Crude oil prices are enjoying the supply tension, and the current month is the first one to trade on a green territory post a crash from 2019 high. The year 2019, saw a sharp upside in crude from the level of US$52.51 (low in January 2019) to the level of US$75.60 (High in April 2019); however global cues took a crude down in May and early June this year, but the recent event drove the crude prices up in the international market.

The rise in crude oil prices brought respite for oil explorers, which previously lost a significant amount of value over the crude plummet. Letâs have a look at the three ASX listed Energy Stocks as follows:

Oil Players on ASX:

Woodside Petroleum Ltd (ASX: WPL)

Latest Update:

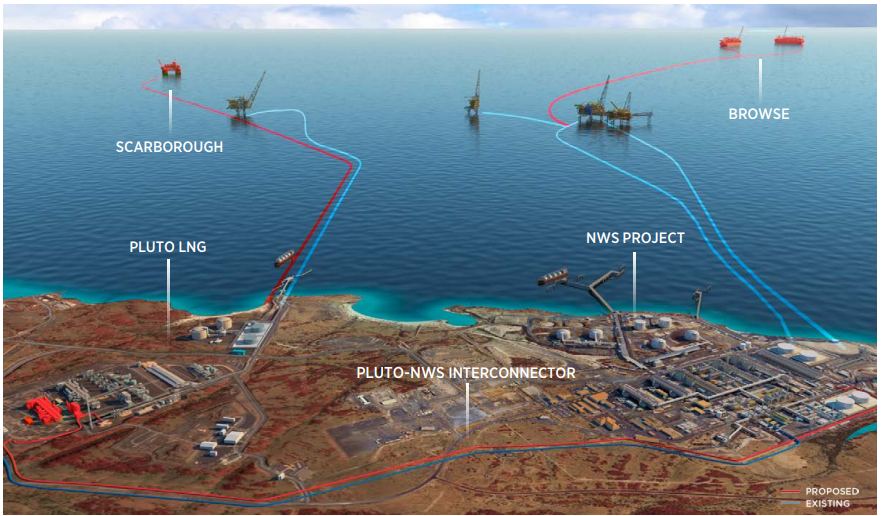

The previous crude plummet brought the shares of the company under the investorsâ lens and on 24th June 2019, WPL conducted investors and analysts visit at its operational facilities in Karratha, during which the Chief Executive Officer of the company, Peter Coleman, undertook a 60-minute question and answer session with the investors and analysts.

During the session, Peter Coleman admitted that WPL would bypass the deadline of a deal undertook by the company, on terms for processing third-party gas through the North West Shelf LNG venture and targeted for the present month.

The company reached the landmark agreement previously to process the third-party gas at the North West Shelf prospect, intending to extend the processing plant life. The Joint Venture partners of the North West Shelf prospect include BHP Billiton, Chevron and Shell.

The third-party agreement had also paved the way for the gas processing at the North West Shelf ventureâs LNG plant from the Browse fields prospect of the company.

Post laying the foundation for the JV deal, the North West Shelf venture reached a preliminary agreement to process the Browse Venture gas along with gas from a separate Chevron venture. The preliminary agreement within the Joint Venture companies paved the way for billion dollars investment in offshore gas production.

WPL believed that the agreements were a pivotal step towards realising the potential of the Burrup Hub in Karratha and would extend the life of the Karratha gas plants for decades.

Burrup Hub (Source: Companyâs Report)

WPL further targets to give a final go-ahead to its Browse project gas processing at the NWS Shelfâs liquified natural gas plant in the late next year.

WPL also updated on 24th June that the company restarted the LNG production at the Pluto LNG prospect.

Price and Performance:

The stock price of the company encashed the crude surge and inched up from the level of A$33.820 (Dayâs low on 6th June 2019) to the level of A$37.500 (Dayâs high on 21st June), which in turn marks an upside of more than 10 per cent in just 30-days. However, the stock price of the company has been trading on a negative zone from the last two trading sessions over the crude spill and stood at A$36.970 (as on 25th June 2019), down by 0.511% from its previous close.

