In this article, we would discuss four companies from the ASX. Three of these companies are engaged in the energy sector and engaged in the extraction, production of fuels and coal. Meanwhile, one of the companies is a dedicated investment house with a substantial interest in the resources sector.

Viva Energy Group Limited (ASX: VEA)

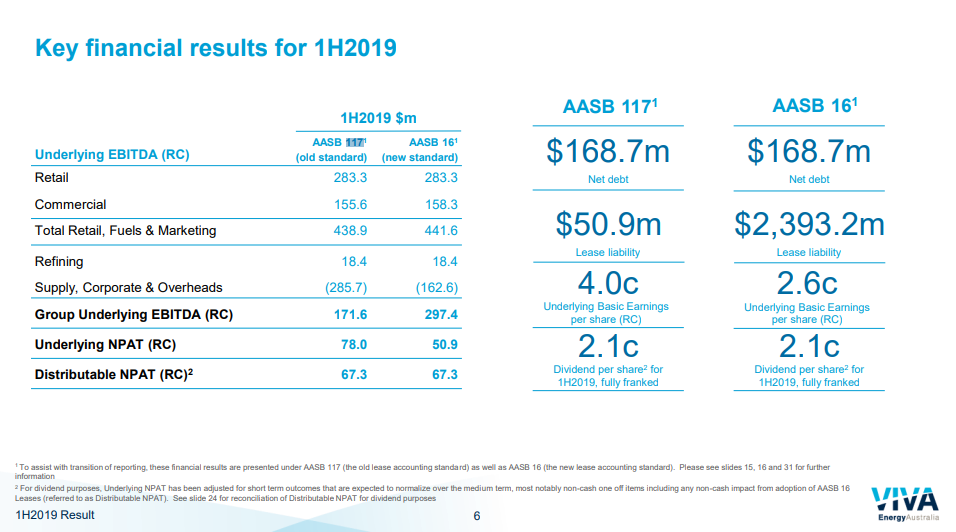

On 26 August 2019, the company declared results for the half-year ended 30 June 2019. Accordingly, the revenue of the company was noted at 7,811.2 million down by 9.3% from 8,608.7 million in 1H2018. On a replacement cost basis, underlying EBITDA was at the upper end of the 2019 guidance range of $150 to $180 million, and underlying NPAT was recorded $78 million within the upper end guidance of $60-$80 million.

Meanwhile, the company adopted AASB 16 leases for all the reporting period starting 1 January 2019, and the change was applied to the reporting of financial statements. Besides, the balance sheet included of net debt- $168.7 million as on 30 June 2019.

Viva has declared a fully franked dividend of 2.1 cents per share for the period. The dividend is payable on 14 October 2019, and the record date is 27 September 2019. It has an ex date of 26 September 2019.

Financial Results (Source: VEAâs 2019 Half Year Results Presentation)

Financial Results (Source: VEAâs 2019 Half Year Results Presentation)

Retail: Reportedly, the company was successful in the renegotiation of the Alliance partnership with Coles Express during the first half, and it took control of retail fuel pumps since March this year. Viva has commenced investment in new marketing initiatives, and competitive pump pricing across the country.

Besides, the acquisition of Liberty wholesale business was announced during the period, which remains under regulatory approval. The completion of the transaction would see Viva holding a 50% interest in the joint venture.

Meanwhile, the retail margin was impacted due to rising costs of oil, and delays in applying new pricing to the retail pump prices.

Commercial: As per the release, the company secured, renegotiated and extended a number of contracts for future growth. The earnings took a toll on higher shipping costs and margin pressure on contract renewals. Besides, the division has undertaken trials of very low sulphur fuel oil, which would allow the company to meet customer requirements following the implementation of new lower sulphur marine fuel rules from January 2020.

Refining: As per the release, the Geelong Refining margins fell to an average of US$5.1/bbl in the first half. However, the operational performance was strong during the period with 21.4 mbbls against 19.1 mbbls in 1H2018.

Meanwhile, the company witnessed record diesel production at 40% of the total production during the period, from 36% in FY2018. It depicts the improvement in crude sourcing to Geelong, resulting in better processing flexibility and reduced exposure to lower gasoline margins.

On 2 August 2019, VEAâs stock was trading at A$2.0, down by 4.762% (at AEST 1:17 PM). Over the year-to-date period, the stock has generated a positive return of 20.34%.

