This article discusses the recent updates made by these six companies as mentioned below. These companies have provided insights on the developments related to ongoing projects and the full-year results. Letâs now look at the updates and announcements made by these six companies.

Carnarvon Petroleum Limited (ASX: CVN)

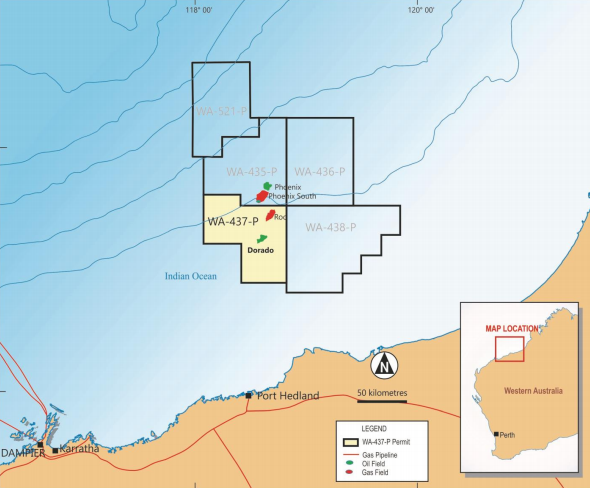

On 12 August 2019, the company reported an update on the Dorado-3 appraisal well. Accordingly, the company had drilled down to a depth of ~2656 metres measured depth (MD), and 13-3/8 casing was set in place. Recently, the well was being drilled ahead in 12-1/4â hole at a depth of ~3,180 metres MD.

Map of WA-437-P (Source: Companyâs Announcement)

Reportedly, the 12-1/4â would be drilled to depth of ~3,880 metres MD, and 9-5/8â liner would be set in place. The company anticipates intersecting no hydrocarbons in this drilling section. Besides, the coring operation over Caley & Baxter reservoir would start after 9-5/8â liner is set in place.

On 13 August 2019, CVNâs stock was trading at A$0.382, down by 0.779% (at AEST 12:48 PM).

Strata-X Energy Limited (ASX: SXA)

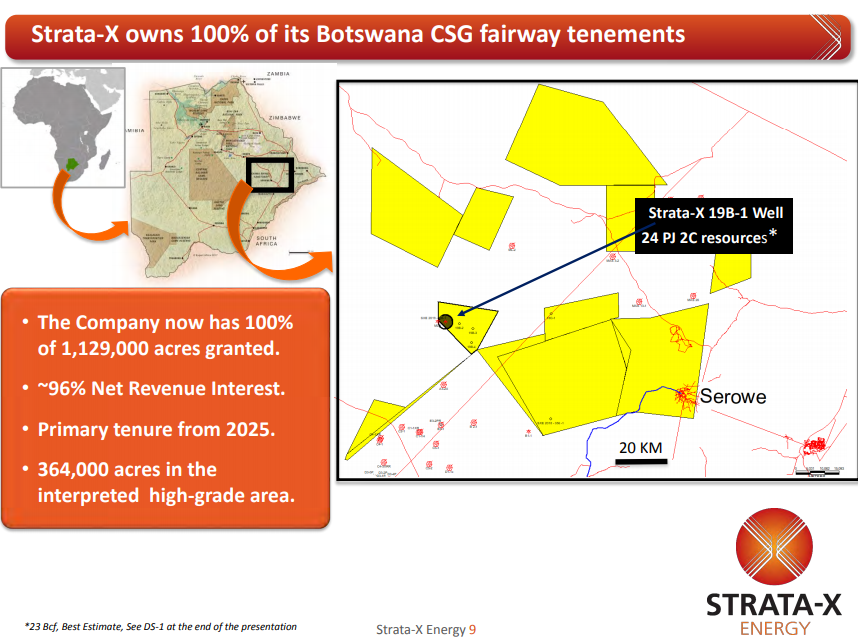

On 12 August 2019, the company reported on the progress on gaining approvals. Accordingly, the company has received an approval for its new Environmental Impact Assessment (EIA) of Serowe CBM Project related to the SXAâs form & scope new EIA or Environmental Impact Assessment. This form & scope obtained a nod from the Botswana Department of Environmental Affairs.

Botswana Tenements (Source: Companyâs Gold Coast Investment Showcase Presentation, June 2019)

Botswana Tenements (Source: Companyâs Gold Coast Investment Showcase Presentation, June 2019)

Reportedly, the company expects to submit the EIA for final review during September 2019. The company would have permission to drill & test up to 75 wells covering the three prospecting licenses within the Botswana CBM fairway after the license is granted, which is expected to receive in December 2019.