The shares of the company delivered a return of 6.48 per cent in one year, and a return of 5.90 per cent in just 5-days over the event-driven crude bull rush. The YTD return (as per yesterdayâs close) is at 21.88 per cent.

The prices are now near to its previous up-rally, which we explored and presented in our previous technical article on the company.

Mayur Resources Limited (ASX: MRL)

Latest Update:

MRL announced on 25th June 2019 that the company acquired the remaining 11 per cent minority interest via a roll up share allocation to consolidate 100 per cent ownership of its power and energy resources portfolio, which includes Mayur Energy and Mayur Power Generation.

The company previously owned 89 per cent stake in MR Energy PNG Pte Ltd and MR Power Generation PNG Pte Ltd. Both the subsidiaries are incorporated in Singapore, and Waterford Ltd controlled the minority equity stake of 11 per cent.

Waterford Ltd is a PNG incorporated entity, which holds the MRL exploration licences for coal in Gulf province, and MRL acquired Waterford Ltd before its IPO and offered the minority stake in the two subsidiaries of the company.

MRL had an option to acquire Waterford Ltd for a cash consideration of US$2.5 million; however, the Original Waterford Shareholders elected to take the minority stake in the companyâs subsidiaries, which in turn, valued the subsidiaries collectively in mid-2017 at circa US$22.7 million.

Background:

The Original Waterford Shareholders continued to fund their respective share of the development costs of the two subsidiaries, which marked a recent cash contribution of A$442,304 by the Original Waterford Shareholders.

The two subsidiaries continued to demonstrate significant progress, which is as follows:

- Maintained all the dialogues for the Lae EEP project with the industry stakeholders and the Government.

- Completed a detailed air modelling which proposed the technology for Lae EEP would improve the air quality.

- Signed two MOAs with Morobe Provincial Government and Gulf Provincial Government, respectively, to support the Lae EEP.

- The subsidiaries successfully completed the regional coal mapping program, field mapping and surface sampling in Gulf Province.

- Secured a non-binding offtake agreement for coal.

Apart from the above-mentioned significant progress, the two subsidiaries accomplished many other milestones.

The Acquisition:

MRLâs acquisition of the two subsidiaries was initially due to be via cash; however, over extensive negotiations, the company consented to roll up the Minority Equity Stake of the subsidiaries into MRL at an agreed valuation and conversion into MRL shares.

The valuation for the proposed rollup was based upon the averages of the last two broker research paper by Bell Potter, which valued the company at an average of $1.15 a share and apportioned 33.14 per cent of the underlying value to the respective subsidiaries.

The apportioned percentage was then applied to the 14-days volume weighted average price of the company ($0.50), which in turn, valued the subsidiaries at 16.6 cents per share. The minority stake of 11 per cent was then calculated, which resulted in the valuation of 1.82 cents per share.

Post implementing the 1.82 cents per share to the agreed valuation per share (1.82/50) provided an implied value of 3.65 per cent of MRL shares. This was then applied to MRLâs total issued share capital to achieve a total consideration for the rollup of the minority equity stake of 5,720,646 shares in MRL.

Price and Performance:

The stock price of the company improved from the level of A$0.495 (Dayâs close on 29th May 2019) to the present level of A$0.550. The shares of the company are showing lesser trades and are comparatively less liquid than the shares of WPL and WEL. The shares of the company last traded on 18 June 2019, at a price of A$0.510.

The yearly return from the company is in the negative zone at -27.14 per cent.

Winchester Energy Limited (ASX: WEL)

