Artificial Intelligence:

Artificial intelligence is a technology which allows computers or robots controlled via computer to do a particular set of work of human beings. Some of the examples of AI include the ability of the system to communicate like a human being, discover meanings etc. With the advancement of technology, the companies, as well as the government bodies, are implementing artificial intelligence. Many companies are combining artificial intelligence to their cloud communications solutions to provide improved customer experiences and better productivity.

In this article, we would be looking at three artificial intelligence (AI) companies and understand their AI technologies or the applications of AI technology.

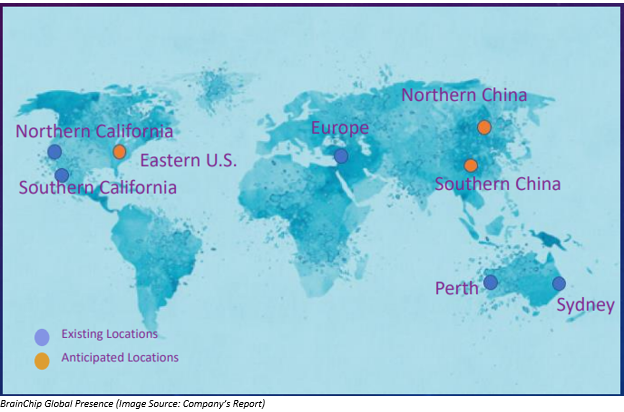

BrainChip Holdings Ltd

Company Overview:

BrainChip Holdings Ltd (ASX:BRN) is a company which provides neuromorphic computing solutions. A neuromorphic computing solution is a type of artificial intelligence that is inspired by spiking neural networks of the human being. The spiking neural network (SNN) technology of the company is a type of neuromorphic computing that is capable of leaning things alone. It generates and links information like a human being.

Technology:

The SNN technology of the company has many striking features which include the potential to get trained rapidly. It has a high level of accuracy and has low compute overhead.

Just like human beings, the technology of BRN learns from experience. BRNâs SNNs is capable of learning without any supervision. There is no requirement for the large dataset and locates patterns which even human beings are not aware of.

The AI technology of the company is characteristically low power consuming, gets quickly trained and is capable of working in a challenging atmosphere. Based on the above mentioned features of the BRNâs technology, the company has a large addressable market and the technology can be used in a variety of applications.

BRNâs Akida NSoC can be applied to any embedded vision system for identifying an object. Akida NSoC can be applied in ADAS/AV, drones, vision directed robotics, as well as machine vision. It can also be used in cybersecurity applications, finding patterns in huge unlabeled financial data, forensic object search and facial classification, casino solutions and many more.

Products:

- Akida NSoC

- BrainChip Studio

- BrainChip Accelerator

Recent Update:

BrainChip Holdings Ltd (ASX:BRN) recently on 27 August 2019, released its results for the half-year ended 30 June 2019. The companyâs revenue from continuing operations declined in 1H2019 by 87% to US$66,635 as compared to the corresponding prior-year period. The fall in the revenue was mainly attributable to revenues recognized in the previous period from the GPI agreement.

The operating loss in 1H2019 was US$4,488,060. However, in 1H2019, it improved by 49% compared to that in the corresponding prior-year period.

The balance sheet of the company witnessed a significant drop in net assets from US$8,879,309 as at 31 December 2018 to US$5,239,205 as at 30 June 2019. The fall in the net asset was due to a significant increase in the total liabilities and a decrease in the total assets.

The company used US$4,241,084 in operating activities and US$222,658 in investing activities during the half-year 2019. During the period, the company raised US$2,565,000 by issuing convertible securities. After making the payment of convertible securitiesâ costs and lease liabilities, the net cash inflow through financing activities was US$2,439,974.

By the end of 1H2019, the position of net cash and cash equivalents with the company was US$5,519,777.

