Coal is the largest energy resource of Australia, accounting for nearly two-third of the power generation from coal-fired power stations in the country. New South Wales and Queensland are the two largest coal producing states in Australia.

Below discussed are three coal producers with operations in Queensland. Let us have a close look at their recent operations and stock performance.

Yancoal Australia Limited (ASX: YAL)

About the company:

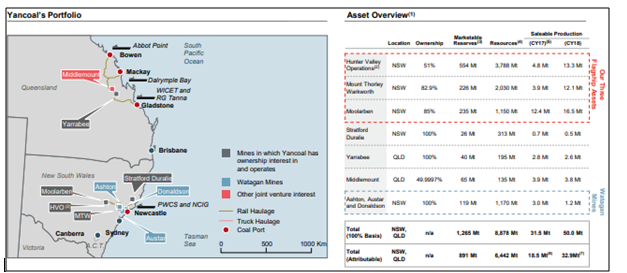

Yancoal Australia Limited is a pure play coal producer in the Australian energy market. It operates five mines, in addition to managing five others, in the states of Queensland, New South Wales and Western Australia. Moreover, it has an equal joint venture with Peabody Energy in the Middlemount mine in the Bowen Basin. In 2018, the company reported saleable (attributable basis) thermal and metallurgical coal production of around 32.9 million tonnes, while for 2019, it is targeting ~ 35 million tonnes of saleable coal production.

YAL Portfolio Overview (Source: Companyâs Report)

Stock Performance:

In the past six months, YAL stock has provided a return of 1.33%. On 19 July 2019, the companyâs stock last traded at $ 3.360, up 1.818% from its previous closing price. The company has a market capitalisation of $ 4.36 billion and 1.32 billion outstanding shares. Its EPS stands at $ 0.676, while it has an annual dividend yield of 7.97%.

Recent Updates:

Quarterly Activities Report:On 16 July 2019, the company updated the market regarding its achievements during the quarter ended June 2019. It reported ROM coal production of 17.1 million tonnes in the second quarter of 2019, representing similar volume registered during the year-ago period. Its saleable coal production grew 6% year-on-year to 13.4 million tonnes, while attributable saleable production reported an increase of 6% year-on-year to 9.0 million tonnes.

Moreover, the company reported that year-to-date attributable saleable coal production is running 9% ahead of 2018. The total recordable injury frequency rate stood at 7.17 in the June quarter, compared with 7.12 in the previous quarter. The average coal price realised in the current quarter stood at A$116 per tonne, up from A$133 per tonne reported in the previous quarter.

Meanwhile, YAL kept its guidance for 2019unchangedfor attributable saleable coal production at approximately 35 million tonnes, FOB operating costs (excluding royalties) at A$62.50 each tonne and capital expenditure of A$285 million.

Performance Share Rights Issue:In the month of June 2019, the company issued 2,161,669 performance share rights at a nil issue price to its executive director and certain senior executives.The rights issue, which has a vesting date of 31 December 2021, is subject to vesting conditions based on relative EPS and cost target conditions, which are to be determined and vesting at the measurement period end on 31 December 2021.

New Hope Corporation Limited (ASX: NHC)

About the company:

New Hope Corporation Limited, operating in the Australian energy sector, has a diversified portfolio of business interests and operations. The company is engaged in exploration, development, production and processing of coal and oil & gas properties. Other businesses of the company are port operations, innovative technologies and investment. The company, which was listed on the ASX in September 2003, was founded in 1952 and is headquartered in Queensland.

Stock Performance:

In the past six months, NHC stock has provided a negative return of 32.10%. On 19 July 2019, the companyâs stock last traded at $ 2.540, down 0.781% from its previous closing price. The company has a market capitalisation of $ 2.13 billion and 831.27 million outstanding shares. Its EPS stands at $ 0.185, while it has an annual dividend yield of 6.25%.

Recent Updates:

Colton Project Update:On 12 July 2019, the company updated the market regarding the decision of the Supreme Court of New South Walesconcerning its previously made announcement on 1 February 2019.NHChad announced to have started proceedings with its relevant subsidiaries against Wiggins Island Coal Export Terminal Pty Ltd (WICET) and others in the court, seeking, amongst other things, a declaration that the company was not bound by a Deed of Cross Guarantee (DOCG) to guarantee the debts of Northern Energy Corporation Limited (administrators appointed) (NEC) and Colton Coal Pty Ltd (administrators appointed) (Colton Coal).

The Supreme Court of New South Wales concluded that New Hope Corporation Limited has not guaranteed the debts of NEC and Colton Coal under the DOCG.

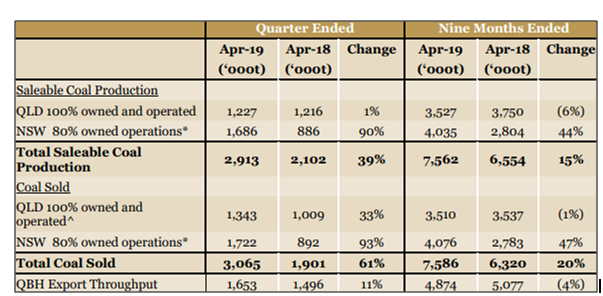

Quarterly Activities Report:NHC released its quarterly activities report for the period ended 30 April 2019 on 28 May 2019. The company reported a 39% year-on-year increase in total saleable coal production to 2.91 million for the quarter ended April 2019. Moreover, total volume of coal sold stood at 3.07 million in the quarter ended April 2019, up 11% from 1.5 million of coal sold in the same period a year ago. Below figure depicts the companyâs performance during the quarter.