Beach Energy Limited (ASX: BPT)

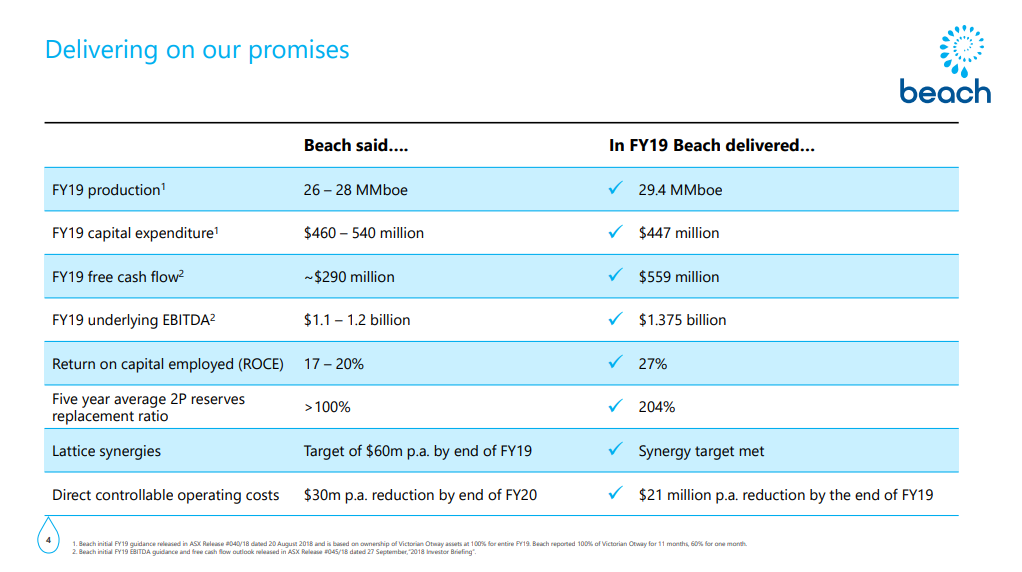

Recently, the company had disclosed full year results for the period ended 30 June 2019. Accordingly, the production was 29.4 MMboe, up by 55% over FY18 period. The revenue of the company wes noted $2,077.7 million, up by 64% in FY2019 compared to 1,267.4 million in FY2018.

Besides, the reported NPAT was up by 190% to $577.3 million FY2019 compared with $198.8 million in FY2018; however, the underlying NPAT was at $560 million in FY2019. Meanwhile, the company had declared a fully franked dividend of 1 cent per share payable on 30 September 2019, and the record date for the dividend is 30 August 2019.

Guidance Vs Results (Source: Beach Energy FY19 Results Presentation)

Guidance Vs Results (Source: Beach Energy FY19 Results Presentation)

Reportedly, the company realised $60 million synergy target during the year. Additional improvements in facility reliability helped to achieve record reliability of 97% across six operated facilities resulting in the production of 29.4 MMboe.

Since FY2019, the company has been applying low cost operating model and expects to meet the 20% sustainable cost reduction target by the end of FY20, which was approximately $30 million per annum of savings. Besides, the cost operating model is being applied in divisions such as logistics, maintenance planning, efficiency improvements, and technology collaborations with its JV partners.

FY20 Guidance: Reportedly, the company has anticipated production of 27-29 MMboe with capital expenditure of $750 to $850 million. Besides, it expects an Underlying EBITDA of $1.25 to $1.40 billion with DD&A of $17-18/boe.

On 27 August 2019, BPTâs stock was trading at A$2.24, up by 2.752% (at AEST 1:32 PM). Over the year-to-date period, the stock has provided return of 68.99%.

Yancoal Australia Limited (ASX: YAL)

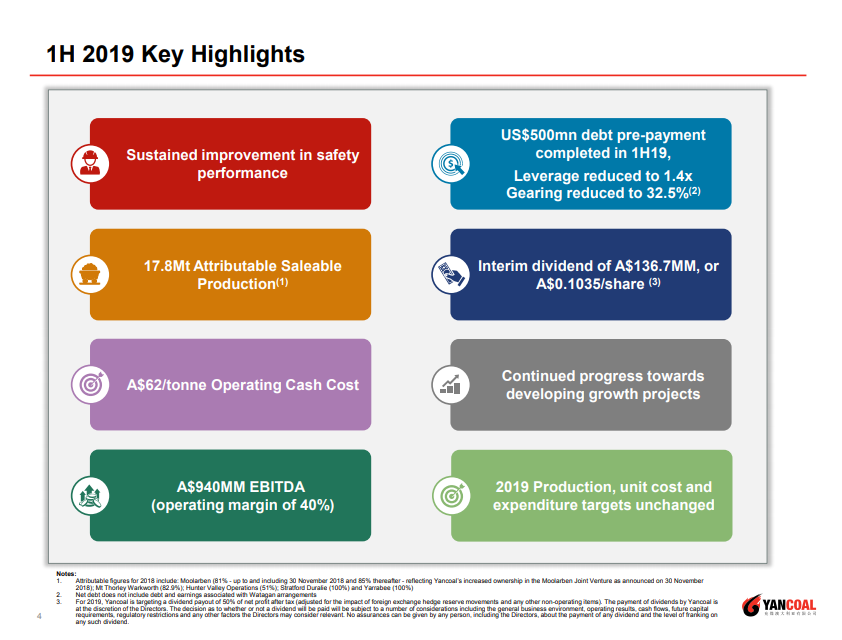

Recently, on 21 August this year, the company had released the half-year results for the period ended 30 June 2019. Accordingly, the revenue was noted of $2,350 million for the period almost same as compared to $2,347 million in the previous corresponding period. Further, it declared an unfranked dividend of A$0.1035 per share payable on 20 September 2019 to the shareholder, with a record of 6 September 2019.

