Australian property values appear to ease in April after CoreLogic Inc. hedonic home value index released today indicated a fall in property prices across all capital cities except Canberra.

The house prices in Australia have witnessed the biggest annual fall since the after-effect of the global financial crisis.

As per CoreLogic Inc. data, the property values in the state and territory capitals combined declined 0.5 per cent in April in comparison to a 0.7 per cent drop in March. Over a year, the prices have dropped 8.4%.

The nationâs two biggest property markets, Sydney and Melbourne have demonstrated a fall of 0.7 per cent and 0.6 per cent respectively in April. Also, the housing prices in the two cities have plunged since they both peaked in 2017, with a 14.5 per cent drop in Sydney and 10.9 per cent in Melbourne.

Although the decline in housing prices has spread to a national level, the rate of decline has slowed for the fourth consecutive month, providing a positive outlook for the market, as per market analysts.

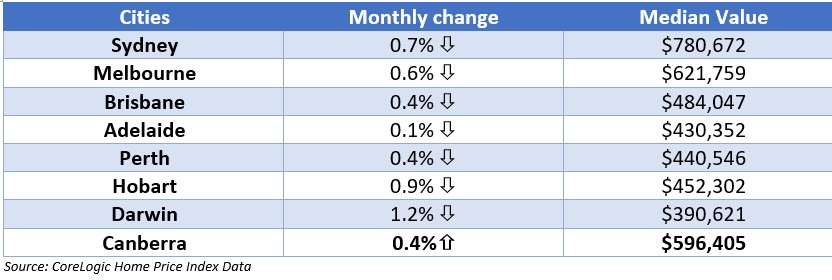

The following table shows the percentage change in the property values across the capital cities and their respective median price value:

As shown in the above table, Canberra has seen a rise of 0.4 per cent in property value to a median price of $596,405.

As shown in the above table, Canberra has seen a rise of 0.4 per cent in property value to a median price of $596,405.

According to CoreLogic's Research Head, the housing market conditions of Australia have moved through the worst downturn now. But there are more places around the country showing negative growth indicating the existence of the tighter credit policies. According to the Research Head, the credit started flowing slightly better after the modest gain in housing finance approvals but itâs still very tight.

UBS economists have anticipated the spread of borrowing restrictions to non-major banks later in the year. As the credit growth hit a record low of 2.5 per cent year-on-year in Big-four banks, the same is expected for the non-major banks. This is due to certain roll-outs in the coming year including credit tightening from verification, debt-to-income limits, comprehensive credit reporting and open banking.

After the disappointing inflation figures released recently, market players are expecting an interest rate cut by Reserve Bank with anticipations over slow-down in credit growth to less than 2 per cent year-on-year in 2020. An interest rate cut next month could help the borrowers facing stricter lending standards, but the credit availability becomes a significant hurdle.

On the other hand, CoreLogic's Research Head believes that the anticipated rate cut by Reserve Bank in the coming months would be beneficial for the housing market. With most of the effect going on to mortgage rates, the rate cut may be enough to slow the rate of decline in property values further.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.