Source: Companyâs Report

The company also unveiled that its stake in the Bengalla Joint Venture grew to 80% after it completed the acquisition of an additional 10% interest in the JV on 25 March 2019. The company paid $215 million to Mitsui for the interest. The remaining 20% stake in the JV is held by Taipower.

For the reported quarter, New Hopeâs share of coal produced at Bengalla, the thermal coal mine located in the Sydney Basin of the Upper Hunter Valley region in New South Wales, stood at 1.7 million tonnes, representing an increase of 90% from the same period a year ago.

Moreover, the company was notified by the Queensland Department of Environment and Science on 12 March 2019, regarding the grant to the application to amend the Environmental Authority for the New Acland Coal Mine Stage 3 Project, which needs to secure mining leases, an associated water licence and several secondary approvals in order to start mining activity.

Stanmore Coal Limited (ASX: SMR)

About the company:

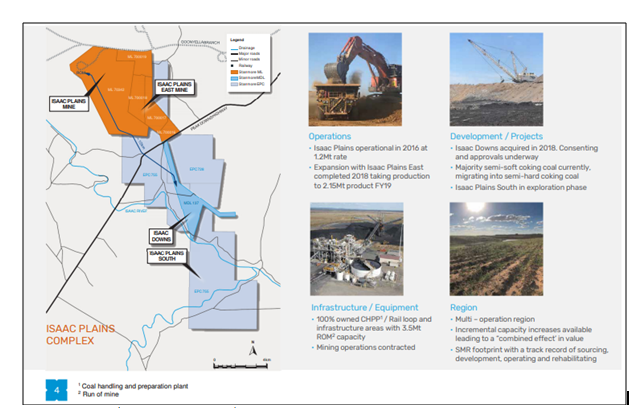

Stanmore Coal Limited is a metallurgical and thermal coal producer in the Australian energy market. The company wholly owns the Isaac Plains Complex, including the Isaac Plains Mine, the Isaac Plains East (operational) and Isaac Downs (open cut mine project) and the Isaac Plains Underground Mine. The company caters to the steel manufacturing industry with coal produced from the metallurgical mine. Additionally, the company has a diversified portfolio of development and exploration properties situated in the Bowen and Surat Basins in the Australian state, Queensland. Its properties host and produce some of the best coking, PCI and thermal coal in the globe.

Isaac Plains Complex (Source: Companyâs Report)

Stock Performance:

In the past six months, SMR stock has provided a return of 60.73%. On 19 July 2019, the companyâs stock last traded at $ 1.485, down 3.257% from its previous closing price. The company has a market capitalisation of $ 393.17 million and 256.13 million outstanding shares. Its EPS stands at $ 0.076, while it has an annual dividend yield of 3.26%.

Recent Updates:

Additional Capacity:Golding Contractors Pty Ltd, the wholly owned subsidiary of NRW Holdings Limited (ASX: NWH), reached an agreement with Stanmore Coal for additional capacity at the Isaac Plains East mine project, according to a NWH announcement on 3 July 2019.

The deal, which involves the addition of a third truck and excavator fleet, is aimed at boosting the overburden removal capacity. It would result in the addition of approximately $ 450 million to the existing value of the five-year contract estimated atnearly $ 950 million at the current production levels of the mine.

The third fleet is scheduled to start operations in the month of August 2019. As part of the deal, Golding Contractors will deliver an additional Hitachi EX3600 excavator and 5 EH3500 Hitachi trucks, in addition to the remainder of the ancillary fleet to be mobilised from NRWâs Middlemount project, contract for which is not formally scheduled for completion before the end of -FY20. Meanwhile, Stanmore Coal will supply a new Caterpillar 6060 excavator, which will be operated and maintained by Golding.

New Investment:On 3 July 2019, SMR announced to have reached binding agreements for the acquisition of a 600-tonne excavator from Hasting Deering (Australia) Limited. The company plans to finance the excavator acquisition through an equipment loan facility set up with Caterpillar Financial Australia Limited. The loan facility has a term period of five years. The excavator will be used at the Isaac Plains East mine and later transferred to Isaac Downs Project after the company secures grant of environmental approvals for the project.

Meanwhile, the company also finished the Isaac Plains Underground Bankable Feasibility Study, confirming that the production levels at the new underground mine could be increased up to an average of 1.2 million saleable tonnes per annum from the second year of the production plan.

Debt Refinance Completion:In a market update on 1 July 2019, SMRâs Board announced the refinancing of its bonding and working capital facility with Taurus, the companyâs existing financier. The facility, which was earlier due for maturity on 15 November 2019, received extension till 30 June 2022.

Additionally, the Board unveiled to have established a new bonding facility with Liberty Speciality Markets, to provide financial assurance to the state government of Queensland as part of its future rehabilitation obligations. The $20 million facility has a premium rate of 4.7% per annum. The new arrangements are part of the companyâs business strategy and highlight its growing financial strength.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.