Sydney-based Yancoal Australia Limited (ASX:YAL) operates a diversified portfolio of world-class assets consisting of both large-scale open cut and underground mines. Its services include coal mining, processing, and sale of pure-coal, metallurgical coal, and more. Besides, the company also exports its products worldwide.

On 31 May 2019, Yancoal Australia released its 2019 Annual General Meeting (AGM) CEO Presentation. Mr Reinhold Schmidt is currently leading as the Chief Executive Officer of the company. Also, in 2018, Yancoal got listed on the Stock Exchange of Hong Kong Ltd.

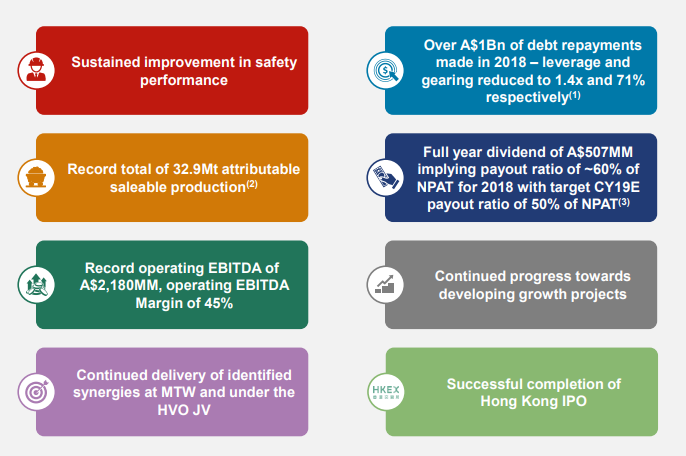

The highlights of the presentation for the year 2018 included:

Source: 2019 AGM CEO Presentation

Source: 2019 AGM CEO Presentation

The company continued to develop and implement Core Hazard Critical Controls throughout the year with a commitment to operating mines to the highest safety standards. The Yancoal Total Recordable Injury Frequency Rate stood at ~ 7.7% as of December 2018, reducing significantly from ~ 12.5% since the completion of Coal & Allied acquisition in September 2017.

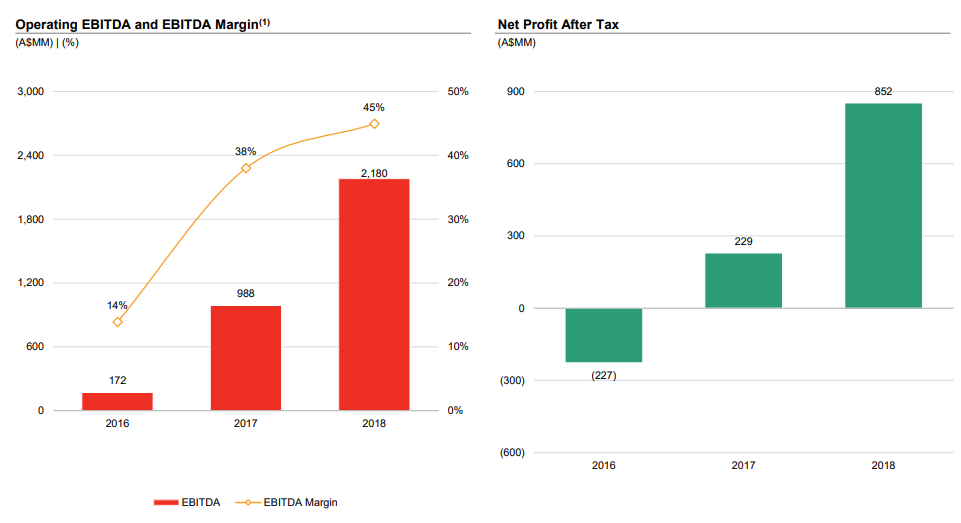

On the financial front, the companyâs operating performance delivered a record operating EBITDA of AU$ 2,180 million (EBITDA margin of 45%), which is way higher than AU$ 988 million in 2017. The net profit after tax (NPAT) also reached record levels at AU$ 852 million, rising from AU$ 229 million in 2017 and a loss of AU$ 227 million in 2016.

Source: 2019 AGM CEO Presentation

Source: 2019 AGM CEO Presentation

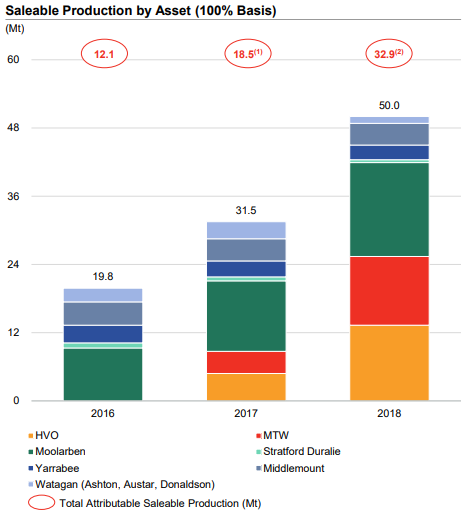

There was a significant expansion of operations with the completion of Coal & Allied acquisition and record production from Moolarben. The total gross saleable coal production for 2018 amounted to a record 50Mt, up 59% on the prior year on the back of 84% contribution from Yancoalâs three tier-one assets, Hunter Valley Operations (HVO), Mount Thorley Warkworth (MTW) and Moolarben which produced 41.9Mt in total.

The record annual production for Moolarben stood at 16.5Mt with maximised extraction rates at OC4/OC2 pits, and the Moolarben longwall (commissioned in November 2017) continues to deliver high productivity rates.

Source: 2019 AGM CEO Presentation

At MTW, Yancoalâ recorded fleet efficiency gains in 2018 and the receipt of approvals enabled the expansion of West Pit. Besides, HVO maintained high rates of extraction and haulage, while the ongoing maintenance reviews are expected to drive further production gains. The company anticipates ~ 35Mt of saleable production on an attributable basis in 2019.

According to the CEO, the robust financial performance has enabled the company to distribute dividends and undertake early debt repayments. The combined dividends for 2018 were A$ 507 million, or A$ 0.39 per share. In addition to this, the debt of US$ 1,400 million has been repaid during the past 20 months. Also, in 2018, the Yancoal Community Support Program invested more than $ 800,000 into the local community initiatives across Australia such as QUTâs Cancer and Ageing Research Program, Westpac Rescue Helicopter, Science, Technology, Engineering and Mathematics (STEM) and others.

Going forth, the companyâs 2019 guidance for saleable production is around 35 million tonnes (attributable share), with stable production costs of A$ 63.5 per tonne (FOB basis and excluding royalties) and a capital expenditure of approximately $ 285 million (equity share).

The YAL stock is currently trading at A$3.280 (as on 3 June 2019, 12: 15 PM AEST), up by 1.548%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.