5 Golden Rules of Investing in Dividend Stocks

- Investors should go for the dividend stocks to earn a regular stream of income. The dividend stocks also have the capacity to post significant capital gain if the investor is holding the stocks for a longer period of time. The company as a part of capital management distributes a part of their earnings to the shareholders in the form of dividends and share buy backs. The dividends in Australia are either franked or unfranked. The companies pay franked dividends from the earnings that have been taxed at the full Australian corporate tax rate. However, the companies also pay unfranked dividends on the earnings for which non-Australian corporate tax are already paid or from the earnings that are tax exempt earnings. Dividends franked between 0 and 100 per cent are generally a combination of franked and unfranked dividends.

- Secondly, dividends paid by the companies positively reflect the ownership concentration, profitability, firm size and payment of taxes, and are inversely related to leverage, the opportunity for growth and business investment.

- Dividend stocks are considered as defensive stocks as they are always considered as safer way of investments. However, it is not so safe as term deposits or government bonds which are effectively risk free).

- The stocks that have good dividend yield are considered good for investing, though it depends upon the prevailing interest rate and prevailing market conditions. Generally, it is experienced that if the interest rate is rising then the high yield dividend stock will underperform. The stocks having dividend yield of 4 to 6 percent are considered good for investment as it is expected to offer more income to the investors.

- The stock price falls on its ex-dividend date by the amount of the dividend declared by the company. The investors acquiring the stock, obtains the share at a lesser price and are eligible to receive the dividend.

Let us now go through the recent updates of the 5 players - NAB, AVN, OMH, BHP & SCG

National Australia Bank Limited (ASX: NAB)

Faced the Challenging Environment in FY 19:

National Australia Bank Limited (ASX: NAB) is one of the biggest four banks in Australia. It also operates in countries like New Zealand, Europe, Asia and the United States.

NAB has recently on 20 November 2019, notified the market that it has agreed to pay an amount of $49.5 million for the settlement of the class action, which was put by the law firm - Slater & Gordon regarding CCI or Consumer Credit Insurance. However, this settlement can take place after getting the approval of the Federal Court of Australia.

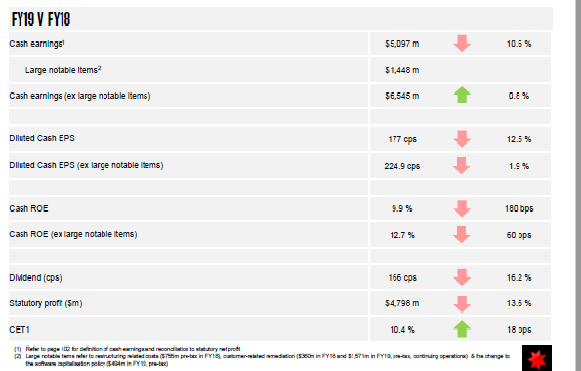

On the other hand, for FY 19 period, the company delivered 10.6% fall in the cash earnings to $5,097 million on the back of additional charges of $1,100 million after tax for customer-related remediation and also due to change in the software capitalization policy. Excluding the customer-related remediation, the company posted 1.1% increase in the revenue & 1.7% rise in underlying profit.

FY 19 Financial Performance (Source: Companyâs Report)

Meanwhile, NAB will be paying a 100 percent franked dividend of 83 cents on 12 December 2019 and its ex-dividend date was 14 November. Thus, the company declared the total dividend of 166 cps, which reflects a 16% reduction compared to FY18.

On 27 November 2019, NAB stock last traded at $26.18, edging up by 0.115 percent compared to its last close. NAB has a dividend yield of 6.35 percent on an annualised basis. Also, NAB stock has fallen by 3.36% in the last three months duration.

Aventus Group (ASX: AVN)

During FY 19 AVN has posted $85 million increase in its valuation:

Aventus Group (ASX: AVN) is a leading player in real estate group, that is into the development and management of retail centers in Australia.