Meanwhile, the profit before tax was $492 million in 1H19 against $539 million in 1H18. Besides, the reported profit after tax was $564 million in 1H19, up from $361 million in 1H18. This was impacted by a one-off tax expense adjustment of $219 million related to the Coal & Allied acquisition.

Reportedly, the company had recorded total ROM production attributable to YAL of 22.7Mt, up by 10% from 20.7 Mt in the previous corresponding period. The attributable saleable coal production was 17.8Mt in the first half compared to 16.4Mt in the previous corresponding period.

Key Highlights (Source: YALâs 2019 Interim Results Presentation)

Key Highlights (Source: YALâs 2019 Interim Results Presentation)

Meanwhile, the company realised an average price of A$112/tonnes for thermal coal products down from A$117 in 1H18. It realised A$184/tonne for metallurgical coal product, down from A$191 in the previous corresponding period.

Outlook: As per the release, the company has a long-term strategic commitment to organic growth, and it is currently focusing on the expansion works across Mount Thorley Warkworth and Moolarben. In the Asia-Pacific region, the demand for thermal coal had subdued during the first half. Whereas the metallurgical coal had seen better price stability during the first half, and the company expects it to decline in the second half.

Meanwhile, the companyâs stated guidance target has not changed, and it expects attributable saleable coal production of around 35 million tonnes. Besides, the attributable capital expenditure is around A$285 million.

On 27 August 2019, YALâs stock was trading at A$2.99, down by 0.664% (at AEST 1:39 PM). Over the year-to-date period, the stock has given a negative return of 18.28%.

Washington H Soul Pattinson and Company Limited (ASX: SOL)

The company holds interest in the organisations engaged in mining, equities, property, financial services, building products, pharmaceuticals and telecommunications.

On 15 August 2019, SOL announced that one of its directors, Robert Gordon Westphal changed his interests in the company on 14 August 2019. The director now holds 10,000 direct interests and 13,739 indirect interests.

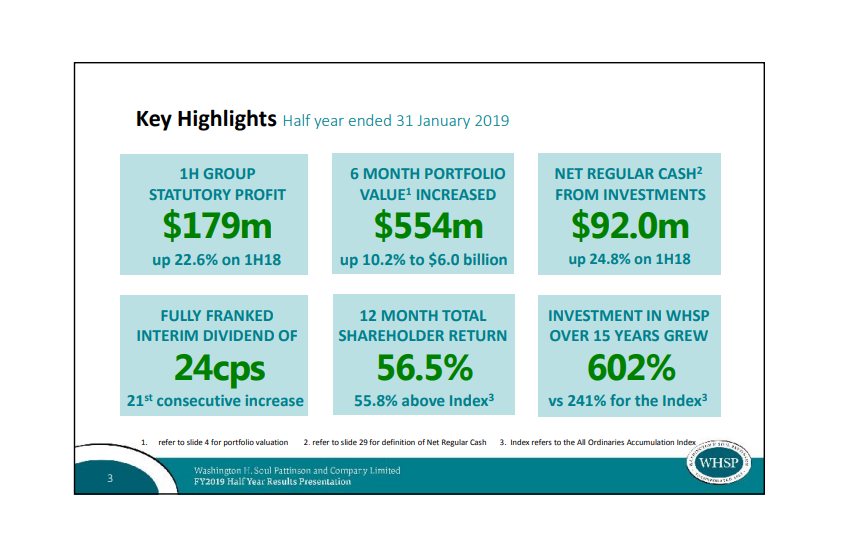

In March 2019, SOL released half-year results for the period ended 31 January 2019.

Highlights-First Half (Source: SOLâs Analysts Presentation HYE)

Highlights-First Half (Source: SOLâs Analysts Presentation HYE)

Reportedly, the regular profit after tax was $186.7 million for the period, up 12.2% over the previous corresponding period. The profits were attributable to a substantial contribution from New Hope Corporation Limited (ASX: NHC), Brickworks Limited (ASX: BKW) and Round Oak Minerals Pty. Limited.

Meanwhile, New Hope reported strong results for the first half of 2019 backed better thermal coal prices, increased production from Bengalla. Besides, it witnessed improved realised pricing on oil sales and additional acquisition of an interest in the Bengalla JV.

Besides, Brickworks had recorded statutory NPAT of $115 million for the half year, which was up by 18% over the previous corresponding period. It suffered margin declines, particularly at Austral Bricks. Brickworks completed the acquisition of Glen-Grey in November 2018.

Further, Round Oak Minerals contributed to a loss of $22.7 million to the group, and it was attributed to cost and expense for the development of various projects.

On 27 August 2019, SOLâs stock was trading at A$20.41, up by 1.09% (at AEST 1:51 PM). Over the year-to-date period, the stock provided with a negative return of by 17.05%.

Disclaimer

This website is a service of Kalakine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.