Scott Morrison clinches crossbench support to pass the $158 billion tax package, it proposed during federal election. The government gets support from the Centre Alliance Senator, Rex Patrick and Tasmanian Independent Senator, Jacqui Lambie. Also, two other Senators have backed the tax package taking the total to four crossbench votes secured by the government. With the crucial support won by the Morrison government, Australians are expected to get their cash back as soon as next week.

Do You Know About $158bn Income Tax Cut Package?

About 94 per cent of the Australian taxpayers will face the maximum personal income tax rate of 30 per cent from July 2024 under the $158 billion income tax cut package proposed by the Morrison government.

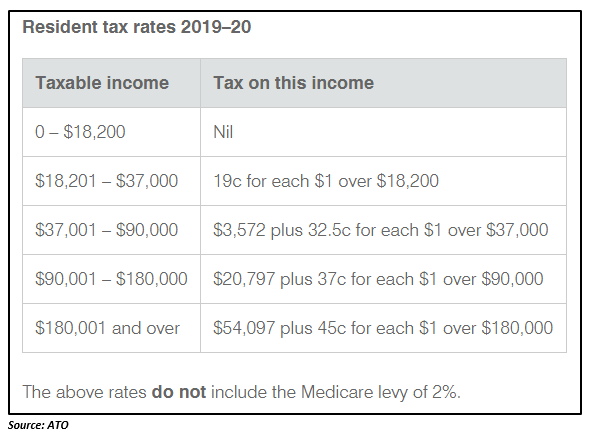

Quite Confused? Let us go into some detail. Firstly, take a look at the current resident tax rates for 2019-20 in the below table:

Under the Morrison governmentâs tax package, the top income threshold in the 32.5 per cent tax bracket will be raised from $90,000 to $120,000 from 1st July 2022, providing a tax cut of up to 1,350 dollars per year. Last year, the top threshold for the individuals under the 32.5% tax bracket was already raised from $87,000 to $90,000 that delivered a tax cut of up to 135 dollars per year.

Beginning from 1st July 2024, the top income threshold in the 32.5 per cent tax bracket will rise from $120,000 to $200,000 as suggested by the government. The government has also proposed to abolish the 37 per cent tax bracket completely, taking the top tax rate cuts to be applicable at $200,000.

Who Gains When The Tax Package Will Be Fully Effective?

Once the Morrison governmentâs tax package gets fully implemented, the 37 per cent and 32.5 per cent tax brackets will be completely eliminated by 2024-25, leaving all incomes between $45,000 and $200,000 to be taxed at the rate of 30 per cent. This would happen as the Coalition government will reduce the 32.5 per cent tax rate to 30 per cent in 2024-25.

When the $158 billion tax package will take full effect, the marginal income tax rates will be 19%, 30% and 45% (plus the 2 per cent Medicare Levy). The tax package is expected to benefit the high-income earners the most as they currently fall under the 47 per cent tax bracket (including Medicare Levy) which would be reduced to 45 per cent later on.

A Medicare levy of 2 per cent of the taxable income has to be paid by the income earners in Australia to fund some of the costs of universal health insurance scheme, Medicare.

The package will bring a tax relief of $1080 for low and middle-income earners (earning between $48,000 and $90,000) under the first stage of the tax package. However, the dual income families could net up to $2160 per year.

Senators Supporting Tax Package

Following months of negotiations with the crossbench, the Morrison government secured Centre Alliance and Tasmanian independent Senatorâs support.

Reason Behind Centre Allianceâs Support for the Tax Package

The Centre Alliance has secured policy commitments from the federal government in return for crossbench support of the tax cut package. The Centre Alliance demanded measures to reduce the gas prices and support to ensure sufficient gas supply in the market by changing the Australian domestic gas security mechanism. In June this year, Centre Alliance senator, Rex Patrick raised concerns over the horrifying energy price rises in Australia and wanted the federal government to consider an Australia-wide gas reservation policy.

The federal government had talked through gas reforms with Centre Alliance Senators, informed Finance Minister Mathias Cormann. In return, the Senators supported the governmentâs full tax cut bill. The party entered into a deal with the government with the following demands:

- Intervention in current pricing mechanism (demands action over high electricity costs in South Australia).

- Market Transparency Measures.

- Measures to tackle the monopoly nature of East Coast gas pipelines.

- Longer term measures ensuring future gas projects provide surplus supply to the Australian market.

Reason Behind Tasmanian Senatorâs Support for the Tax Package

The Tasmanian Senator, Jacqui Lambie supported the governmentâs tax package in return for the demand to forgive Tasmania's public housing debt. The Senator negotiated with the government to forgive the $157 million housing debt her state owed to the Commonwealth. Tasmania's housing sector has witnessed many people becoming homeless due to a lack of public funding. The Senator will work with the government to find a solution to this endemic problem. Senator Lambie puts forward her view that she could not support the income tax cuts when her home state has thousands of low-income earners struggling with homelessness. She had been given an undertaking from the federal government that it will respond to the issue.

Laborâs View on Morrisonâs Tax Package

The Labor party demanded a split in the bill $158 billion tax package proposed by the Coalition government in June this year. The party wanted the Coalition government to make the changes proposed in the tax package from 1st July 2022, in July 2019 itself. The Party also demanded the third stage of the Coalitionâs plan to be completely scrapped. However, the government refused Laborâs proposal that resulted in higher chances of the implementation of the proposal.

Besides amendment in the tax laws, Mr Morrison is also dealing with the other issues persisting in the Australian economy. Let us have a look at two of such issues below:

Morrison Government Pushes Religious Freedom

The federal government would begin consulting on a religious freedoms bill this week to push religious freedom. The government is planning to put new laws to the Parliament to prevent discrimination on the grounds of religious belief or activity. It has emphasized the need for unity in Australiaâs anti-discrimination laws. Besides modifications in the religious discrimination bill, the government wants to make some transitions in other laws like marriage law, charities law, anti-discrimination legislation, etc.

Recently, Prime Minister Scott Morrison advised employers to respect their employees' private religious practice. Mr Morrison cautioned employers to have reasonable expectations from the employees, suggesting them to avoid impinging against workers' private beliefs.

Morrisonâs View on US-China Trade War

At the G 20 summit meeting in Osaka, the Australian Prime Minister, Scott Morrison had conversations with the US President Donald Trump and Chinaâs leader, Xi Jinping. According to Mr Morrison, it is unrealistic to expect a quick resolution of the trade dispute between the US and China. He believes that there are some real, difficult and substantial issues that are to be resolved.

The trade war between the two largest economies of the world aggravated when the US President, Mr Trump, decided to raise the tariff on the Chinese goods to 25 per cent from 10 per cent. The equity markets across the world tumbled with Mr Trumpâs decision. The situation worsened when China also announced retaliatory tariffs on US goods in answer to Trumpâs threat. However, the US and China held talks at the G 20 summit meeting to resolve the trade conflicts. Following the meet, the US President decided to not impose further tariffs on Chinese exports. According to the market experts, a continuation of the trade war further could possibly shipwreck the global economy.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.