Digital technologies are transforming the way people and businesses are living and working, respectively. These technologies are shaping varied sectors and are forecast to contribute $ 139 billion to the Australian economy between 2014 and 2020, representing growth of 75%, according to data from the Australian Trade and Investment Commission.

With such anticipations of growth, companies engaged in offering digital technologies like artificial intelligence, autonomous systems and robotics are expected to attract more and more investors, as they would look to reap the benefits out of the emerging opportunities for these players.

Let us have a look at some of the IT sector players listed on the ASX, whose stocks are trading at a lucrative market price.

Computershare Limited

Computershare Limited (ASX: CPU) is an IT sector player that is involved into the operation of various services such as investor services, employee share plan services and communication services.

Latest Updates

- The company through a release dated 13 September 2019 announced that it had bought back 50,000 shares at a consideration of $798,555.

- In another update, CPU unveiled that AustralianSuper Pty Ltd has become an initial substantial holder in the company with a voting power of 5.05%, effective from 10 September 2019.

FY19-Operational and Financial Performance

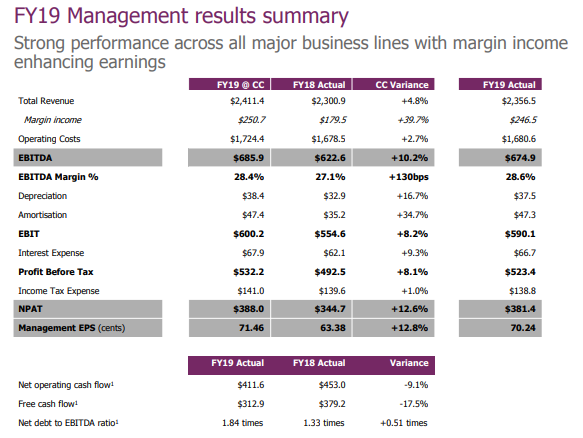

The company recently updated the market with its performance during the financial year 2019, delivering strong results via sound execution.

- Computershare reported revenue amounting to $ 2,411.4 million, reflecting a rise of 4.8% on pcp.

- EBITDA stood at $ 685.9 million, a rise of 10.2% year-on-year.

- The company witnessed a rise of 130 basis points to 28.4% in group EBITDA margins.

- Return on equity surpassed 26%.

- Margin income of the company increased by $ 71.2 million and the figure stood at around $ 251 million.

Source: Companyâs Report

FY19-Capital Management and Dividend

The company has a strong balance sheet, with net debt to EBITDA leverage ratio below the midpoint of the target range. CPU declared a $ 200 million worth of a market share buy-back program, in addition to a final dividend amounting to 23 cps, reflecting a rise of 9.5%.

Stock Performance

The stock of Computershare Limited closed the dayâs trading at a price of $ 15.910 on 13 September 2019, with a market cap of $ 8.64 billion, approx. 542.96 million outstanding shares, annual dividend yield of 2.77% and a PE multiple of 14.57x. The stock witnessed a fall of 8.35% in the last six months. On a year-to-date basis, the stock posted a decline of 6.41%.

Xero Limited

Xero Limited (ASX: XRO) is a provider of online accounting software for small businesses. The market capitalisation of the company stood at $ 8.83 billion as on 13 September 2019. The company recently announced that it had issued 51 fully paid ordinary shares on vesting of restricted stock units.

Results of Annual General Meeting

XRO conducted its Annual General Meeting on 15 August 2019, wherein the following resolutions were passed:

- Resolution 1-Fixing the remuneration of the auditor

- Resolution 2-Re-election of Susan Peterson as a director

- Resolution 3-Election of David Thodey as a director

- Resolution 4-Increase cap on non-executive director remuneration

- Resolution 5-Approval of the issue of shares to a director

FY19-Financial Performance

The company in its release of FY19 results mentioned that it witnessed growth of 36% in operating revenue and the figure stood at $ 552.8 million.

- It posted Annualised Monthly Recurring Revenue amounting to $ 638.2 million, reflecting growth of 32%.

- The company reported a net loss for FY19, which increased to $ 27.1 million mainly because of impairments in 1H FY19. Net profit amounted to $ 1.4 million in 2H FY19.

- XRO posted EBITDA of $ 73.2 million, which increased from $ 48.2 million in the previous period year, while EBITDA excluding impairments increased 84% to $ 91.8 million.

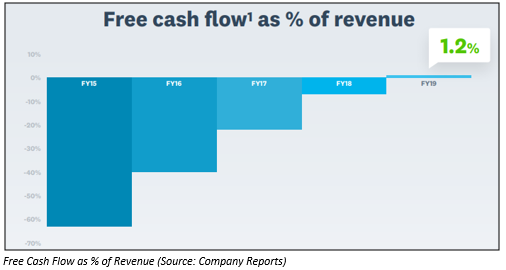

- Free cash flow grew by $ 35.0 million year-on-year to $ 6.5 million.

Future Guidance

The company would continue to focus on growing its global small business platform as well as maintaining a preference for reinvesting cash generated, which is subject to investment criteria and market conditions, in order to create long-term shareholder value. Free cash flow for FY20 is anticipated to be a similar proportion of total operating revenue to that reported in FY19

Stock Performance

The stock of Xero Limited settled at a price of $ 62.150 on 13 September 2019, with approx. 141.37 million outstanding shares. The stock witnessed a rise of 29.20% in the time span of last six months. On a year-to-date basis, the stock posted a rise of 48.82%.

WiseTech Global Limited

WiseTech Global Limited (ASX: WTC) provides software to the logistics services industry worldwide. As per a company release dated 13 September 2019, WTC has scheduled the release of 320,750 fully paid ordinary shares from escrow with effect from 1 October 2019.

Changes in Holdings and Interest

- The company recently announced that Christine Holman, a company director, has made a change to holdings (indirect) in the company by acquiring 3,000 ordinary shares at an average price of $ 32.67 per share.

- In another update, the company announced that FIL Limited and the entities have made a change to their substantial holding in WTC. The voting power of the substantial holder reduced to 5.89% from the previous voting power of 6.90%.

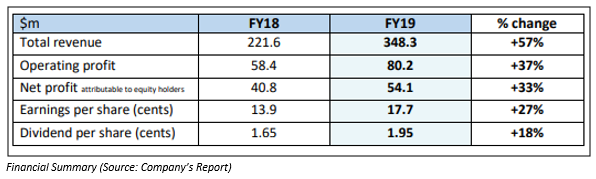

FY19-Financial Performance

- The company reported total revenue amounting to $ 348.3 million, reflecting a rise of 57% on pcp.

- Net profit attributable to equity holders stood at $ 54.1 million, a year-on-year increase of 33%.

- EBITDA up 39% to $ 108.1 million, depicting the companyâs strategy to accelerate its global growth and industry penetration, driven by geographic expansion, relentless innovation and deepening product capability.

- In FY19, the company declared a final dividend amounting to 1.95 cents per share, fully franked.

Stock Performance

The stock of WiseTech Global Limited closed the dayâs trading at a price of $ 34.760 on 13 September 2019, with a market cap of $ 11.22 billion and approx. 318.18 million outstanding shares. The stock witnessed a rise of 66.35% in the time span of last six months. On a year-to-date basis, the stock posted a rise of 106.99%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.