The property market in Australia is witnessing adverse impacts of slow economic growth in 2019, due to domestic and overseas headwinds. The economy performed well in 2018, representing accelerated economic growth, lower unemployment and further growth from construction activities. Continued downward pressure on the AUD, fall of ASX indices in 2018 and downward trending in commodity prices were indicative of a slower economic growth in 2019.

We will now have a look at recent updates for few stocks in the Real Estate space.

Dexus

Dexus (ASX: DXS) owns and develops high quality real estate assets and manages real estate funds.

FY19 Financial Highlights: The company recently announced financial results for the period ended 30 June 2019. Adjusted Funds From Operations per security, was reported at 50.3 cents, rising 5.5% from the same period a year ago. Distribution for the year stood at 50.2 cents per security, representing an increase of 5.0% year-on-year. Net profit after tax for the period was reported at $ 1.28 billion, down 25.9% when compared with the previous year. The decrease in profit was due to lower net revaluation gains of investment properties than in FY18. Driven by the strong AFFO and revaluation gains from the development at 100 Mount Street in North Sydney, the company achieved a ROCE of 10.1% for the year. Balance Sheet for the period remained strong with gearing at 24.0% at 30 June 2019.

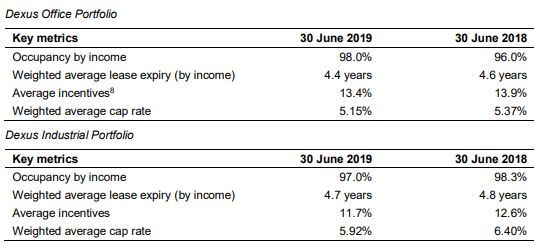

FY19 Operational Highlights: Under property portfolio, the company leased a total of 567,039 square metres across the total portfolio. The companyâs office portfolio outperformed the MSCI office benchmark over three and five years. In addition, strong leasing outcomes were achieved at key developments located in Perth and North Sydney. The groupâs development and concept pipeline enhanced to a value of approximately $ 9.3 billion.

Property Portfolio (Source: Company Reports)

Under funds management, the period was characterised by the setting up of Dexus Australian Logistics Trust, valued around $ 2 billion. The company also attracted new investors across three other managed funds. Dexus Wholesale Property Fund continued to outperform over 1,5,7 and 10 years.

The company delivered post-tax trading profits amounting to $ 34.7 million during the year and significantly de-risked trading profits for FY20 and FY21.

Overall, the company performed well across all areas of business during the year. Distribution guidance was met with the company remaining focused on creating sustained value. The company secured $ 3.1 billion of quality opportunities, leading to increased exposure in core markets and an enhanced pipeline of office development projects in Sydney and Melbourne CBDs.

The stock of the company closed the dayâs trading at a market price of $1 3.220 on 14 August 2019, down 0.751% from its previous closing price. It has a market capitalisation of $ 14.61 billion and ~ 1.1 billion outstanding shares.

Goodman Group

Goodman Group (ASX: GMG) invests in directly and indirectly held industrial property, investment management, property services and property development.

Dividend: In the month of June, the company released an announcement regarding the payment of dividend on fully paid ordinary shares or units stapled securities. The distribution amount stood at AUD 0.150 per security, to be paid on 09 September 2019.

Key Highlights of Investor Day Presentation: In the presentation, the company provided updates on strategies for different regions. In Asia, the company aims to focus on major infill markets. The company has received multiple development projects in the region and remains focused on quality, scale and intensification opportunities. In New Zealand, the companyâs strategy is to invest in the Auckland industrial market and continue to monitor potential for further acquisitions in strong distribution locations. In Australia, the company is targeting major metropolitan cities on the east coast. In addition, the company wishes to focus on LA, Pennsylvania, New Jersey and Inland Empire West, in the North American Region.

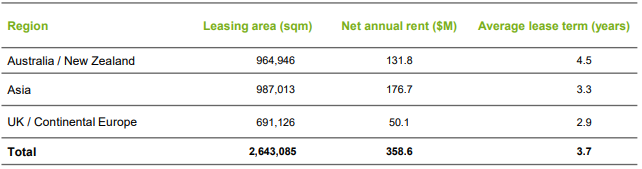

Q3FY19 Highlights: At the end of nine months ended 31 March 2019, the group delivered strong operating performance with total assets under management amounting to $ 44.1 billion. The company reported a 3.3% like for like growth in NPI in its managed partnerships. At the end of the period, development work in progress was valued at $ 3.7 billion. During the period, the company leased 2,643,085 square metres across its platform totalling to a rent of $ 359 million per annum. Asia accounted for the largest lease area of 987,013 sqm, with a net annual rent amounting to $ 176.7 million and average lease term of 3.3 years. Leasing area in ANZ measured at 964,946 sqm, with net annual rent of $ 131.8 million and average lease term of 4.5 years. Lease area in the UK/Continental Europe region stood at 691,126 sqm, with net annual rent and average lease term of $ 50.1 million and 2.9 years, respectively.

Leasing Details (Source: Company Reports)

The stock of the company closed the dayâs trading at a market price of $ 14.870 on 14 August 2019, down 0.867% from its previous closing price. It has a market capitalisation of $ 27.21 billion and ~ 1.81 billion outstanding shares.

Scentre Group

Scentre Group (ASX: SCG) runs various shopping centres in Australia and New Zealand.

Dividend: The company recently updated that it has declared a dividend amounting to AUD 0.113 per security, to be paid on 30 August 2019.

