Led by the weakness in both the apartment and detached-housing sectors, the building approvals fell again in April 2019 by 4.7 per cent in seasonally adjusted terms and 0.6 per cent in trend terms, relative to March 2019.

The Australian Bureau of Statistics (ABS) recently published data on dwelling approvals for April, which indicated a 24.2 per cent fall in Australiaâs building approvals (seasonally adjusted) on an annual basis.

The overall decrease in the number of dwellings approved was led by private sector houses, which slipped 1.9 per cent in trend terms and 2.6 per cent in seasonally adjusted terms in April. In comparison to April 2018, the number of private sector houses approved in April 2019 has dropped 20.5 per cent in seasonally adjusted terms and 16.8 per cent in trend terms.

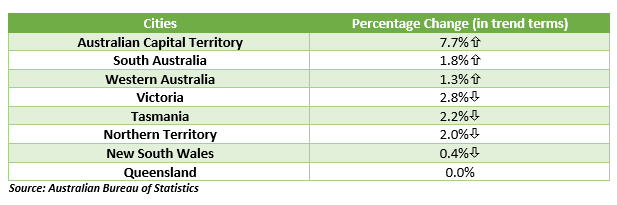

The table below shows the percentage change in overall dwelling approvals in April 2019 across the Australian states and territories in trend terms:

The fall in the approvals for private sector houses was driven by the falls in eastern states. The states like New South Wales, Victoria, Queensland and South Australia witnessed a fall in building approvals of 3.8 per cent, 2.7 per cent, 0.8 per cent and 0.1 per cent, respectively.

The private sector dwellings excluding houses improved 1.2 per cent in trend terms, while it fell 6.5 per cent in seasonally adjusted terms in April 2019.

Along with the data on the dwelling approvals in April, ABS has also released the data on Private New Capital Expenditure and Expected Expenditure for March Quarter 2019. The figures indicate a falling business investment in March Quarter, pointing to an even sharper than expected economic slowdown.

As per the data, the investment contracted in the key sectors of equipment, plant and machinery as well as building and structures by 0.5 per cent and 2.8 per cent, respectively in seasonally adjusted terms.

Recently, ABS also reported the figures for construction work done in the March quarter 2019. The construction work declined 2.4 per cent in trend terms and 1.9 per cent in seasonally adjusted terms during the quarter.

According to market analysts, the recent developments in the Australian economy including the Reserve Bank of Australiaâs indication for a rate cut in June, the victory of Coalition government and removal of 7 per cent home loan buffer had boosted hopes for a sooner-than-expected improvement in housing prices. However, an improvement in dwelling construction was some way off.

The experts believe that the construction activity is likely to continue to decline over the next year due to the falling approvals. The public holidays during the month is also anticipated to be the reason behind the falling building approvals by economists.

With prices declining steeply in most cities through 2018, the country is facing its worst property market slump in 25 years. However, some analysts expect house prices to recover in the following days in the wake of anticipated looser monetary policy by the central bank and efforts by developers to cut supply.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.