an Australian-based company with AI-Powered Sales Enablement Automation platform, which offers a better consumer experience.

Stock Performance

The stock of BTH last trading at $0.55 on ASX on 19 September 2019, up by 2.804 per cent from its previous closing price. The company has a market cap of $140.130 million and approx. 261.93 million outstanding shares. The 52-week high and low value of the stock is at $0.600 and $0.238, respectively. The stock has generated a positive return of 24.03 per cent in the last six months and 97.12 per cent on a year-to-date basis.

Recent Updates

On 10 September 2019, the company has secured a 3 - year contract with a total value of $2.8 million with the leading apparel retailer. Bigtincan Zunos will be used to empower retail associates on thousands of Apple devices.

On 5 September 2019, the company announced the acquisition of Asdeq Labs at an initial price of around $490,000. The Asdeq Labs existing products will give an edge to the Bigtincan technology and would contribute ~$400,000 in annualised recurring revenue.

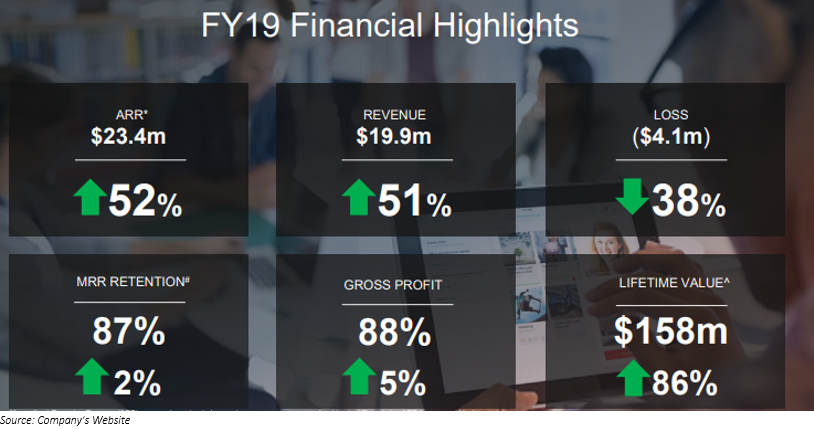

Financial Highlights

On 29 August 2019, BTH released FY19 report for the period closed 30 June this year. Highlights of the same are as follows:

- Revenue increased by 51 percent to $19.9 million compared to the last year.

- Gross Profit increased by 60 per cent to $17.5 million.

- Net loss after tax decreased by 38 per cent to $4.1 million from $6.6 million in FY18 period.

Zip Co Limited

Zip Co Limited (ASX:Z1P) provides a variety of retail finance solutions to medium and small scale firms. Z1P has a cloud-based platform that utilises the companyâs technology.

Stock Performance

The stock of Z1P last traded higher at $3.65 on ASX on 19 September 2019, rising by 0.829 per cent from its previous closing price. The company has a market cap of $1.27 billion and approx. 352.14 million outstanding shares. The 52-week low and high value of the stock is at $0.890 and $4.170, respectively. The stock has generated a positive return of 108.24 per cent in the last six months and 221.82 per cent return on a year-to-date basis.

Recent updates

On 6 September 2019, The company acquired SME lender, the Australian and New Zealand business, namely, Spotcap ANZ and additionally, S&P Dow Jones Indices announcement, updated that Z1P was included in S&P/ASX 300 index, w.e.f 23 September this year.

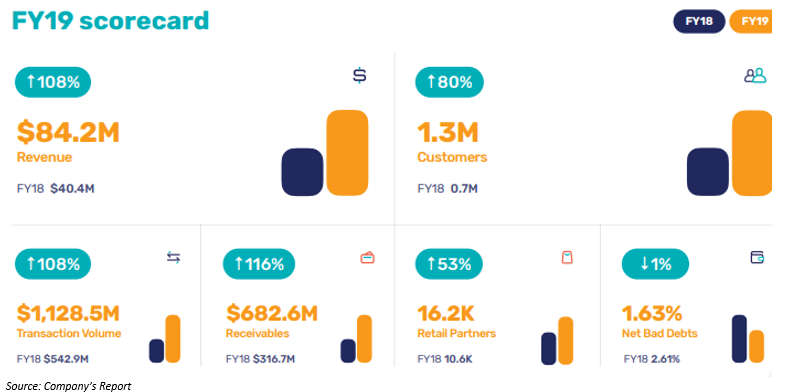

Financial Summary of FY 2019

On 22 August 2019, Z1P declared FY 19 results for the period closed 30 June this year. A few highlights of the same are as mentioned below:

- Revenue increased by 108 per cent to $84.2 million compared to last year.