Disposal of Sydney CBD Office Towers: In the month of June, the company released an announcement regarding disposal of Sydney CBD Office towers to some funds managed by Blackstone. The assets were disposed for a total consideration of $ 1.52 billion. The company would use the proceeds to repay debt. The transaction is also expected to be dilutive by approximately 0.4 cents per security, to Funds from Operations in 2019.

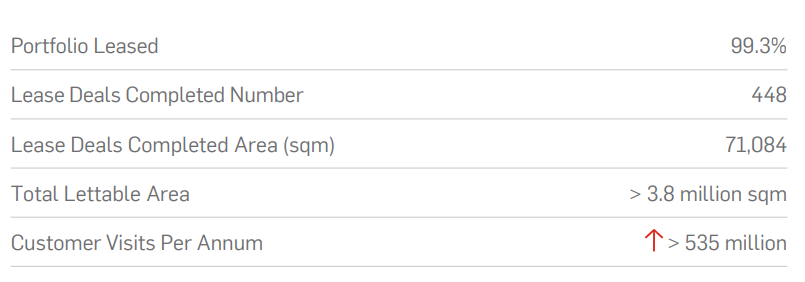

March Quarter Update: As at 31 March 2019, the company completed a total of 448 lease deals, comprising lease deal area of 71,084 sqm. Total lettable area at the end of the period measured more than 3.8 million sqm. The company also increased on the customer visits per annum, with more than 535 million customers visiting its sites.

Operational Highlights (Source: Company Reports)

Total speciality in-store sales for the quarter increased by 1.5%. Total portfolio sales amounted to $ 24.1 billion, reporting an increase of 1.3%.

Development Activity: The company continued to boost its platform with a redevelopment project at Westfield Newmarket in Auckland. The facility is scheduled to open in phases during 2H19. Under a redevelopment project worth $ 21 million, the company also brought in six new restaurants to the South of Canberra. This follows the Bradley Street Dining precinct special project at Westfield Woden.

The stock of the company closed the dayâs trading at a market price of $ 3.870 on 14 August 2019, down 2.764% from its previous closing price. It has a market capitalisation of $ 21.16 billion and ~ 5.32 billion outstanding shares.

Mirvac Group

Mirvac Group (ASX: MGR) is engaged in property investment for the purpose of deriving rental income and investments in unlisted funds.

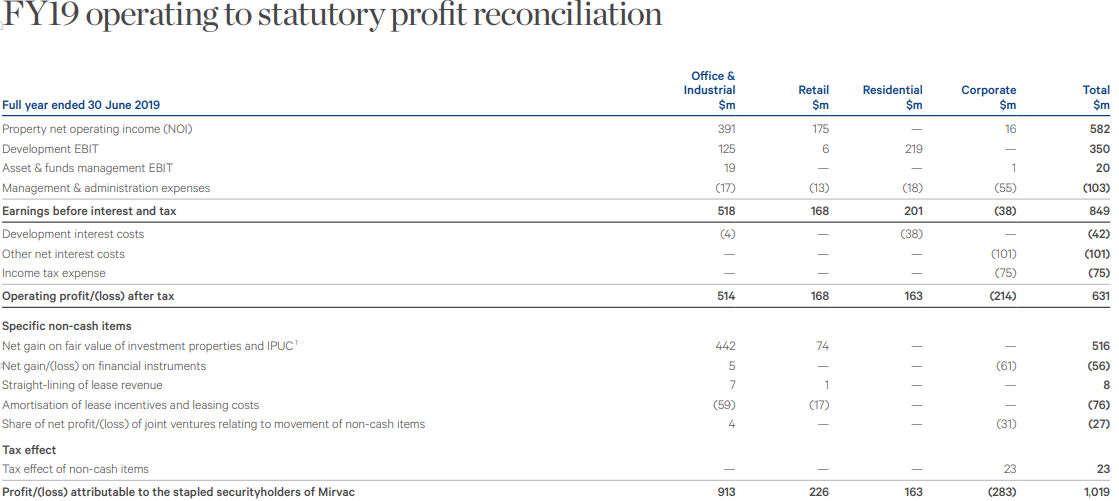

FY19 Financial Results: The company recently released financial results for the year ended 30 June 2019. During the year, the group reported a statutory profit amounting over $ 1 billion, delivering a value at the top end of the guidance. Earnings per share for the period stood at 17.1 cents per stapled security, increasing 4% on the previous year. Distribution per share stood at 11.6 cents per stapled security, depicting an increase of 5% on the previous year. During the year, the companyâs operating profit was reported at $ 631 million, up 4% on the FY18 operating profit of $ 608 million. MGR leased over 250,000 square metres across its investment portfolio with a high occupancy rate of 99%. Group Return on Invested Capital for the year was reported at 10.1%.

Source: Companyâs Report

Other developments included strong net property revaluation uplifts of $ 516 million across the investment portfolio, supported by weighting of 82% of the portfolio to Melbourne and Sydney. During the period, the company secured $ 1.7 billion in residential pre-sales along with settlement of 2,611 residential lots. The period also saw an extension of the build-to-rent development pipeline, with confirmation of a second purpose built BTR project in Melbourne.

FY20 Guidance: The company expects operating EPS for FY20 to be in the range of 17.6 â 17.8 cents per stapled security, representing an increase of 3% - 4%. Distribution guidance was provided at 12.2 cents per stapled security, representing growth of 5%.

The stock of the company closed the dayâs trading at a market price of $ 3.180 on 14 August 2019, down 0.313% from its previous closing price. It has a market capitalisation of $ 12.55 billion and ~ 3.93 billion outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.