Property market is beginning to stabilise in Australia. Let us have a look at what is new in the Australian property market.

Weekend Auction Clearance Rates Rise

Property market in Australia seems to be on the recovery path, as auction clearance rates are surging well ahead of where they were during the same period a year ago. Preliminary auction clearance rate is the percentage of properties that are sold during an auction every weekend. This rate is an early indicator of how the property market is performing.

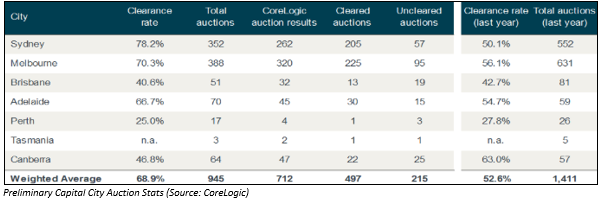

According to the preliminary data released by property data firm CoreLogic on 8 July 2019, preliminary auction clearance rate grew to 68.9 per cent with 945 properties listed for auction in the Australian capital cities during the first week of July 2019 from a rate of 62.9 per cent with 1,295 properties listed over the prior week. This was the fourth week in a row that preliminary auction clearance rates grew above 60 per cent. Moreover, in the same period a year ago, preliminary auction clearance rate stood at 52.6 per cent with 1,411 auctions held.

The number of properties that were listed for auction is less when compared with the last week, which can be due to school holidays in most of the Australian states and lower mid-winter listings. However, the number of people coming to auctions is growing, highlighting that the property market is moving towards the upward trend in the country.

Despite the lower number of properties on auction, clearance rate in Sydney was the highest among all the cities across the country, signalling towards improving conditions and increase in housing prices in the city. In Sydney, preliminary clearance rate from 352 auctions that were listed on sale hit 78.2 per cent for the weekend on 7 July 2019, up from a 67.9 per cent preliminary clearance rate with 503 auctions held across the city over the previous week and 50.1 per cent from 552 auctions held in the year-ago period.

Meanwhile, Melbourne stood at the second stop, with the second highest clearance rate across the nation. There were 388 auctions held during the first week of July 2019 in Melbourne, resulting in a 70.3 per cent preliminary clearance rate for the city, compared with 535 auctions returning a 68.6 per cent final clearance rate in the last week and 631 auctions returning a 56.1 per cent clearance rate during the same period in the last year.

These two cities accounted for the bulk of auctions of properties in the country, while the national clearance rate stood at 68.9 per cent for the weekend on 7 July 2019.

These early signs of improved confidence of buyers in the Australian property market are suggesting that the real estate market in Australia is on the rise once again. Below are the factors that according to the market experts are helping in reviving the countryâs property market:

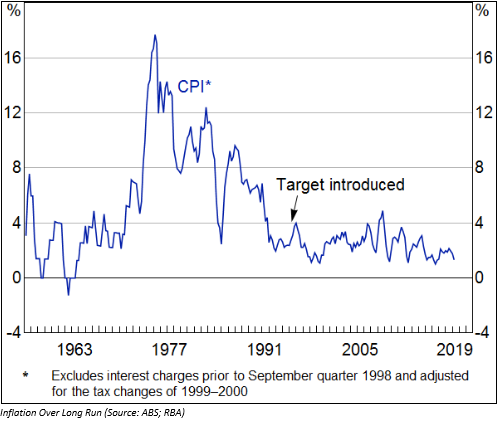

- Back-to-back cut in interest rate by the Reserve Bank of Australia as of 2019, aimed at lowering unemployment levels and bringing back inflation to its target range of 2-3 per cent in the country. The central bank lowered the benchmark rate to 1 per cent by 25 basis points on 2 July 2019 as part of its measures to help kickstart the sluggish economy. Also, in June 2019, the central bank had announced its first rate cute.

The RBA move was welcomed by majority of the banks in the country. Moreover, all the four major banks in the country â Commonwealth Bank of Australia (ASX: CBA), Australia and New Zealand Banking Group Limited (ASX: ANZ), National Australia Bank Limited (ASX: NAB) and Westpac Banking Corporation (ASX: WBC) â announced a range of changes in their interest rates, in line with the second rate cut announcement.

- Loosening lending restrictions by the APRA (Australian Prudential Regulation Authority), which is the banking regulator in the country. The APRA, on 5 July 2019, unveiled its plans to move ahead with the changes proposed under its guidance on the residential mortgage lending. The regulator issued a letter to authorised deposit-taking institutions (ADIs), in which it finalised the amendments, according to which ADIs will no longer be required to use a minimum interest rate of at least 7 per cent to assess applications regrading home loans.