Meanwhile, the company wholly owns ~320k acres within the identified high-grade area spanning over five licenses fully owned by SXA. Besides, the concentration on the high-grade region would be a key to the growth, and SXA is planning to tender a multi-well appraisal drilling & production testing work within the hige high-grade region that steps out from the 19B-1 well.

SXAâs stock last traded at a price of A$0.052, on 12 August 2019.

KALiNA Power Limited (ASX: KPO)

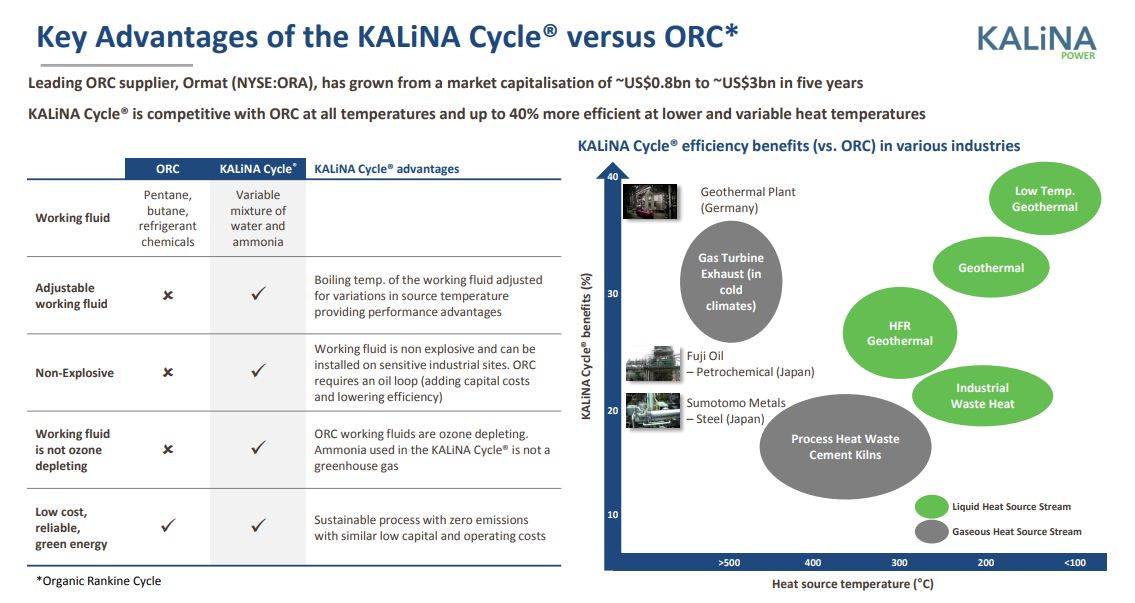

On 12 August 2019, the company updated on its Alberta program. Accordingly, the company has concluded major project development and design optimisation for its projecst in Alberta. The company is now placed to raise $300 million in funding for project development & financing for the initial five power plants.

Reportedly, KPO is aiming to achieve a portfolio of ten 22 MW combined cycle power plants that would provide clean energy at one of the lowest emission levels of its peer group. A 15 MW gas-fired turbine along with a 7 MW KALiNA Cycle® power island would be configured in each plant.

KALiNA Cycle® (Source: Companyâs Presentation, October 2019)

KALiNA Cycle® (Source: Companyâs Presentation, October 2019)

Commercial Projects: As per the release, the company has selected five sites development, and contracted a local utility firm to confirm industrial load requirement, profiles at each site. The sites were selected after a comprehensive site assessment, evaluation process by the company and several specialist firms based in Alberta. Besides, the company has swapped initial site for a superior site at a nearby location.

Project Financing: Reportedly, the top five priority site represents over CA$300 million of investments for the KALiNA CCGT projects. Additional opportunities identified in the pipeline represent over CA$600 million of projects. Besides, the company is compiling detailed materials, project information to project finance investor standards.

Further, the company also responded to the queries raised by ASX on Appendix 4C. Accordingly, the company replied that it expects to have negative cash flows, as it is a developing company. It also clarified that it had appointed dedicated advisors to raise capital, and the company is in discussion with Australian brokers as well. Besides, the company expects to meet its operational & business objectives based on the current cash balance.

On 13 August 2019, KPOâs stock was trading at A$0.021, down by 4.545% (at AEST 1:05 PM).

