Introduction

The Australian benchmark S&P/ASX200, by the end of the trading session, on 20 September 2019, was at 6730.8 points, up by 13.3 points or 0.2 percent from the prior close. Accordingly, S&P/ASX200 Energy (Sector) which trades on ASX under the code XEJ, ended up at 10,904.9 points, up by 10 basis points or 0.9 percent from the last close.

In this article, we would discuss a few energy sector stocks listed on ASX and track their latest developments, as follows:

Paladin Energy Ltd

Retirement of Non-Executive Chairman:

Paladin Energy Ltd (ASX: PDN) on 19 September 2019, notified the market that Mr Rick Crabb, Non-Executive Chairman of the company told its management Board, that he intends to get retired from it. He will remain on the Board till December 31, 2019.

On the other hand, as per PDNâs update on 17 September 2019, the company has already raised $30.2 million (before costs) through the institutional placement of shares. The company will be raising an additional $7 million through the share purchase plan.

The funds raised will be used to meet the working capital requirements at both Langer Heinrich and Kayelekera. The funds raised will ensure the company, that it has the required fund for funding the remaining pre-feasibility work needed to restart its operations at Langer Heinrich. Langer Heinrich operations will help the company to be a âfirst starterâ if the uranium market recovers and rise, though the exact timing of any recovery of uranium market is still uncertain. At Langer Heinrich, the company was progressing with a pre-feasibility study for the optimisation of the mine plan and production rates, capital and rehabilitation plan. This will company to restart production from early-mid 2021. Further the company is selling its Kayelekera Mine in Malawi.

On 20 September PDNâs stock last traded at $0.120, surging up by 9.091 percent from the previous close. The company has a market cap of $217.46milion with ~1.98 billion shares outstanding. In the last 6 months period, the stock has given a negative return of 33.33 percent.

Viva Energy Group Ltd

Credit Rating Reaffirmed by S&P Global Ratings:

Viva Energy Group Ltd (ASX: VEA), a leading company operating in energy segment that holds exclusive licensee of the Shell brand and its products distribution in Australia.

On 19 September 2019, the company notified that its credit rating got re-affirmed at âBBB-âby the firm S&P Global Ratings. However, S&P has given its outlook from stable to negative, on the back of the challenging industry conditions. VEA on this has specified that the companyâs debt terms does not depend on a particular credit rating and outlook that is revised by S&P will not have an effect on its term to borrow debt. As at 30 June 2019, VEAâs net debt stood at $168.7 million.

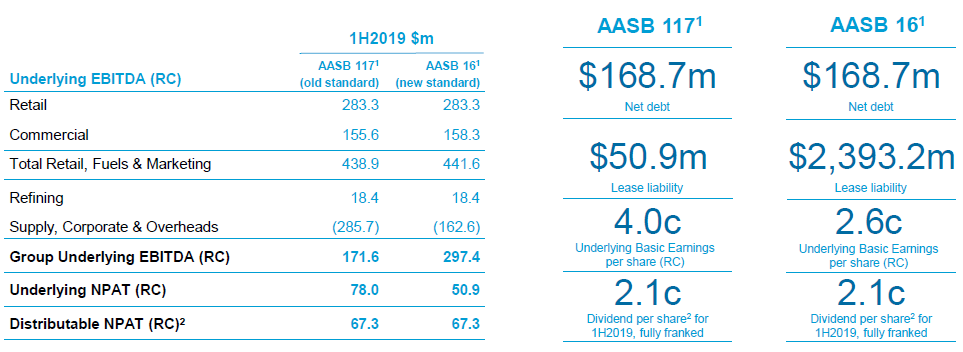

Meanwhile, VEA for the first half of 2019 has reported decline in Underlying NPAT (RC) under AASB 117 of $78 million versus $129.6 million in the first half of 2018. During 1H 2019, the total Underlying EBITDA (RC) also decreased to $171.6 million compared to $262.7 million in 1H 2018 under AASB 117.

During 1H 2019, there has been 2.5% increase in the total volumes to 7,126 million litres versus 1H2018 but in 1H 2019 the company posted approximately 2.2% decline in the total market volumes compared to the prior corresponding period. Additionally, for the second half of 2019, the company expects the total sales volume to remain flat compared to the sales volumes achieved in 1H2019.

