Introduction

The stocks of oil companies moved up after the drone attack that affected almost half of Saudi Arabiaâs daily crude production. The drone had attacked Saudi Arabiaâs oil production facilities located in Abqaiq (worldâs largest oil processing facility and crude oil stabilisation plant that can process more than 7 million barrels per day) and Khurais, which is claimed by Yemenâs Houthi rebels. The attack affected about 5.7 million barrels of daily crude production, which is approximately 50% of the Saudi Arabiaâs oil output. This forms above 5 percent of the worldâs everyday oil production. However, Saudi Arabiaâs biggest oil entity Aramco is making its attempt to restore approximately a third of its crude output after the attack.

As a result, during the weekend, benchmark Brent Crude futures moved by almost 10% to $66.22 per barrel and U.S. crude futures surged by almost 9% to $59.75 per barrel. Further on Monday, Brent surged 19% to almost $72 a barrel and U.S. crude rose more than 15% to about $63 a barrel.

Meanwhile, the rise in oil prices is not expected to be sustained as U.S. President Donald Trump has said that it will release oil from Americaâs strategic petroleum reserve if the need arises.

On the other hand, the market is also affected by the Reserve Bank of Australiaâs decision to cut its cash rate by a quarter point to a fresh new record low of 0.75 percent. This decision was anticipated by the market.

Letâs have a look at the 5 oil stocks, with strong presence in energy sector.

Beach Energy Ltd (ASX:BPT)

Raised 5 Year Target On the back of Strong FY 19 Performance:

Beach Energy Ltd (ASX:BPT), one of the strongest performers on ASX in 2019, in fiscal 2020 is targeting 194 wells and the companyâs focus is on Cooper Basin and Otway Basin. This reflects a growth of 45 percent from FY19 period. The company expects that 90% of growth projects will start in FY20, which is projected to deliver IRRs of more than 50%.

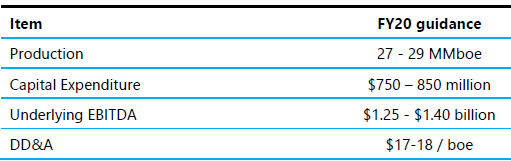

For FY20, the company projects that its investment expenditure will be in the range of $750-$850 million and expects to produce in the range of 27 â 29 MMboe during the period.

Moreover, the company has raised the 5-year production target to 34 â 40 MMboe from the previous range of 30 â 36 MMboe. The company has also increased 5- year free cash flow target to be $2.7 billion, which reflects over $1 billion free cash flow in FY24. BPT has also identified an additional investment opportunity of about $1.5 billion.

Meanwhile, for FY 19 results for the period closed 30 June 2019, the company has reported 86% increase in the Underlying NPAT of $560 million and 80% increase in the Underlying EBITDA to $1,375 million. During FY 19, the company produced more by 55% to 29.4 MMboe compared to FY18 and has achieved 85% drilling success rate in the company-operated wells.

FY 20 Guidance (Source: Companyâs Report)

On 4 October 2019, BPT stock last traded at $2.43, up by 0.413 percent from its prior close. The market cap of BPT was noted at $5.52 billion, with ~2.28 billion shares outstanding. The stock has given a return of 87.60 percent in YTD.

Cooper Energy Ltd (ASX:COE)

Anticipates producing over 5 petajoules of gas and about 240,000 barrels of oil in FY 20:

Cooper Energy Ltd (ASX: COE) has recently, on 17 September 2019 notified the market that it received the permit for six-year term to explore offshore Victoria at VIC/P76 located in the Otway Basin. This area is surrounded by gas fields and adjoining Annie-1 gas discovery. The permit covers the area that has good quality 3D seismic data, including Nestor, which have many similarities to the Annie gas discovery. The area is at the proximity to their existing pipelines and also has the access to the Minerva Gas Plant.

Moreover, Casino Henry participants is acquiring the Minerva Gas Plant from the Minerva Joint Venture (in which BHP Petroleum holds 90% and Operator, Cooper Energy hold 10% stake).

