Technology stocks belong to those companies and organizations that are into the technology-related businesses. Some examples of technology stocks include software, hardware, semiconductors, biotechnology etc.

It is believed that technology stocks have huge growth potential. The growth of these technology stocks is driven by innovation and entrepreneurship culture of these companies. Further, these stocks have provided better profits than companies belonging to a different sector.

Apart from these, technology stocks act as the primary constituents of a portfolio of stocks. Technology stocks being better performers, help in reducing the risk of the portfolios through diversification.

In this article, we would look at 5 technology stocks and see how the stocks performed in the last 6 months, on 9 September 2019 and see their recent updates.

Envirosuite Limited

Environmental Technology Company, Envirosuite Limited (ASX: EVS) on 6 September 2019 released an announcement where it entered into a legally binding agreement in order to secure a strategically funded entry into the China market. The company finds this market as the largest market for its solutions. The Chinese government has taken a high-profile public initiative which is known as âBeautiful Chinaâ under which the government is focusing on cleaning toxic air and polluted water and soil across the country via technological innovation. In this process, the company has positioned itself well to provide its solutions in areas of waste and wastewater, mining and smart cities.

The company has entered into a partnership with one of the most prominent leaders in China, Mr Zhigang Zhang, in the environmental protection sector.

Terms of the transaction:

- Around 50,000,000 shares of the company would be placed at a price of A$0.08 per share to the investing entity of Mr Zhigang Zhang, ZZL Pty Ltd as trustee for the ZZL Family Trust, as well as his nominated entities across two equal tranches. The first tranche is expected to be finalised by 22 September 2019 as per the existing ASX Listing Rule 7.1 capacity of the company.

The second tranche is expected to be completed by 31 October 2019 that would depend on the shareholdersâ approval in the annual general meeting of the company scheduled on 16 October 2019.

- There would be 25,000,000 unlisted options for the placement investors who could subscribe for ordinary shares in the company at an exercise price of A$0.15 per share and would expire on 31 March 2022. The options will vest on a minimum of A$10 million in cumulative revenues that would be received by the 100% owned Chinese subsidiaries of the company from the date of the beginning of the operations till 31 December 2021.

Trimantium GrowthOps Limited

Trimantium GrowthOps Limited (ASX:TGO), technology-based business advisors who offer its clients with end-to-end growth solution, recently on 30 August 2019 announced its FY2019 results for the year ended 30 June 2019.

The pro forma revenue of the company for FY2019 was $71.4 million, slightly below the revised guidance provided by the company on 1 May 2019. The company in the revised guidance had estimated its revenue to be in the range of $73 million to 75 million. The pro-forma EBITDA for FY2019 was $8.6 million. It represents an EBITDA margin of 12.0%.

The results during the period got influenced by the challenging external factors, which include subdued business spending along with the deferred client purchasing decisions. This impact on the revenue got partly offset by stronger growth in technology services in Australia.

The statutory revenue of the company in FY2019 was $69 million, and statutory loss was $65 million.

Key Developments:

The management of the company during the period got restructured. The eight businesses acquired at IPO got integrated with the operation of APD that was acquired during August 2018. The entire business is known as Foundation companies.

The company also launched a new brand into the market and at the same time, retained and utilized the specific equity of important brands. Majority of office locations got transitioned to âcampusesâ. The company was also able to expand its geographical footprint.

GrowthOpsâ pro forma annual interest expense declined by $1 million via refinancing of assumed APD debt with a new two-year, $14 million senior secured debt facility with Westpac Banking Corporation.

RightCrowd Limited

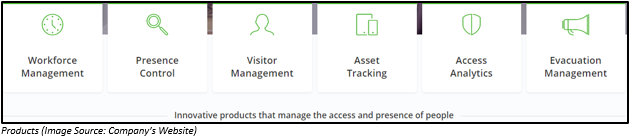

RightCrowd Limited (ASX: RCW), the developer of physical security, safety and compliance software on 30 August 2019 released its FY2019 results for the year ended 30 June 2019. The total sales revenue of the company increased by 69.9% year over year to $9,378,615 and total revenue by 24.6% to $11,691,931. The company incurred a significant loss which grew 20.4% year over year to $6,170,821.

