In this article, we discuss recent updates from energy focused companies listed on the ASX. On 8 August 2019, the S&P/ASX 200 Energy Index was trading at 10,405.5 , up by 88.2 points or 0.85% from the previous dayâs close, while the benchmark index S&P/ASX 200 was trading at 6,541.2, up 21.7 points or 0.33% from the previous dayâs close (as at AEST: 2:08 PM).

Winchester Energy Limited (ASX: WEL)

On 7 August 2019, Winchester Energy released an announcement related to capital raising . It notes that the company has received commitments to place ~100 million shares at an issue price of A$0.025, which would raise ~A$2.5 million before costs. Additionally, the placement would result in the total number of shares on the issue to reach approximately 531 million.

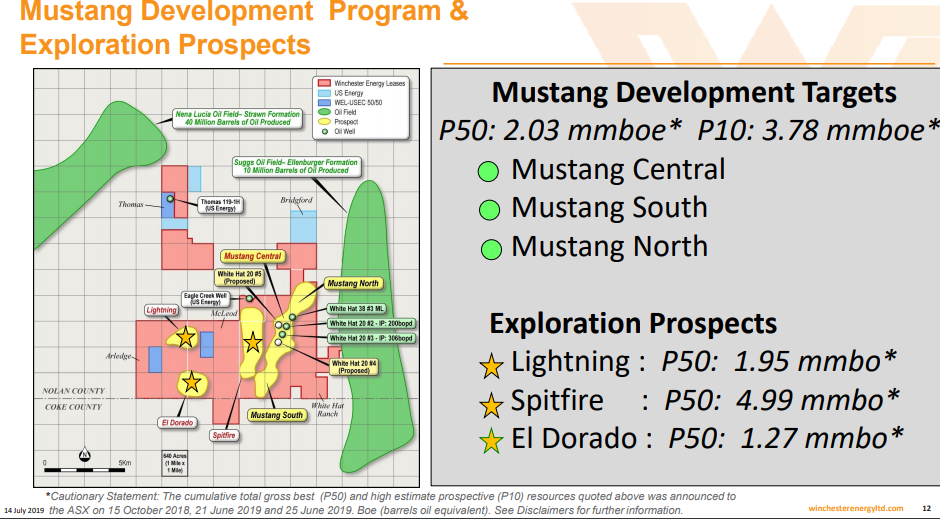

The company intends to utilise the fresh capital to undertake drilling activities at the Mustang Oil Field, which is located within the 17k acres leasehold estate in the eastern shelf of the Permian Basin, Texas. Besides, the proceeds would be utilised for the ongoing assessment of recently discovered prospects, and general working capital requirements.

Reportedly, the private placement was managed by CPS Capital Group Pty Ltd (CPS), which would be entitled to the placement fee of 6% of the raised capital. Besides, the placement is expected to be completed on or around 14 August 2019.

(Source: Company Presentation 17 July 2019)

(Source: Company Presentation 17 July 2019)

Neville Henry, MD of Winchester Energy, asserted that the recent discovery at the Mustang Oil Field has uncovered significant potential revenues in a short span of time, and that fresh capital would be deployed for drilling activities. Besides, the company would shortly commence completion activities at Arledge 16#2 well, which recorded highly encouraging test results.

On 8 August 2019, WEL was trading at A$0.031, down by 11.429% from the previous dayâs close (AEST: 2:23 PM). Over the year-to-date period, the stock has appreciated +60%. Besides, the stock is up by 6.67% over the past one-month period. By the close of the previous trading session, the market capitalisation of the stock was approximately A$15.1 million.

ADX Energy Ltd (ASX: ADX)

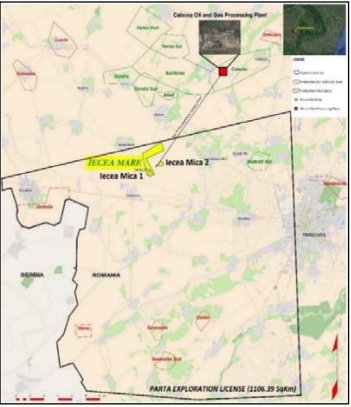

On 7 August 2019, ADX Energy reported the commencement of drilling at the Iecea Mica-1 Well (the well). The well is located in the Iecea Mare licensed area, on shore in Western Romania.

Reportedly, the well was spudded on the morning of 6 August 2019 at around 10 AM local Romanian time. Besides, the company anticipates to intersect the 1st target reservoir, which was previously tried ~ thirteen days following the spud. Further, the company expects to take approximately twenty-seven days following spud to drill and evaluate the Iecea Mica 1 well.

IM?1 Well location (Source: Companyâs Announcement)

ADX Energy Panonia SRL wholly owns the production license, and ADX Energy Panonia SRL is the wholly owned subsidiary of Danube Petroleum Limited.

On 8 August 2019, ADX was trading at A$0.012, unchanged from the previous dayâs close. Over the year-to-date period, the return from the stock has been 20%. Besides, the stock is up by 71.43% over the past one month.

Byron Energy Limited (ASX: BYE)

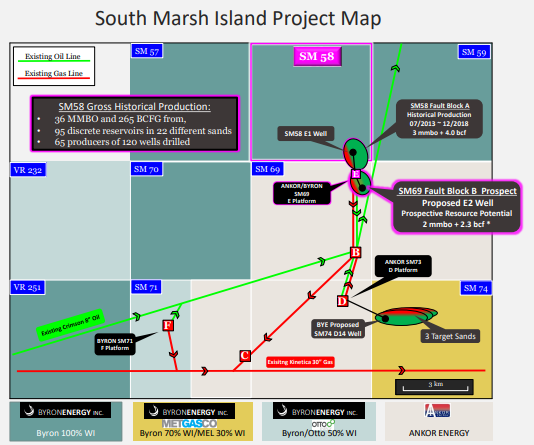

On 7 August 2019, the company reported the commencement of drilling at the SM58 011 exploration well. The release stated that the company utilised Enterprise 263 jack-up drilling rig for the drilling operations at the SM58 011 well.