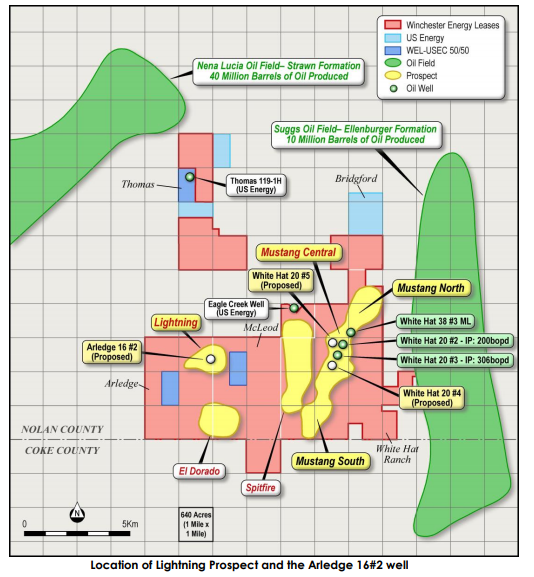

In an announcement made public by the company on 25th June 2019, WEL mentioned that it would spud new well Arledge 16#2 in the coming month of July, which would target the relative shallow Cisco Sands at the newly defined Lightning Prospect.

Source: Companyâs Report

Cisco Sands has historically produced more than 5 million barrels and 2.25 billion cubic feet of gas from 89 wells, which in turn, represent an average of 25 million cubic feet of gas and 57,000 barrels per well. The same Cisco Sands has produced about 100,000 barrels in the Bast Field, which makes the Cisco Sands a proven producer in the Permian Basin.

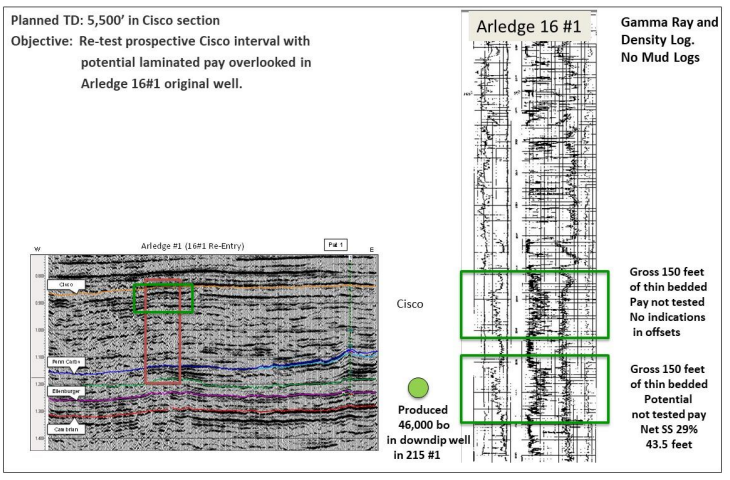

The Arledge 16#2 well would test 150 ft of potential gross oil pay of 29 per cent net pay, and the well is planned to test a depth of 5,500 ft, which in turn, would extend the Arledge Lease of 3,342 acres by a year further.

The production from the down-dip location recovered 46,000 barrels of oil.

Arledge16#1 (Source: Companyâs Report)

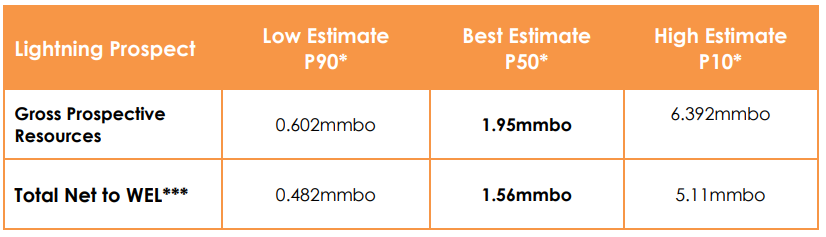

WEL estimated the Gross Prospective Resource from the lower sand lobe of the Lighting prospect, which are as:

Source: Companyâs Report

The chance of success of recovering oil & gas from the prospect stands at 22.5 per cent based upon risk proportion of 50 per cent Trap, 50 per cent Seal, 90 per cent Charge and 100 per cent Reservoir.

Price and Performance:

The stock price of the company improved with the recovery in crude oil prices, and the stock rose from the level of A$0.020 (low in June) to the level of A$0.035 (high in May); however, the prices in the present month remained lower than its previous month high of A$0.039. The WELâs stock last traded on 24 June 2019, at a price of A$0.028.

The shares of the company delivered a return of 12.34 per cent in one year, and a return of 7.69 per cent in just 5-days over the event-driven crude bull rush.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.