During the period, 83% of the sales revenue was generated from outside Australia. The total revenue of the company includes revenue from the research & development tax rebate as well as other income items.

The company made investments in additional staff for commecialising its software solutions in the global markets and helping the company in its revenue growth. The company also made two strategic acquisitions which are complimentary to the recent software solutions provided by the company and also help in extending its global presence as well as the potential of the company.

The balance sheet of the company witnessed a significant increase in the net assets from $6,890,468 in FY2018 to $21,438,610 in FY2019 as a result of a significant increase in the total assets. The position of net cash and cash equivalents of the RCW by the end of FY2019 was $4,972,136.

MyFiziq Limited

Term sheet with TicTrac:

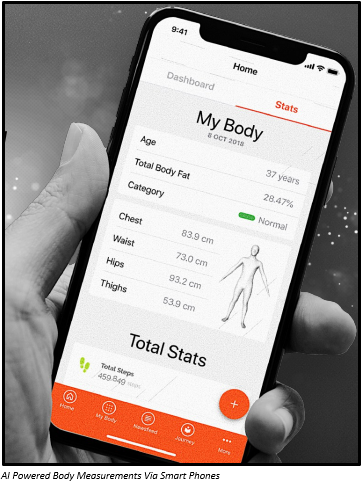

MyFiziq Limited (ASX: MYQ), a company which is into the business of developing and marketing mobile application for its application in the fitness industry, in the last one week has come up with three major news related to its term sheet with TicTrac, term sheet with WellKom and the appointment of new CFO.

On 9 September 2019, MYQ entered into a nonbinding term sheet with Tictrac Ltd, which is a global health engagement company under which the company would implant its technology across the Tictrac ecosystem.

With this agreement, both the parties would be integrating their technologies to gamify, involve and offer an improved product as well as user experience to all of their clients and users. Both the parties would now use the power of the wearable technologies when mapped with the goals and targeted health outcomes of an individual. The combined technology would then be taken to the governments already associated with the platform.

Term Sheet with WellKom

On 4 September 2019, MYQ entered into a binding term agreement with a UK Based Corporate Wellness provider WellKom Corporate Services Limited for expanding its digital tracking capabilities into the multibillion-dollar global corporate wellness market.

As per the terms and condition of the agreement, the companyâs technology would be combined into the WellKom platform which would be provided to the employers across the UK & Europe initially as a part of performance, engagement and wellness solutions.

Appointment of new Chief Financial Officer (CFO)

On 2 September 2019, MYQ announced the appointment of its new CFO, Mr Steven Richards as a part of the companyâs commercialization and growth strategies. Also, he would be transitioning to the companyâs secretarial position in the upcoming months.

Jaxsta Ltd

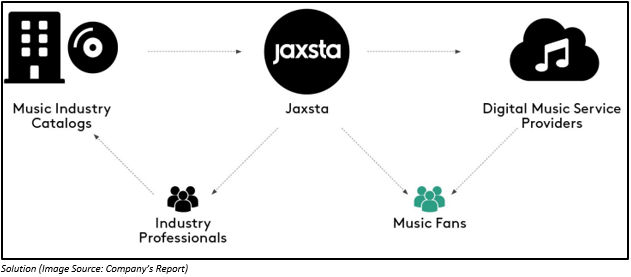

Jaxsta Limited (ASX:JXT), a music technology company recently on 30 August 2019 released its full-year results for the FY2019 ended 30 June 2019. During the period, the company did not generate any revenue. It made a huge loss of $19.261 million, down by 487% as compared to the previous corresponding period (pcp).

During the period, the company launched Jaxsta.com, which is live with more than 100 million credits. The company expects its first revenue stream in the second half of CY2019 with the launch of paid B2B subscription platform, Jaxsta Pro.

The company would be able to maintain its competitive advantage over its customer via big data technology.

The balance sheet of the company witnessed an increase in the net asset as a result of increased total assets. Total shareholdersâ equity for FY2019 was $10,906,694. The net cash and cash equivalents at FY2019 end were $2,452,760.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.