Perth-based oil & gas exploration and production company Woodside Petroleum Ltd. (ASX: WPL) is a forerunner of the Liquified Natural Gas (LNG) industry in Australia.

In the first half of FY19 (six months ended 30 June 2019), the company witnessed strong production performance from its NWS Project and Wheatstone project and was able to generate strong cash flows and margins.

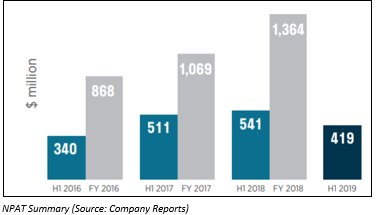

During the half-year period, the company achieved a net profit after tax of USD 419 million with an operating revenue of USD 2,260 million. The net profit was 23% down on previous corresponding period (pcp), majorly due to the impact of cyclone activity and the Pluto LNG turnaround.

The company was able to produce 39.0 Million Barrels of Oil Equivalent (MMboe) during the half-year period. Based on the company's performance in the first half, the company CEO Peter Coleman anticipates a strong second half and expects to achieve targeted annual production of around 100 million barrels of oil equivalent in 2020.

During the half-year period, the cash flow for the company increased by 123% to USD 869 million, demonstrating its increased spending capacity.

An interim dividend of 36 US cents per share (fully franked) was announced for the half year period and the Dividend Reinvestment Plan (DRP) was also reinstalled. The Dividend Reinvestment Plan allows its existing shareholders to obtain additional shares of the company by reinvesting the dividend received.

H1 FY19 Highlights

While announcing the profit, CEO Peter Coleman highlighted various areas that proved to be imperative for the company's achievement of the profit.

- Major turnaround at Pluto LNG

- Strong cash flow generation from Pluto LNG

- Efficient and effective delivery from the Greater Vincent wells

- Major contracts entered into at the Scarborough Joint Venture and Senegal

Pluto LNG (90% Interest)

During the half year period, Pluto LNG delivered 14.2 MMboe of production and was able to complete facilityâs first major turnaround. It is expected that the work turnaround will provide significant benefit in terms of ongoing high reliability and production optimisation and will also provide an opportunity to install tie-ins for the proposed Pluto-NWS Interconnector.

During the period, the company completed the construction of the Pluto truck loading facility which will help in transporting LNG across Western Australia.

Wheatstone (13% Interest)

At Wheatstone, Woodside Petroleum was able to deliver solid production during H1 FY19, primarily due to improved reliability and increased flow rates. The companyâs share of production was 6.8 MMboe in H1 FY19. Wheatstone is expected to deliver over 13 million barrels of oil equivalent in 2020.

NWS Project (16.67% interest)

The company delivered strong LNG production from the North West Shelf (NWS) Project during the half-year period. The company also implemented several improvements to increase the efficiency and capacity of Trains 4 and 5. Woodsideâs share of production was 16.8 MMboe for H1 FY19.

Major Operational Highlights for H1 FY19

- Expecting first oil from the Greater Enfield Project in August 2019, on schedule and on budget;

- Awarded multiple Scarborough contracts for engineering design activities;

- Awarded the FEED contract for the SNE Field Development Phase 1 FPSO facility;

- Approved the Browse to NWS Project basis of design with the joint venture;

- Commenced operation of the Pluto LNG truck loading facility;

- Signed a heads of agreement with ENN Group for the sale of 1.0 Mtpa of LNG for a period of ten years, commencing in 2025.

WPL has been paying a special focus on the commercial negotiation of a tolling agreement for the processing of Scarborough gas at Pluto LNG. The company has already progressed the negotiations and engineering design for the proposed Scarborough and Pluto Train 2 developments. Recently, a contract was awarded by the Scarborough Joint Venture to Boskalis Australia Pty Ltd for seabed intervention and shore crossing civil works for the export pipeline shore crossing.

Recent Updates

- Subsequent to the half-year period, the company signed agreements for the mid-term supply of up to around 3.5 million tonnes of LNG in the period to 2026.

- Recently on 25 August 2019, the company advised that its Greater Enfield Project has produced first oil through the Ngujima-Yin floating production storage and offloading vessel, demonstrating Woodsideâs capacity to execute the major projects that will underpin its next phase of growth.

Greater Enfield Project Highlights:

- Production from the Greater Enfield reservoirs is an important contribution to Woodsideâs targeted annual production of around 100 MMboe in 2020;

- The Greater Enfield Project is a joint venture between Woodside Energy Ltd (Operator, 60%) and Mitsui E&P Australia Pty Ltd (40%).

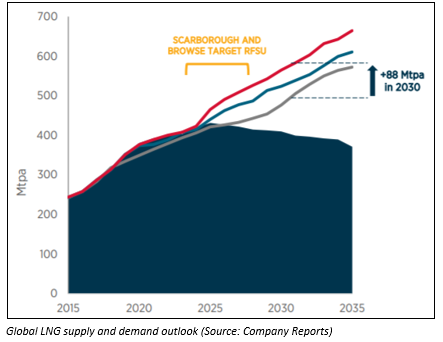

Global LNG Supply and Demand Outlook

The global LNG demand is expected to grow significantly in the coming years, majorly due to the increase in the new market opportunities.

Stock Performance

On 3 October 2019 (AEST 01:11 PM), the stock of Woodside Petroleum was trading at a price of $30.765 with a market capitalisation of approximately $29.91 billion. The stock has a 52-week high price of $39.380 and a 52-week low price of $29.330. On a year to date basis, the companyâs stock has provided a return of 4.10%, while its dividend yield is 5.68% and PE multiple is 16.44x.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.