As per the changes to Prudential Practice Guide APG 223 Residential Mortgage Lending (APG 223), the ADIs can use a revised interest rate buffer of at least 2.5 per cent over the interest rate of the loan, as well as assess and establish their own minimum interest rate floor for use in serviceability assessments.

3.The federal election win, as the coalition returned to the government. This took off the capital gains tax and negative gearing changes proposed by the Labor as well as resulted in the swift passage of the federal governmentâs $158 billion tax plan.

The tax package has secured support from the Centre Alliance and Tasmanian independent Senator. Once completely implemented, the tax package will result in the elimination of 37 per cent and 32.5 per cent tax bracket by 2024-25. Meanwhile, all the incomes between $45,000 and $200,000 will be taxed at a rate of 30 per cent, owing to the fact that tax rate will be reduced from 32.5 per cent to 30 per cent in the above reported period.

All these factors are expected to encourage buyers back into the market and boost borrowing among Australians, as these are expected to free up some spending room for Aussies. So, Australians can be now be viewed as desirable borrowers in the country.

Major policymakers are coming up with all such initiatives because the economy of the country isnât doing that great. Hopefully, these factors would trigger a stronger activity in the economy on a broader level.

Caydon to Develop Mixed-Use Residential Project, HOME

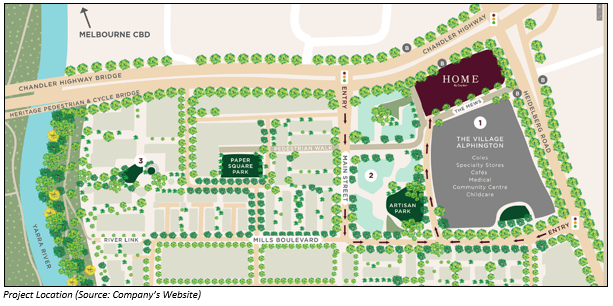

Another major development was witnessed in the Australian property market, as property development company, Caydon Property Group secured approval for the development of a mixed-use residential project worth $ 300 million at the former paper mill site in the inner north-east of Melbourne.

The mill site is situated on the corner of Heidelberg street and stretches along the Chandler Highway. Moreover, the site, which is located next to the Yarra River, is a key strategic redevelopment within Yarra City and inner Melbourne. Additionally, it is only 600 metres away from the train station at Alphington and about 6.5 kilometres from the central business district of Melbourne.

The company plans to develop 324 dwellings over 16 levels at the project, with construction work likely to start within the next 12 months. The company is expecting to complete the project within the two years of starting.

The project, which will cater to various buyers such as first home buyers, down-sizers and upgraders, will have one, two- and three-bedroom apartments, in addition to two and three-bedroom Skyhomes and a mix of three-bedroom Terrace homes. Unit cost will range from $ 379,000 to a maximum of $ 2.6 million.

The project will also feature amenities such as a park at Level 4 with a playground for both kids and four-legged family members, a glass edged pool on the rooftop, and two hotel style guestrooms.

The in-house design and architecture team of the company will design the project, with nearly 75 per cent of an acre of landscaped and communal space incorporated into the design of the building.

The company plans to launch the project, known as HOME, in the coming week, as it has received a number of enquiries only from the hoarding on the site.

Caydon acquired the development site, which covers an area of 7,471 sq metres, within the 16.5-hectare site in Alphington in a deal worth $ 29 million in 2017. Glenvill Group holds over 60 per cent of the site. It reached a deal with Alpha Partners in 2013 to acquire the majority of the site for $ 120 million. Meanwhile, Alpha Partners holds a portion of the site that covers an area of 2.1 hectares. Moreover, Arccare, an operator of aged care facilities, has also acquired a portion of the site.

The development site is an addition to the global development pipeline of Caydon Property Group, which has a development pipeline of projects worth $ 4 billion in Melbourne, along with multi-family apartment projects in the US cities- Houston and Seattle. Some of the companyâs Melbourne projects include the Mason Square multi-tower development project in Moonee Ponds and the Nylex Plastics silo site redevelopment project on the banks of the Yarra.

Caydon Property Group

Headquartered in Abbotsford, Australia, Caydon Property Group is a privately owned, international property developer, which is engaged in the development of apartments and commercial properties, such as contemporary apartments, luxury hotels, retail outlets and commercial spaces. The company serves its clients through agents.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.