Strike Energy Limited (ASX: STX)

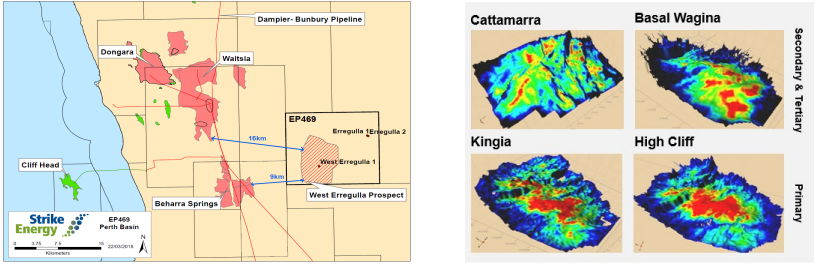

On 12 August 2019, the company reported that it upgraded the view of the Wagina sandstone conventional gas discovery at the West Erregula-2. Besides, it undertook an additional review of logs, which represented a better net reservoir suggesting discovery similar to the Beharra Springs gas fields.

West Erregulla-2 Location (Source: Companyâs Announcement)

West Erregulla-2 Location (Source: Companyâs Announcement)

Wagina: Reportedly, the company undertook a further review of wireline logs, which suggested net reservoir to at least 10.2 metres across the Wagina sandstone. Besides, the drilling observations confirmed the reservoir over 6,800 psia, which would underpin the possible material flow rates when the production test are undertaken.

Beharra Springs Analogy: Reportedly, the flow testing from the fields depicted some of the highest onshore flow rates at the time, up to 38mmscf/d. Besides, the outcomes were obtained along with the reservoir pressures of about 5,780 psia, average net pay of 10.4 metres and porosities of 9.5 percent.

On 13 August 2019, STX stock was trading flat at A$0.130 (at AEST 1:29 PM).

Cooper Energy Limited (ASX: COE)

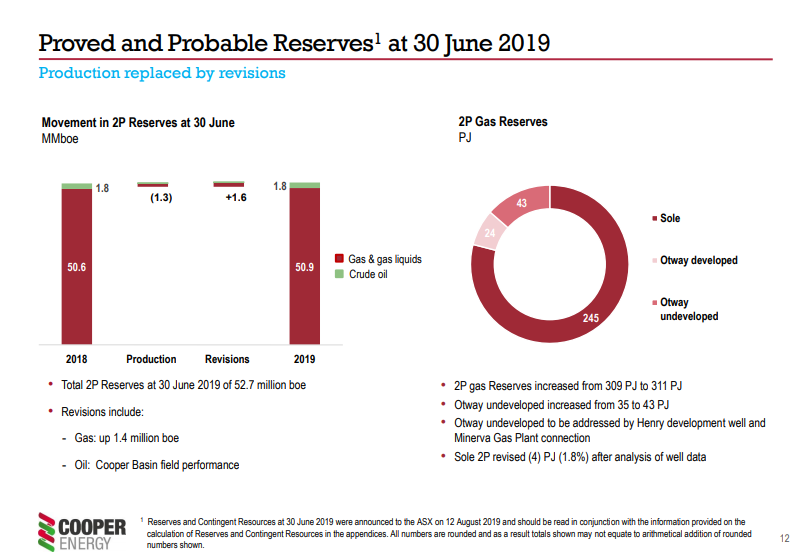

On 12 August 2019, the company reported results for the year ended 30 June 2019. Accordingly, the company suffered a statutory net loss after tax of $12.1 million in FY19 compared with $27 million net profit in FY18.

Reportedly, the group incurred significant items worth $25.4 million, which resulted in a loss. The significant items for the period were inclusive expenses related to the rehabilitation of Patricia Baleen gas field during the first half. Meanwhile, the impact of lower risk-free rates used to discount the provisions added to the resulting loss during the second half of the period. Besides, the last yearâs net profit was inclusive of the gain on sale of the Orbost Gas Plant.

As per the release, the sales revenue of the company grew by 12% to $75.5 million, which was $67.5 million. Also, the companyâs revenues from gas increased to $52.3 million in FY19 from $40.9 million in FY18, and this helped the lower revenues from oil. Besides, the cash flow operating activities was $20.5 million, down by 8% over the previous year of $22.2 million.