On the other hand, for FY 19, the company has reported statutory net loss after tax of $12.1 million compared to net profit after tax of $27 million, that had included significant items of total of $17.2 million. However, for FY 19, the company posted 36% rise in Underlying profit after tax to $13.3 million & 1% increase in Underlying EBITDA of $32.9 million with 28% growth in Gas sales revenue. The company during fiscal 2020 expects to produce over 5 petajoules of gas and about 240,000 barrels of oil.

FY 19 Financial Performance (Source: Companyâs Report)

On 4 October 2019, COE stock last traded at $0.56, up by 4.673 percent from its previous close. The market cap of COE was noted at $867.53 million, with ~1.62 billion shares outstanding. The stock has provided a return of 4.90 percent in the last 6 months timeframe.

Woodside Petroleum Limited (ASX: WPL)

First oil from The Greater Enfield Project:

Woodside Petroleum Limited (ASX: WPL) witnessed first oil from The Greater Enfield Project, which is a JV or joint venture among Woodside Energy Ltd (Operator, 60 percent) and Mitsui E&P Australia Pty Ltd (40 percent). The company had invested approximately US$1.9 billion in this project. The company is aiming to generate around 100 MMboe in 2020 period.

For 1H 2019 period, WPL had reported the net profit after tax of $419 million compared to $541 million in the corresponding period previous year, on the back of cyclone activity and the Pluto LNG turnaround. However, during 1H 2019, there has been 123% rise in the free cash flow to $869 million and the company generated $1,485 million of cash flow from operating activities.

On 4 October 2019, WPL stock last traded at $30.85, up by 0.26 percent from its earlier close. The market cap of WPL was noted at $28.99 billion, with ~942.29 million shares outstanding. The stock has provided a return of 0.92 percent in the YTD timeframe.

Oil Search Limited (ASX: OSH)

Companyâs Managing Director Mr Peter Botten will retire:

Oil Search Limited (ASX: OSH) notified the market recently, that its Managing Director Mr Peter Botten, will retire from the company effective from 25 August next year. Dr Keiran Wulff will become the Managing Director, effective from 25 February 2020.

On the other hand, PNG Government concluded the overall evaluation of the Papua LNG Gas deal.

For 1H 2019 period, OSH has reported 37% rise in sales volume to 13.4 mmboe & 105% rise in the net profit after tax to $161.9 million. Operating cash flows during 1H 2019 rose by 72 percent, on the back of elevated sales and average realised LNG and gas prices in 1H19 period, which was partly compensated by rise in production costs. The companyâs net debt fell 15 percent driven by US$3,048 million continuing refund of PNG LNG project debt.

On 4 October 2019, OSH stock last traded at $7.04, up by 0.428 percent from its earlier close. The market cap of OSH was noted at $10.69 billion, with ~1.52 billion shares outstanding. The stock has given a return of 4.94 percent in the last 30 days.

Origin Energy Ltd (ASX:ORG)

Outlook for FY 20:

Origin Energy Ltd (ASX: ORG) recently updated the market that two Petroleum Lease Applications (PLA) were lodged by the Mahalo Joint Venture (MJV) which will lead to the initial development area for the Mahalo Gas Project. The whole procedure would be handled by DNMRE, as an initial move taken, in the procedure for the developers of gas fields for the shorter-term exploration tenure to get converted into much longer-term development tenure.

On the other hand, for fiscal 2020, the company expects (Energy Markets) Underlying EBITDA to be in the range of $1,350 - $1,450 million. During fiscal 2020, the gross profit of the natural gas portfolio is projected to remain stable, though electricity gross profit will fall. APLNG or Australia Pacific LNGâs production in FY 20 is expected to be in the range of 680 to 700 petajoules. APLNG breakeven is projected to range between US$33 and US$36 per boe.

In FY 20 period, corporate costs are projected to be in the range of $70 to $80 million. Capital expenditure and investments, excluding APLNG, is expected to be in between $530 to $580 million.

On 4 October 2019, ORG stock last traded at $7.74, up by 0.519 percent from its last closing price. The market cap of ORG was noted at $13.56 billion, with ~1.76 billion shares outstanding. The stock has provided a return of 21.84 percent in the YTD period.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.