- Retail partners increased as well and stood at 16.2k, rising by 53 per cent last year.

- The customers during FY19 period increased by 80 per cent to 1.3 million.

- The receivables of the company stood at $682.6 million.

Serko Limited

Serko Limited (ASX: SKO) is a travel and expense technology solutions company with the global team of around 200 people. The company had established a blue-chip consumer base in more than 35 nations. Serkoâs technology is accessed by above 2 million people.

Stock Performance

The stock of SKO last traded higher at $3.84 on ASX on 19 September 2019, moving up by 0.524 per cent from its previous closing price. The company has a market cap of $309.13 million and approx. 80.92 million outstanding shares. The 52-week high and low value of the stock is at $4.490 and $2.410, respectively. The stock has generated a positive return of 19.37 per cent in the last six months and 46.92 per cent return on a year-to-date basis.

Recent Updates

On 4 September 2019, the company released a notice of change in the interests of the directors Simon Botherway and Claudia Batten with the acquisition of 862.62 and 862.67 shares, respectively. The number of shares held after the acquisition for Simon Botherway were 26,596.57 and Claudia Batten were 26,597.39.

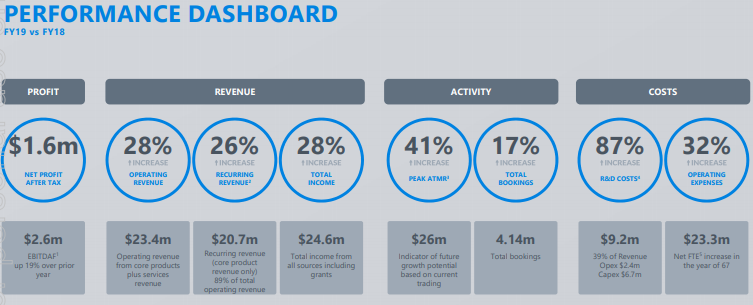

Financial & Operating Highlights

On 21 August 2019, the company announced the financial results for FY 2019, a few snapshots of results are as follows:

- The companyâs net profit after tax stood at $1.6 million.

- Operating revenue increased by 28 per cent to $23.4 million.

- Total bookings increased by 17 per cent to 4.14 million.

- Recurring revenue of the company rose by 26 per cent to $20.7 million (core product revenue only).

LiveTiles Limited

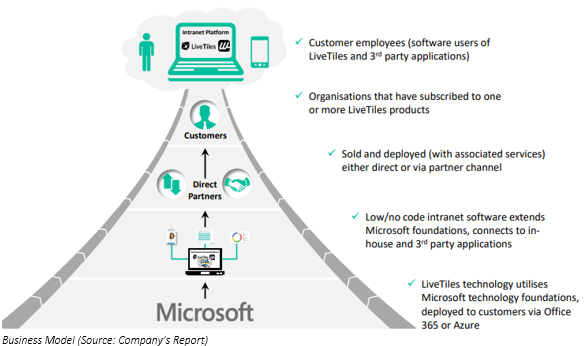

New York based, LiveTiles Limited (ASX:LVT) is an international software entity, which gives a smart workplace software for the government, education sector and so forth.

Stock Performance

LVTâs stock last traded on ASX at $0.380. With ~660.67 million shares of the company in the market, the market cap of the stock stands at $264.27 million.

Recent Updates

On 19 September 2019, LVT notified the market, on successfully raising $50 million through a share placement to entitled institutional and other sophisticated and professional investors at $0.35/share.

Further, Share Purchase Plan to raise up to $5 million would be launched by LVT to the already existing eligible shareholders. The proceeds would be utilised to produce continued solid consumer and revenue increase as LVT is aiming at $100 million in an annualised recurring revenue by 30 June 2021 period.

On 18 September 2019, the company published the Investor Presentation wherein, it provided the key highlights, business overview, case studies, global market opportunity and business update.

On 27 August 2019, LVT notified the market on Financial Performance for FY 2019 for the period ended 30 June this year. The highlights of the same are as follows:

- Loss after tax dipped by 93% to $42.765 million.

- Total Revenue and other income increased by 249% to $22.485 million.

- The companyâs cash balance as on 30th June 2019 stood at $14.880 million.

- Revenue from ordinary activities increased by 218% to $18.091 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.