Crude oil prices posted its highest monthly loss in May 2019 after a continuous four-month rise. The prices of ICE benchmark Crude Oil Futures dropped from the level of US$ 75.60 (Dayâs high on 25th April 2019) to the present level of US$ 65.55 (as on 31st May 2019 AEST 2:18 PM).

Array of factors exerted the pressure on crude oil prices, while crude oil moved in a downtrend from its previous month high of US$ 75.60:

- Global Growth Concerns

- Economic Figures

- OPEC stance

- Improved United States Crude Inventory

The re-escalation of the trade dispute between the United States and China raised concerns among the energy community of a slower growth in global economic conditions. This raised pessimism among the market participants and reduced the overall oil demand as compared to demand in April 2019, which in turn exerted further pressure on oil prices.

On the economic figures, due to the no visible outcome of the bilateral trade disagreement, major activities in both the significant economies declined. Data on manufacturing, non-manufacturing, pricing, etc posted weaker results, which in turn, further exerted pressure on crude oil prices.

The Consumer Price Index in the United States declined from the level of 0.4% in March 2019 to 0.3% for April 2019, and Core CPI declined to 0.1% against the market expectation of 0.2%.

The Core Retail sales in the United States also took a hit and declined significantly to 0.1% in April from 1.3% previously, and Retail Sales figures declined till -0.2% in April from 1.7%.

In China, the Industrial Production declined from 8.5% to 5.4% in April 2019, and today Manufacturing PMI declined below its mean value of 50 to stand at 49.4, which in turn further suggests a slowdown in economic expansion in China.

The data mentioned above date backs to April 2019; however, as they usually take 15-20 days of calculation, their effects become evident, post publishing.

On the OPEC stance, the cartel is expected by EIA to inch up the production to offset the production loss of oil due to middle east tension and Iran import suspension and waiver offtake by the United States.

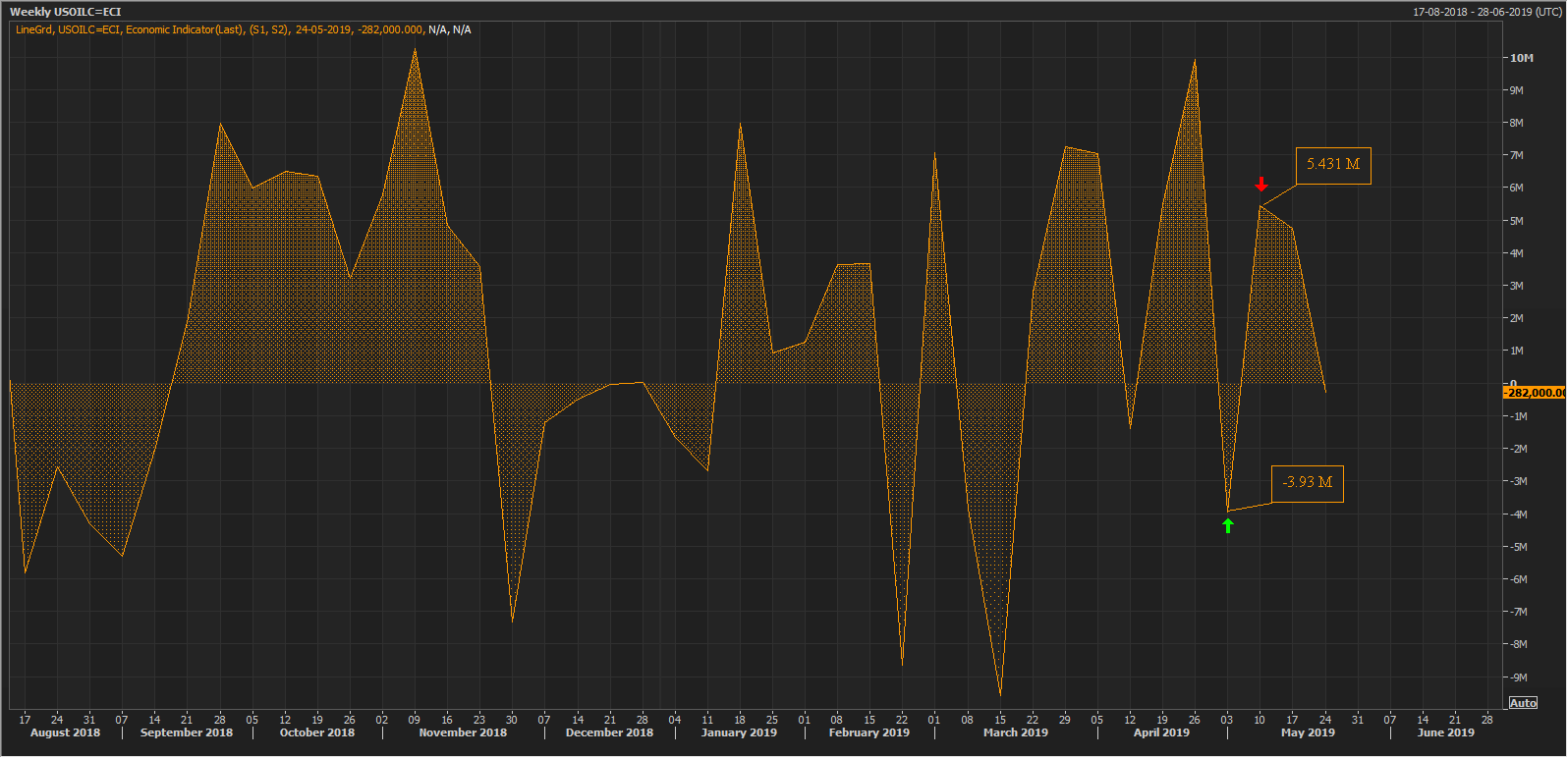

The last but not the least, the rise in crude oil inventory in the United States is a significant contributor towards the fall. The crude oil stockpiles in the U.S has built up sharply from the level of -3.93 M at the starting of May 2019 to 5.431M (Week ended 17th May 2019).

U.S. Weekly Crude Oil Inventory (Source: Thomson Reuters)

U.S. Weekly Crude Oil Inventory (Source: Thomson Reuters)

However, the crude oil refinery output in the United States is inching up, which in turn, reduced the oil inventory in the United States from its May 2019 top of 5.431 M to the present level of -2.82M.

U.S. Weekly Crude Oil Refinery Inputs (6-Months) (Source: Thomson Reuters)

U.S. Weekly Crude Oil Refinery Inputs (6-Months) (Source: Thomson Reuters)

If the refinery inputs in the United States keep on rising, it could further deplete the oil stockpiles at a rapid pace and is something that investors should keep a close eye at.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.