Proved & Probable Resource (Source: FY19-FY20 Outlook Investor Presentation)

Proved & Probable Resource (Source: FY19-FY20 Outlook Investor Presentation)

The company expects a substantial increase for gas production in FY20, when Sole gas field would start supplying. Also, the company has completed construction during the year, and post completion of the upgrade to APAâs Orbost Gas Plant the production would commence at the Sole gas field.

As per the release, the existing production assets of the company would produce more than 5 petajoules of gas and around 240k barrels of oil in the year FY20. Besides, the company expects supply from Sole gas filed in the December quarter 2019, and revised guidance would be provided.

On 13 August 2019, COEâs stock was trading at A$0.55, down by 2.655% (at AEST 1:36 PM).

Contact Energy Limited (ASX: CEN)

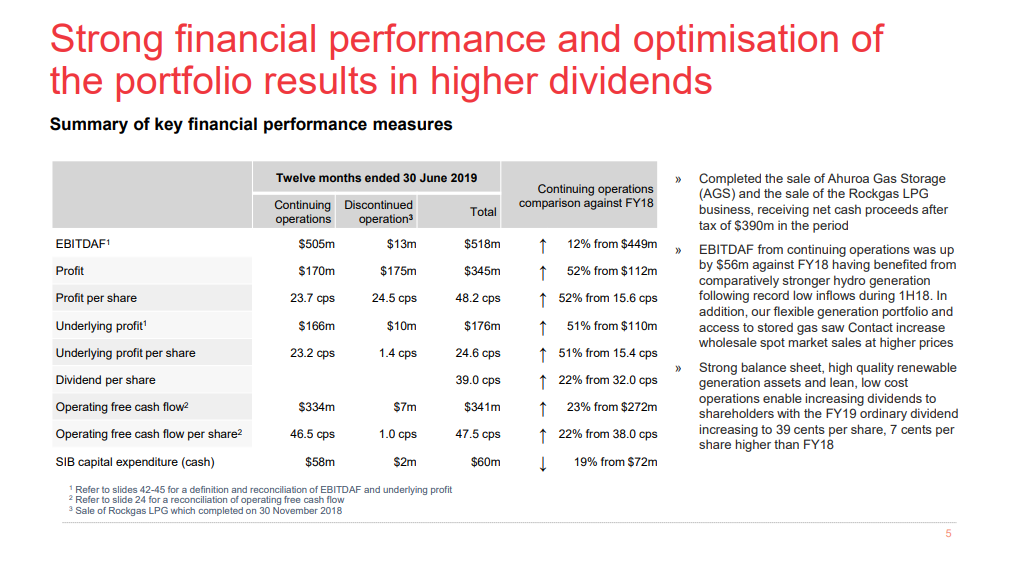

On 12 August 2019, the company reported the full-year results for the year ended 30 June 2019. Accordingly, the company delivered a statutory net profit for the period of $345 million, up by 161% from $132 million in the previous year. The profit figure was backed by the gains on the sale of Rockgas and AGS of $170 million.

Financial Highlights (Source: FY19 Full Year Results Presentation)

Financial Highlights (Source: FY19 Full Year Results Presentation)

As per the release, the company witnessed an increase of $56 million to achieved $505 million in EBITDAF from continuing operations, which was due to better operational performance in wholesale segment. Also, the operating expenses were down by 5% over the previous corresponding period led by operational enhancements.

Meanwhile, the company declared an unfranked dividend of NZD 0.25647059 per share, which would be ex on 28 August 2019, and record date for the dividend is 29 August 2019. Further, the dividend is scheduled to be paid on 17 September 2019.

The customer business of the company continues to optimise cost while improving customer experience. Reportedly, the customer experience improvement witnessed final quarter Net Promoter Score of +26, up by +6 over pcp. The company also invested in new products & digital capability to improve on customer experience. Despite strong operational performance, the customer segment EBITAF was down by $9 million to $67 million for the period.

The companyâs wholesale business has working with stakeholders to decarbonise New Zealandâs energy sector. Reportedly, Generation EBITDAF was up by $67 million to $464 million for the period, which was backed by 22% increase in hydro generation, and company capitalised on wholesale spot demand in addition to contracted sales.

Reportedly, the company remains on track for the development of geothermal power station at Tauhara, after successfully optimising costs of geothermal business. Besides, the company has been actively collaborating to reduce carbon emissions and invested in Simply Energy.

Additionally, the company is concentrating on the transformation programme to cut down the controllable costs, and it is also looking for other prospects to tap value from the scale efficiencies.

On 13 August 2019, CENâs stock was trading at A$7.91, up by 0.508% (at AEST 1:45 PM).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.