The Australian economy continues to be deprived of a property lift even after over two years of free fall. 2019 has been a year of twists and turns for the Australian economy, and the persistent fall in property prices has played a vital role in it. Negating the housing market slump, the market has gone through certain stages of rebound and recovery which may not be sustained.

Australian PCI® for July 2019

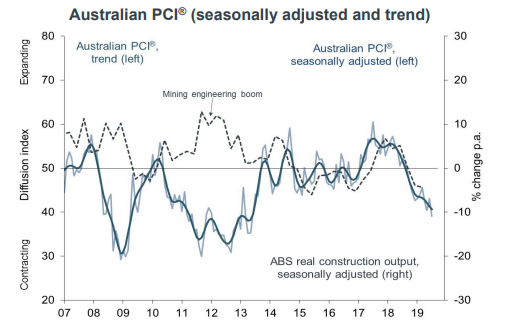

The construction industry is shrinking further, as per the latest release of The Australian Industry Group/Housing Industry Association. July numbers are in and they are not satisfactory for the present scenario and future outlook of the economy, as the month witnessed an eleventh consecutive month of narrowing of the Australian PCI®.

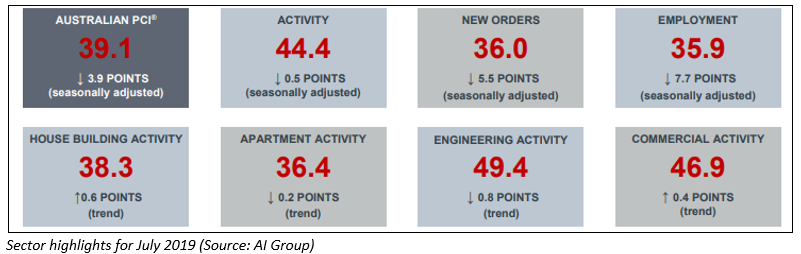

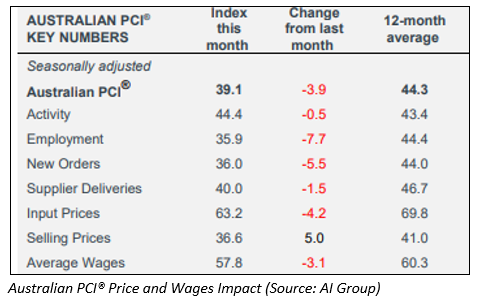

The construction index decreased by 3.9 points from June and was recorded at 39.1 points after a seasonal adjustment. The figure depicts that the dip is the steepest that the industry has witnessed in six years. Further, the July decline shows a decline in new orders and employment, in times where unemployment is already a sensitive issue in the country.

Australian PCI® (Source: AI Group)

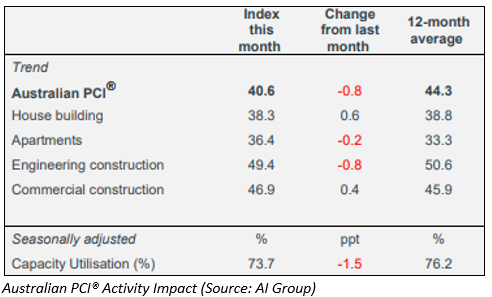

Impact on Sectors: On a trend basis, the Australian engineering construction was largely stable through June 2019 at 49.4 points with a decline of 0.8 points. A project pipeline added by the government might prove to be a boon for the sector. According the Australian Bureau of Statistics , excluding mining related projects, the engineering work in the pipeline in the yearâs first quarter was valued at an impressive figure of $43.5 billion,. This demonstrates that the Engineering new orders sub-index decrease of 2.1 points (43.3 points) could better its stance in the coming days.

However, in July 2019, both the house building (38.3 points, with the sub-index rising by 0.6 points), and commercial construction (46.9 points) sectors declined at marginally slower rates.

House building activity was slim for a 12th month in a row, though the contraction rate eased marginally. The private sector house approvals and new orders continued their route of a downward trend.

The house building new orders sub-index slid down by 0.7 points on a trend basis, to be recorded at 34.5 points. The decline in new orders has been persistent since September 2017. Amid these hollows, the housing activity is expected to remain cowed in the months to come following the 0.8 per cent m/m fall in the private sector house approvals in April. New orders pertaining to the commercial construction sector also slumped for thr 12th month, though marginally by 0.4 points to 45.1 points on a trend basis.

