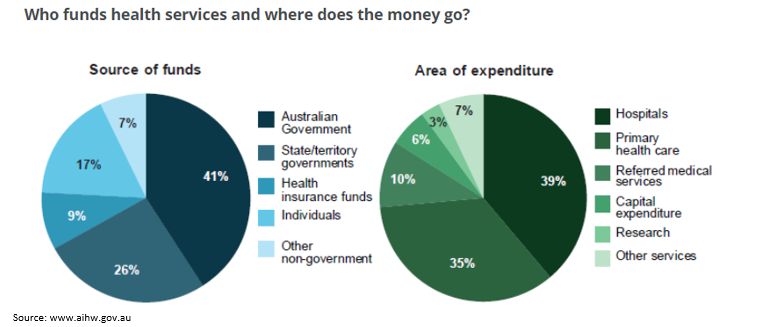

Healthcare sector is one of the largest contributors to Australian economy. A 2017 report by the Commonwealth Fund ranked Australia healthcare system as one of the best across the globe. Australia had a healthcare spending of A$180.7 billion in FY17, more than A$7,400 per person, according to the Australian Institute of Health and Welfare (AIHW). During the reported period, in real terms, Australian government spending was up 6.8% from the average growth recorded during the past five years.

Proportion of elderly people (65 years and above) is growing in Australia, with almost one in every six people in 2016 from one in seven people in 2011, as per the 2016 Census of Population and Housing. Aged care is one of the largest service sectors in the country, which has more than 2,000 aged care service providers offering three types of services: residential care, home care, and home and community care. According to an Intergenerational Report (Treasury, 2015), Australian ageing population is projected to cross 8.9 million in FY55 from 3.6 million in FY15. With increasing ageing population in the country, demand for aged care services is expected significantly grow in the coming years.

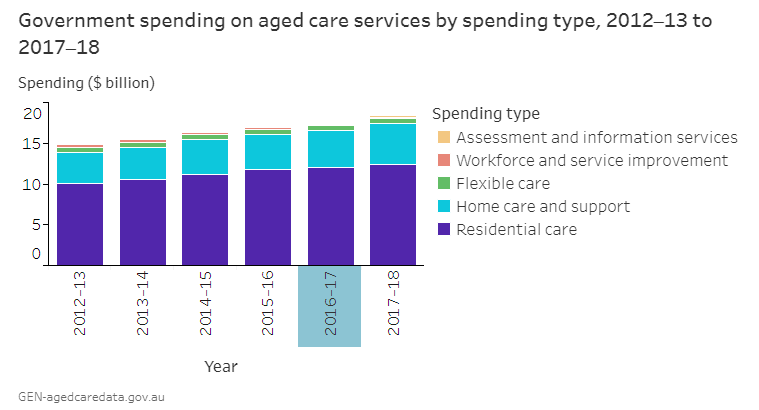

Aged care is nearly 97% covered by the Australian Government (including the Australian Government and state and territory governments). In FY18, approximately A$18 billion was spent on elderly care in the country. As per official stats, around 67% of the aged care spending was made in residential elderly care services, while community-based care (home care and home support services) accounted for 28% of the total government spending on aged care.

Let us have a look at recent updates from Australian elderly care provider, Regis Healthcare Limited

Regis Healthcare Limited

Australia-based Regis Healthcare Limited (ASX:REG), an aged care provider, has a total of 6,753 operational places across New South Wales, Queensland, Victoria, Western Australia and South Australia. The company offers services covering ageing-in-place and home, palliative, specialist dementia and respite care, along with access to retirement villages.

According to an ASX announcement made by the company on 6 June 2019, it expects its NPAT (Normalised) guidance for FY19 to be at the lower end.

The company had earlier reaffirmed its FY19 guidance on 25 March 2019, according to which NPAT was expected to be A$47-A$51 million. The March guidance also expected EBITDA for 2H FY19 to be in line with the EBITDA (normalised) for 1H FY19, standing at A$56.7 million or circa A$113 million for FY19.