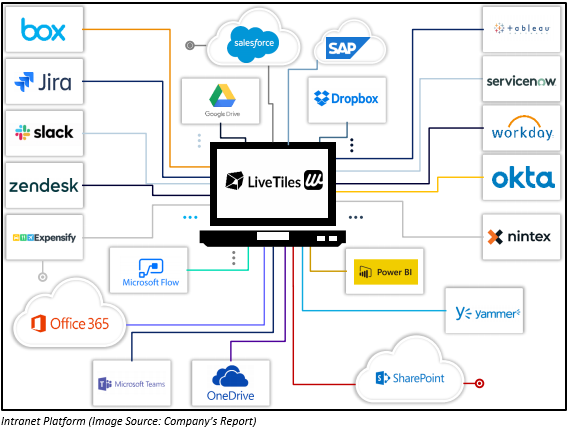

LiveTiles Limited

Company Overview:

LiveTiles Limited (ASX:LVT) is one of the fast-growing enterprise SaaS companies with headquarters situated in New York. The company provides organizations with intelligent workplace software based on cloud technology. The company provides developers and business users with the tools that are capable of creating dashboards, employee portals, as well as corporate intranets which can be further improved using the AI and the analytics features.

Solutions:

LVTâs solution includes Intelligent Intranet, Alliances and Mosaic K-12.

- Intelligent Intranet: The AI-powered intranet solutions follows three principles.

- Make it about people

- Make it simple

- Make it intelligent

- Alliances

- Security

- Starmind

- Zegami

- Mosaic K-12: Intranet for Schools

Recent Update:

Recently, LVT has made two announcements.

- The first is the investor presentation provided by the company on 4 September 2019. In the investor presentation, the company provided its business overview. It discussed how the company addresses customer problems, its product portfolio, the business model, partner channels and alliances and various customer case studies.

- The presentation also highlighted that the company reported strong year-on-year growth of more than 167% in annual recurring revenues. The strong growth in the ARR per customer was driven by a higher proportion of new enterprise customer, cross-selling and bundling as well as increased penetration of prevailing customers. The company also reported strong growth in the cash receipt. The company also noted a gradual improvement in the net operating cash flow.

In FY2020, the company expects to deliver a strong growth in the number of customers and revenues.

- The second is that the companyâs product portfolio, which includes Wizdom and Hyperfish, is under co-sell arrangement with Microsoft in 39 countries, announced to the market on 2nd September 2019. The company would be focusing on its Microsoft Teams features as well as benefits.

Bigtincan Holdings Limited

Company Overview:

Bigtincan Holdings Limited (ASX: BTH) is a company which provides AI-Powered Sales Enablement Automation which helps the user to have a better and faster learning. It also enables the user to sell smartly and become more productive day by day.

Solutions:

For those users who are on the client-facing side, the organization are assured that their people have the most relevant content available with them that would help him/her in the client/prospect interaction. Its Bigtincan Hub helps in increasing the success of the sales and service teams by supporting them in improving the training, meeting preparation, customer engagement as well as the alliance with peers.

Bigtincan solutions provide support in fields of sales, learning, marketing, field service as well as channels.

Recent Update:

Bigtincan Holdings Limited on 10 September 2019 released its amended version of the announcement related to its 3-year contract with a total contract value of $2.8 million with leading global sports apparel retailer, Nike, Inc. The company won a competitive bid for a retail deployment with Nike. Under this contract, Bigtincan® Zunos software platform would be used for creating modern, always current, personalized & mobile learning and content environment that would be used by thousands of frontline retail staff in the USA and worldwide.

The contract demonstrates the continued success of the company in securing as well as growing large enterprise customer deployments in the retail segment.

Veriluma Limited

Veriluma Limited (ASX:VRI) is an innovative Australian software company whose prescriptive analytics software is used across a range of industries as well as applications that need the same fast, precise as well as accurate understanding which can be converted into action. Veriluma Limited was founded in 2010.

VRIâs reinstatement of its shares:

The predictive intelligence software company, Veriluma Limited (ASX:VRI) started trading on ASX after a long trading halt from 9 September 2019, pending an announcement related to the material transaction and director changes. The trading halt was also to prevent trading in the securities in an uninformed market.

On 2 September 2019, Veriluma Limited provided its supplementary prospectus dated 30 August 2019 and was filed with ASIC on that date.

On 3 September 2019, Veriluma Limited announced that it had closed its public offer of fully paid ordinary shares to raise up to $5.4 million. The offer was oversubscribed and was conducted with the support and assistance of Taurus Capital Group and King Corporate for recapitalizing the company, providing the company with funds for business and product development along with the marketing activities. This would also help in facilitating the reinstatement of its shares to quotation in the official listing of Australian Stock exchange.

The company also provided Pre-Reinstatement disclosure on 6 September 2019 before the reinstatement of its securities which includes the capital structure of VRI, its Pro-Forma Statement of financial position and the use of the funds.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.