The Australian Bureau of Statistics released data on the number of buildings approved in Australia in March 2019 today. According to the data, the number of dwellings approved in March has plunged by 0.6 per cent in trend terms. In seasonally adjusted terms, approvals to new dwellings got reduced by 15.5% to 14,429 (17,083 in February).

Most of the March decline is due to the fall in approvals of high-rise apartments which slipped by almost 40 per cent in March to 2858 from 4736 in February before seasonal adjustments.

Economists anticipated a decline of 12 per cent in dwelling approvals in March after a spike in the previous month. However, the actual fall in approvals exceeded the expected fall.

The rate of dwelling approvals per year has remained above 200,000-mark since May 2014. However, the current fall brings the yearly total of dwelling approvals to its five-year low of 199,428.

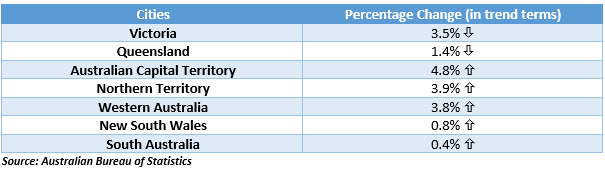

The table below highlights the percentage change in the number of dwellings approved in March 2019 across the Australian states and territories in trend terms:

In seasonally adjusted terms, the number of buildings approved reduced by 27.4 per cent in New South Wales and 27 per cent in Victoria. New South Wales and Victoria are among the most populated cities of Australia that have witnessed a significant fall in house prices over the past year.

The private house approvals decreased by 3.2 per cent, while the approvals of private dwellings excluding houses plunged 30.6 per cent.

The figures suggest that east-coast Australia may experience a shortage of stock and a rental crisis in a few yearsâ time. This is because the constantly rising population is currently absorbing the new supply of apartments.

Experts suggest that this trend of falling approvals is likely to continue in 2019 due to the unfavourable trends being seen in property prices, housing finance, turnover rates and land sales.

According to economists, the dwelling approvals update is also highlighting downside risks to the near-term outlook for new building construction. The GDP and employment growth would be at risk in the period ahead with a slowdown in building approvals. They advise the state and federal governments to look into ways to build confidence in the housing market.

In a recent analysis conducted by National Australia Bank Ltd (ASX: NAB), the analysts forecasted a further fall in housing prices in Melbourne and Sydney. The analysis was performed by comparing the property prices with earnings of full-time workers. The market expected Sydneyâs median house price to fall below 1 million dollars in the next two months. On a Y-o-Y basis, the price of a median house in Sydney has reduced from $1,161,083 last year to $1,027,962 in the present.

The property values in Sydney and Melbourne fell by 0.7 per cent and 0.6 per cent respectively in April, as per CoreLogic Inc. hedonic home value index released a few days ago. Also, the combined property values in the state and territory capitals plunged 0.5 per cent in April in comparison to the previous month.

Last month, the Australian Bureau of Statistics also released the figures for building approvals in January. As per the data, the number of dwellings approved in January increased by 2.5% as compared to the previous month.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.