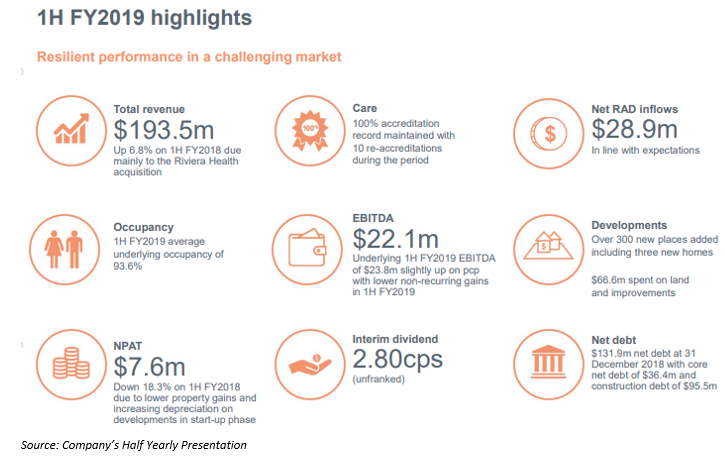

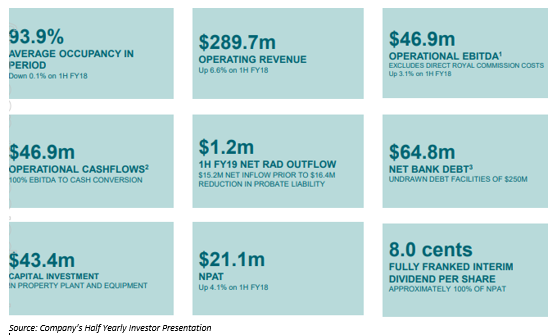

Below is the glimpse of companyâs financial performance in 1HFY19:

Besides, below are further financial highlights of the companyâs recent market update:

- Normalised EBITDA of A$113 million covers one-off additional government funding of circa A$10 million, which the company received in 2H FY19.

- For the period to date for 2H FY19, average occupancy dropped to 91.6%, when compared with 92.8% in the first half of FY19, highlighting occupancy trends across the industry.

- Net RAD cashflow for REG reached circa A$130 million as at 31 May, up from A$ 72 million reported in 1H FY19.

- Continued solid growth reported at the 10 facilities based on main performance indicators â EBITDA, Occupancy, RADs, Quality, Care and Compliance.

Meanwhile, the company also offered FY20 guidance on the same day. Highlights are as follows:

- Normalised EBITDA is expected to reach circa A$105 million.

- Due to higher depreciation expense, as a result of facilities expansion, NPAT is anticipated to stand at circa A$38 million.

- Non recurrent expenses of circa A$3 million. The expenses would include the implementation of regulatory changes, scheduled to be effective on 1 July 2019 including the changes cover the implementation of Charter of Aged Care Rights, adoption of Single Aged Care Quality Framework and the introduction of Quality Indicators reporting requirements.

Moreover, the company mentioned the completion of refinance of syndicated bank debt facilities worth A$515 million on terms and conditions in line with the existing facilities. Of the total, A$295 million was earlier scheduled to mature in July 2020, however, $157.5 million and $137.5 million has now been extended to mature in July 2022 and July 2023, respectively. While, the maturity period of remaining A$150 million and A$70 million tranches remain unchanged; due in May 2021 and July 2022, respectively. The company reported a Net Debt of $320 million as on 31 May 2019, in line with the expectations and well within the required covenants.

REG Stock Performance:

REG is trading at A$2.600, up by 1.562% (As on 7 June 2019, 2:36 PM AEST) with a 52-week high and low of A$3.820 and A$2.310, respectively. The stock has generated a negative YTD return of 6.57% with a decline of 17.68% over last three months (As on 6 June 2019).

Other Aged Care Providers

Japara Healthcare Limited

Headquartered at Southbank, Japara Healthcare Limited (ASX:JHC) is one of the leading residential aged care and retirement living service providers in Australia. The company, along with its subsidiaries, owns and operates 48 homes in New South Wales, Queensland, Victoria, Tasmania and South Australia. Caring for over 3,500 people, JHC also runs 180 independent living units in five retirement villages across the country.

JHC is trading at A$1.225, down by 2.39% (As on 7 June 2019, 2:36 PM AEST) with a 52-week high and low of A$1.890 and A$1.070, respectively. The stock has generated a YTD return of 7.73% with a decline of 8.73% over last three months (As on 6 June 2019).

Estia Health Limited

With nearly 50-year experience, Estia Health Limited (ASX:EHE) is an Australia-based aged care provider, owning and leasing residential facilities/homes in New South Wales, Victoria, Queensland and South Australia, delivering services such as personal assistance, clinical healthcare and respite care. The company is also engaged in providing therapies, nutritionally balanced meals and lifestyle activities.

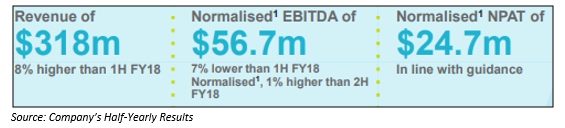

Below is the glimpse of companyâs half-yearly results:

EHE is trading at A$2.690, down by 0.37% (As on 7 June 2019, 2:36 PM AEST) with a 52-week high and low of A$3.450 and A$2.030, respectively. The stock has generated a YTD return of 20.54, soaring by 17.39% over last three months (As on 6 June 2019).

Comparative Stock Performance- REG, JHC, EHE

Comparative Stock Performance (Source: ASX)

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.