Reportedly, the well is the first test-well from the recently acquired South Marsh Island 58 block (SM58). Also, a 500â Measured Depth was drilled by the company, and the current operations are drilling further 800â Measured Depth before the running and cementing of 16â conductor pipe.

The well would evaluate the companyâs Cutthroat Prospect, which is targeting the very productive, normally-pressured O Sands accounting for approximately half of the thirty-five million barrels of oil produced from the well since 1964.

Besides, the well would be operated by the company to undertake drill to a depth of 11,466 feet Measured Depth, and the company has estimated taking close to one month for drilling and evaluation when the rig would be on location. Further, the company would incur all of the costs associated with the well for which it holds operator rights and title.

(Source: Investor Presentation, April 2019)

On 8 August 2019, BYE was trading at A$0.235, unchanged from the previous dayâs close. Over the year-to-date period, the stock has returned +11.90%. Besides, the stock is up by 9.30% over the past one month period.

Beach Energy Ltd (ASX: BPT)

On 7 August 2019, the company notified that the FY19 results along with presentation, would be released before the opening of the market on 19 August 2019.

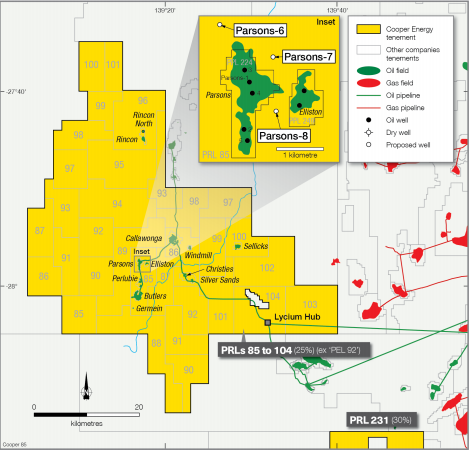

Recently, the companyâs PEL 92 joint venture partner Cooper Energy (ASX: COE) had notified the commencement of three well programs at Parsons. COE holds 25% interest in the joint venture, and the balance is held by Beach Energy.

As per the release, the new campaign is intended to test the limits of the field, and production from the Parsons Field had outstretched the originally planned extent of the field. The program also includes Parsons -6, Parsons -7, Parsons -8; refer to the figure below.

Besides, Namur Sandstone is the primary target of the three wells. The wells are linked via a pipeline to the storage facility at Callawonga of PEL 92. Further, the appraised wells would allow selecting the locations of development of well following the full-field development plan, the execution of which is expected to be completed by the end of 2019.

Three Wells Locations (Source: Companyâs Announcement)

Additionally, the successful wells in the ongoing program could be connected to the PEL 92 system along with production commencement during Q4 2019. The company had anticipated that the each well in the program are likely to take single week to drill & complete.

On 8 August 2019, BPT was trading at A$1.907 up by 1.167% from the previous dayâs close. Over the year-to-date period, the stock has returned +46.12%. Besides, the stock is down by 1.31% over the past one month period. By the close of the previous trading session, the market capitalisation of the stock was approximately A$4.3 billion (AEST: 3:20 PM).

Senex Energy Ltd (ASX: SXY)

Oil & gas producer, Senex Energy is an ASX listed energy company. It manages a portfolio of onshore oil & gas assets in Queensland & South Australia.

On 1 August 2019, the company notified about the commencement of drilling at the Project Atlas (Project). Accordingly, the companyâs natural gas drilling campaign in the integrated Surat Basin, which has ~110 wells, hosts Project Atlas.

Besides, the first well was spudded during the night of 31 July 2019, and Easternwell rig was moved to the Project. Further, the latest development at the Project follows the first 10 wells in the companyâs campaign at the Roma North Development.

Ian Davies, Managing Director & CEO, stated that the Project Atlas is a high-class asset in a demonstrated and prolific gas-producing area, and the company has great confidence in the particular asset. Therefore, the spudding of the initial well brings the company closer to the first gas later in the calendar year.

On 23 July 2019, the company released quarterly report for the period ended 30 June 2019. The company had achieved solid performance in the June quarter and continued to de-risk the delivery of natural gas projects located in Surat Basin.

Sales & Revenue:

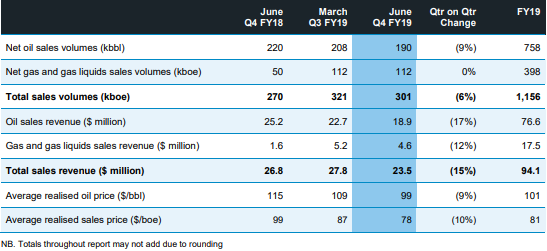

The company recorded full-year FY19 sales volume of 1.2 mmboe up by 42% from the prior year backed by the escalated production. Also, the full-year revenue of ~$94 million was up by 34% from the previous year.

Sales & Revenue (Source: Companyâs Quarterly Report, July 2019)

Q4 FY19 sales volume was down 6% against the prior quarter due to lower oil sales while gas sales were consistent with the prior quarter. Further, the sales revenue at $23.5 million was down by 15% over the prior quarter due to subdued oil sales and realised prices for oil. Importantly, the average realised AUD oil price was down by 9% to $99/bbl from A$109/bbl.

On 8 August 2019, SXY was trading at A$0.300, down by 1.639% from the previous dayâs close (AEST: 3:23 PM). Over the year-to-date period, the stock returned 15.09%. Besides, the stock is down by 11.59% over the past one month period.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.