AVN has recently settled the APS1 or Aventus Property Syndicate 1, which bought McGraths Hill Home from AVN at its book value of $42.5 million. Moreover, the company for FY 20 expects FFO earnings to grow in the range of 3% - 4% growth, which reflects the range to be 19.0 â 19.2 cps.

Further, in FY 19 the company has reported 8.2% increase in the Funds from Operations to $96m on the back of strong underlying rental growth. During FY 19, there has been $85 million increase in its valuation.

AVN paid the unfranked dividend of AUD 0.0422 cents on 31 October 2019 and was ex-dividend on 27 September 2019. AVN has dividend yield of 5.92 percent on an annual basis & the declared dividend was not franked.

On 27 November 2019, AVN stock last traded at $2.83, moving up by 0.355 percent from its prior closing price. Meanwhile, AVN stock has risen 8.46% in the past three months period.

OM Holdings Limited (ASX: OMH)

Intends Secondary Listings on Bursa Malaysia Securities Berhad:

OM Holdings Limited (ASX: OMH) is an integrated player for manganese that invests, explores, develops the related projects, along with the operation and trading of them. The company has operations in South Africa and in Sarawak, East Malaysia apart from Australia.

In October, the company notified that it intended to go for a secondary listing of its common shares on Bursa Malaysia Securities Berhad after getting the required approvals from the relevant authorities in Australia and Malaysia, in order to increase its liquidity, there. The company has already made the investment in OM (Sarawak) Sdn Bhdâs ferroalloy smelter located in Samalaju, East Malaysia for a 75% interest.

Also, OMH will be paying an unfranked dividend of AUD0.01 cent on 29 November this year and its ex-dividend date was on 7 November this year. OMH has a dividend yield of 5.94% on an annualised basis.

On 27 November 2019, OMH stock last traded at $0.490, falling by 2.97 percent from its previous close. Meanwhile, OMH stock has fallen by 18.55% in the last three months timeframe.

BHP Group Limited (ASX: BHP)

Appointed Mike Henry as the Chief Executive Officer:

BHP Group Limited (ASX: BHP) formerly known as BHP Billiton Ltd, is into the exploration & production of various commodities that includes iron ore, metallurgical coal, copper and uranium. Along with this, the company is into petroleum exploration, production, and refining.

The company has agreed to pay US$21.9 million for becoming the top shareholder in Ecuador-focused SolGold Plc. The company has recently appointed Mike Henry as the Chief Executive Officer (CEO) of the company. He will take on the role of Chief Executive Officer and Executive Director w.e.f 1 January next year.

In FY 19 period, the company has reported EBITDA of US$23 billion at an EBITDA margin of 53 & has generated the free cash flow of US$10 billion. Moreover, BHP had paid 100 percent franked dividend of US$0.78 on 25 September 2019 and had an ex-dividend date of 5 September 2019. The company has returned a record US$17 billion to its shareholders.

BHP stock last traded at $38.35, up by 1.187 percent from its prior close. BHP has dividend yield of 5.06% on an annualised basis. Meanwhile, BHP stock has risen 9.25% in the past three months.

Scentre Group (ASX: SCG)

99.3% of its portfolio leased:

Scentre Group (ASX: SCG) a retail estate stock, develops shopping centre with retail destinations that operates under the Westfield brand in Australia and New Zealand. The company also has presence in the United States and the United Kingdom.

SCG had posted more than 535 million increase in the growth of Customer Visits in the third quarter report, released on 31 October 2019 wherein, it mentioned that 99.3% of its portfolio was leased. During the quarter, the company completed 1,859 lease deals and in the lease deals area of 312,566. The company has reported 2.4% increase in the total in-store sales for the third quarter & 2.9% rise in the specialty in-store sales.

Moreover, SCG had paid the unfranked dividend of 11.3 cents on 30 August 2019 and was ex-dividend on 14 August 2019. SCG has a dividend yield of 5.72% on an annualised basis. Meanwhile, SCG stock has given a return of 1.82 percent during the YTD period.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.