The apartment building sector was recorded to be the weakest performing sector for July 2019 at 36.4 points and declined for the 16th month. The sector has been worryingly in a state of decline or steadiness in 22 of the last 24 months, as there has been an overall weakening in the demand for commercial building projects. Subdued market conditions continued to persist, mostly due to the uncertainties prevailing in the Australian economic outlook, softness of new orders and low enquiries. Recording their 16th month of contraction, Apartment new orders sub-index was down by 1.4 points and was recoded at 29.6 points. On a positive note, the possibility of a stability had been indicated by few respondents post the federal elections.

Impact on Price and Activities: The Input price inflation was high in July, with the index falling by 4.2 points to 63.2 points. Moderate cost pressure prevailed in the month, mostly due to the preeminent energy prices and relatively elevated commodity prices along with imported construction materials. The selling prices contracted at a slower rate, with the selling prices sub-index up by 5.0 points to 36.6 points, depicting the highly competitive tendering pricing environment with pressures on businesses with rising costs. The gap between the input price and selling price proves that the profit margins are volatile for Australian businesses dealing with the construction industry.

The activities in the industry in July 2019 followed its previous footprints of contraction and depicted an unchanged rate of decline from the past month. The new orders declined and continued to weigh on the overall conditions, reported at 36.0 points, the sharpest rate of decline in six years, toppled with a reduction in deliveries from suppliers which stood at 40.0 points. A dire concern for the Australian economy, and an epidemic if not addressed well on time, employment recorded the sharpest rate of contraction in six years at 35.9 points, reinforcing the prevailing weakness in the industry.

What do the experts say?

Industry experts believe that the record construction decline of July 2019 has deepened the ongoing slump in Australiaâs construction industry. The condition might further weaken, especially with the drop in new orders, with an unstable work pipeline in the housing and apartment sectors. A section of experts believe in being market optimists, hoping that the historic and consecutive rate cuts by the Reserve Bank of Australia, and the cuts on personal income tax rates along with APRAâs easing of home loans would strengthen the residential components of the economy eventually.

How is the Australian Securities Exchange Behaving to the Property Plummet?

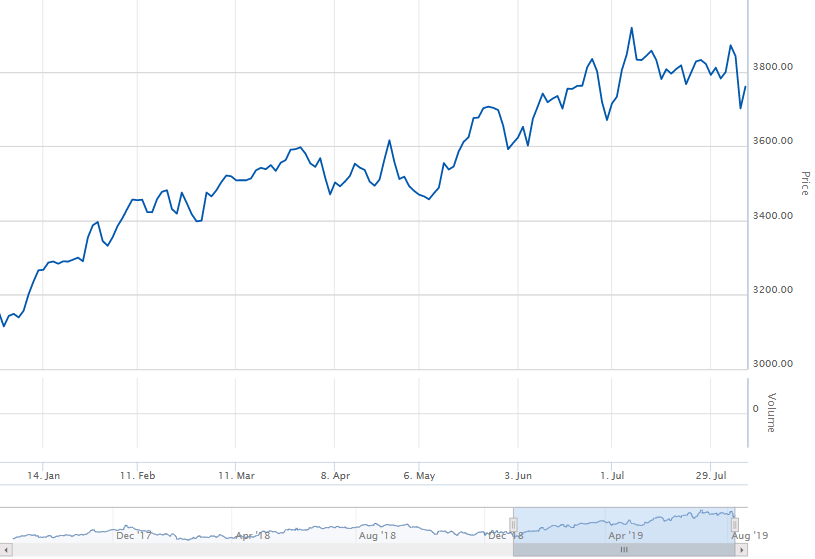

Looking at the equity marketâs reaction to the property slump as evidenced by the released data, the Real estate sector managed to have a good day after the close of trading hours on 8 August 2019. The S&P/ASX 200 Real Estate was up by 1.27 per cent or 48.2 basis points, at 3,760 points by the end of trading session on 8 August.

Real estate (XRE)âs YTD performance (Source: ASX)

Real estate (XRE)âs YTD performance (Source: ASX)

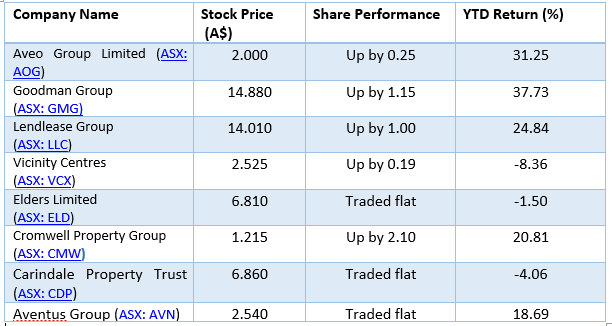

Let us now look at the performance of a few property/real estate stocks on the ASX after the market closed on 8 August 2019:

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.