1H FY 19 Financial Performance (source: Companyâs Report)

On 20 September VEAâs stock last traded at $1.97, 0.505 percent lower than the previous close. The company has a market cap of $3.85 billion with ~1.94 billion shares outstanding. In the last 6 months period, the stock has given a return of 20.48 percent.

Washington H. Soul Pattinson and Co. Ltd

18.1% increase in the regular cashflow from operations in FY19:

Washington H. Soul Pattinson and Co. Ltd (ASX: SOL) declared FY2019 report ended 31 July this year on 19 September 2019, wherein the company for FY 19 period has posted 18.1% increase in the regular cashflow from operations to $169.6 million compared to the previous year. Though, the company for FY 19 has reported 7.2% decline in the regular profit after tax to $307.3 million. During FY 19, the regular profit after tax were positively affected mainly by 22.9% rise in profit of Brickworks to $54.7 million driven by strong performance from property activities, 63.3% rise in the profit from investments and 157.1% rise in the Property Portfolio.

However, the FY 19 profits were negatively affected by 12.8% decline in the profit of TPG Telecom Ltd (ASX: TPM) due to NBN margin contraction and had to cancel its Huawei 5G mobile plan, rise in regular after tax loss from Round Oak Minerals to $54.1 million in FY 19 compared to $9.7million in FY 18. Moreover, if the company goes ahead with the merger of Vodafone, SOL anticipates the dividends from TPM to increase. Further, profit before tax of New Hope Corporation Limited (ASX: NHC) grew 3% during the period and it continues to pay SOL good dividend.

FY 19 Financial Performance (Source: Companyâs Report)

On 20 September SOLâs stock last traded at $22.08, 3.073 percent lower than the previous close. The company has a market cap of $5.45 billion with ~239.4 million shares outstanding. In the last 6 months period, the stock has given a negative return of 21.45 percent.

Origin Energy Ltd

Two Petroleum Lease lodged by MJV:

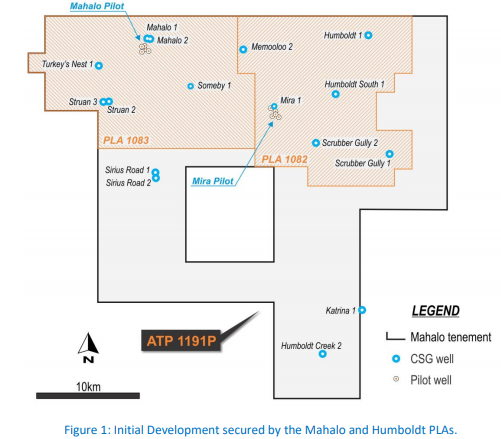

On 12 September 2019, Origin Energy Ltd (ASX: ORG) updated the market that the two Petroleum Lease (Mahalo and Humboldt Petroleum) Applications (PLA) were lodged by Mahalo Joint Venture (MJV) as the first step of the Mahalo Gas Project to produce first gas. The MJV participants comprised of Comet Ridge Limited (ASX: COI) with 40% share, APLNG holds 30% share (ORG is an upstream developer for APLNG) and Santos Limited (ASX: STO) has 30% share.

This is the first step taken by the Queensland Government for the development of gas field and the Gas which will produced from the Mahalo Gas Project is planned to be exclusively marketed in the respective equity share of MJV. The MJV is also in the process of finalisation of a number of applications in coming days for Potential Commercial Areaâs (PCAâs) which intends to cover the remaining area of the Mahalo Block that has not been covered by the PLAâs but would support future development stages.

Source: Companyâs Report

The company for FY 19 period, has reported 333% increase in the statutory profit, 42% increase in underlying profit and 35% increase in the operating cash flows compared to FY 18.

On 20 September ORGâs stock last traded at $7.885, 0.127 percent lower than the previous close. The company has a market cap of $13.91 billion with ~ 1.76 billion shares outstanding. In the last 6 months period, the stock has given a return of 6.18 percent.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.