Xero Limited (ASX: XRO) is one of the fastest growing âsoftware as a serviceâ companies across the world. On 16 May 2019, Xero released its annual report which delivered strong progress in top-line growth, cash generation and profitability during the year which ended on 31 March 2019.

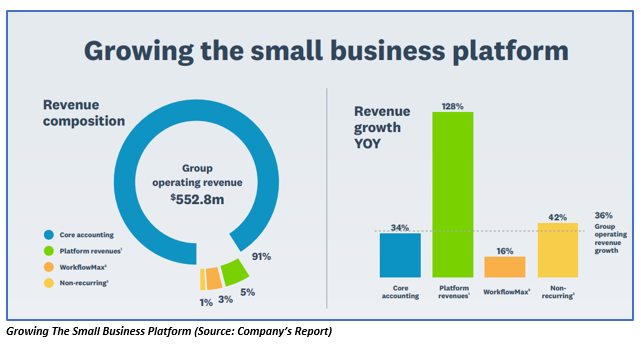

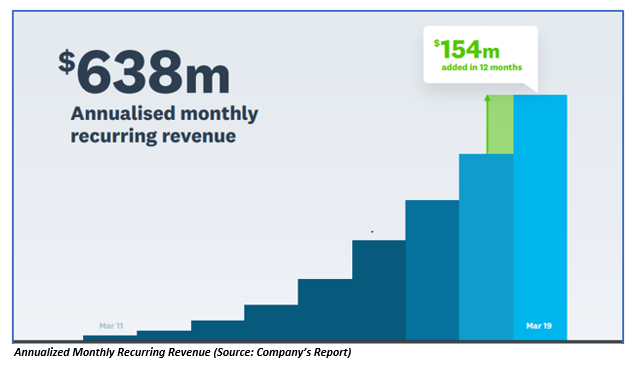

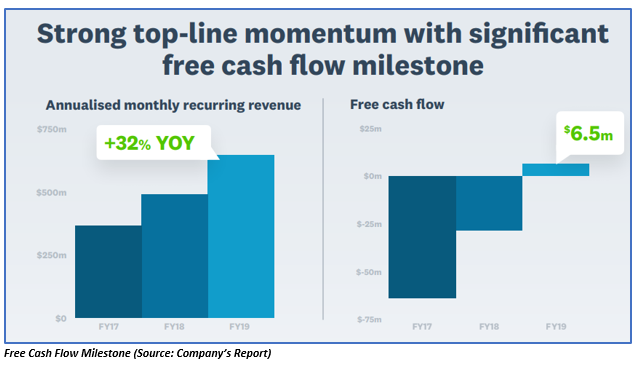

During the period, the company reported a 36% growth in the operating revenue to $552.8 million (34% in constant currency). There was an increase in the Annualized Monthly Recurring Revenue by 32% to $638.2 million. The companyâs total subscribers had reached 1.818 million in number, during the period. Besides, the company reported a net addition of 239,000 international market subscribers. There was an increase in the free cash flow by $35.0 million to $6.5 million as compared to the previous corresponding period. In the second half of FY2019, the company made a profit of $1.4 million. However, for the full year, the company incurred a net loss of $27.143 million.

Market highlights:

ANZ: During the period, the number of subscribers in ANZ increased by 22% to 1.077 million. The revenue increased by 30%.

UK: Subscribers in the UK increased by 48% to 463,000. With the addition of 108,000 subscribers in the second half of FY2019, there was revenue growth of 50%.

North America: The number of subscribers s increased by 48% to 195,000 (excluding the subscribers of Hubdoc on acquisition). The revenue from North America increased by 39%.

Rest of World: From the rest of the world, there was an increase in the number of subscribers by 43% to 83,000 and revenue by 55% as a result of strong progress in new markets which includes the recently established offices in Hong Kong as well as South Africa.

The balance sheet of the company reported an increase in the net asset base as a result of growth in the total asset of the company. The total shareholdersâ equity for the full year was $353.309 million.

During the period, the company reported an increase in the operating cash inflow from $61.196 million in FY2018 to $114.226 million. The primary driver of cash inflow was an increase in the receipts from the customers to $552.256 million. From other sources, the cash inflow was $5.370 million and through interest was $5.028 million.

There was a net cash outflow of $140.471 million from the investing activities of the company. The primary drivers of the cash outflow were in the form of capitalized development costs, Hubdoc acquisition, purchase of property, plant and equipment along with capitalized contract acquisition costs.

There was an increase in the cash inflow from $21.647 million in FY2018 to $143.571 million in FY2019. The cash inflow was from the issuance of convertible notes, net of issue costs and through borrowings. The other sources of cash inflow were through the receipt of lease incentive and exercising of share options.

By the end of the FY2019 on 31 March 2019, the net cash and cash equivalent with the company was $121.527 million.

Outlook:

Outlook:

The company would continue to focus on growing its global small business platform and at the same time maintain a preference for reinvesting cash generated based on the investment criteria, as well as the market condition for driving long-term shareholder value.

The company expects that in FY2020, the free cash flow is expected to be a similar proportion of total operating revenue, which was reported in FY2019.

XRO stock has generated a decent YTD return of 29.46%. At present, the shares of XRO are trading at A$69.550 (AEST 2:57 PM, 16 May 2019), up by 11.49% as compared to its previous closing price. XRO holds a market capitalization of A$7.65 billion and approximately 140.85 million outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.