Gold is coveted throughout the world for its value backed by a rich history. Gold is among the oldest form of currency in use. It continues to be a popular investment even today. With time and upgrading technology, the trading of gold has evolved from physical to virtual trading; with newer entrants like ETFâs entering the alluring gold market.

Why Investors Seek to invest in Gold

Liquidity

An asset class is considered highly liquid if the investor could buy and sell without majorly impacting the asset price. Gold is a highly liquid asset which can be transacted in huge volumes and value without impacting the price of gold. This very nature of gold has allowed many investors to consider it as a safe alternative to cash.

Wealth Creation

Gold is categorised as a precious metal. Due to its unique physical properties, it is used in the making of jewellery and finds use in industrial applications as well. Gold is available in limited supply and thus its value goes up over time with increase in its demand. It is common to find Gold jewellery being passed from one generation to another as a legacy and a symbol of family wealth.

Hedge against Inflation

Owning gold may be a good hedge against inflation. When there is inflation in the economy, the home countryâs currency depreciates and having an investment in gold will help the investor to protect against the inflation as the gold price tends to adjust upwards in the local gold market.

Portfolio Diversification

Diversification can be referred to as allocating the resources in those sectors that are not correlated to each other. Gold has an inverse relationship with stocks and other financial instruments. The decline in paper investment leads to an increase in the gold price. So, investing in gold can be a good choice for investors if they intend to diversify their portfolio.

Dividend Stocks

Dividend stocks are a great way to build long term wealth. Dividend is a form of profit sharing where in the company could pay dividend to its shareholders in different forms such as, issuance of shares, cash payments or via buybacks. Dividends are usually paid by the good well-established companies with limited capital requirements for growing their business. These sort of companies pay a dividend to their shareholder on a are regular basis.

Why Investors require Dividend?

Investors invest their money in businesses with the intention of deriving of good return over long periods of time. Dividend paid to an investor on a regular basis acts as an incentive for the shareholder for patiently holding on to the shares. The amount received via dividends could be used by the investors to further increase their stake in the business -by buying more shares of the company or buy shares in other companies as the investor sees fit.

Why Investors Prefer to Invest in Dividend stocks

Volatility

The Dividend stocks are less volatile as compared to a non-dividend paying stock. The companies do not change the dividend pay-out ratio so often, and usually, the management strives to keep the dividend track record intact. Thus, these stocks are predictable and in turn, less volatile.

Consistent Income

The dividend stocks can provide investors with a steady source of income. This passive income can be used further to meet an investorâs capital need.

Expansion of Profits

The dividend seeking investor could also benefit from the growth in profits and thus, an increase in dividend received. Even though growth stocks are not known for their dividend payments, there are cases wherein growth companies have increased their dividends with growth in profits earned over long time periods.

Let us look at two dividend paying companies i.e. Rio Tinto Limited from the Metal and Mining Sector and Australia and New Zealand Banking Group from the banking sector.

Rio Tinto Limited (ASX:RIO)

Rio Tinto Limited, headquartered in Melbourne, Australia and founded in 1873, is a metal and mining company. The company focuses on the mining and processing of mineral resources.

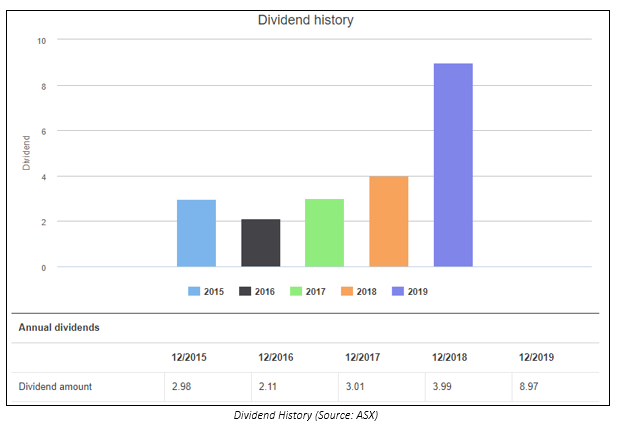

A track record of $32 billion returned to shareholders since 2016

Rio Tinto has returned $32 billion to its shareholders in the past 3 years alone, even under a volatile macro environment. The company is backed by world class assets that have enabled Rio to generate $10 billion of free cash flow in 2019. The company aims to maintain an appropriate balance between capital investment in the business and cash returns to its shareholders, maintaining a pay-out ratio of 70%.

Stock Performance

On 4 November 2019, the stock of RIO closed the dayâs trade higher at $93.69, up by 3.5% as compared to its previous closing price. The company has approx. $371.22 billion outstanding shares and a market cap of $33.6 billion. The 52-week low and high value of the stock is at $68.169 and $106.922, respectively. The stock has generated a negative return of 4.38 per cent in the last six months and a positive return of 24 per cent on a year-to-date basis. It has a dividend yield of 5.19%.

Australia and New Zealand Banking Group (ASX: ANZ)

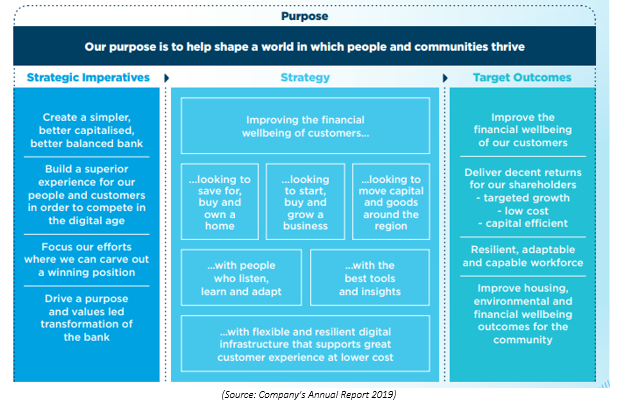

Australia and New Zealand Banking Group headquartered in Melbourne is a financial services company. The company has an asset of $247 billion and is one of the largest banks in Australia. The group is officially listed on Australian Stock exchange.

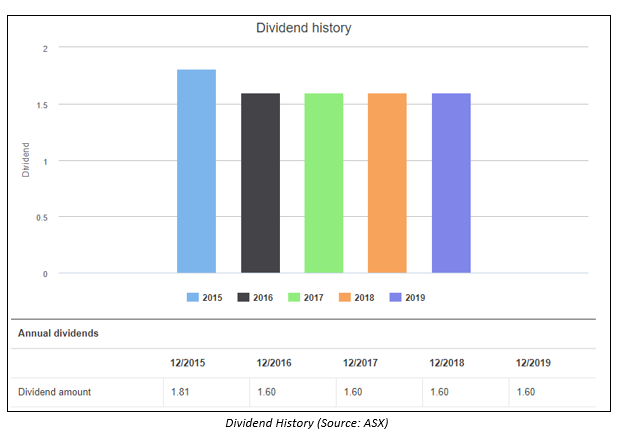

Despite Tough conditions, ANZ maintains FY19 Full Year Dividend.

The company recently unveiled its FY19 annual report. The reportedly witnessed challenging conditions in 2019, which reflected in its profit falling down by 7% and came in at $6 billion. However, despite the challenges the company held its FY19 full year dividend at 160 cents with a final dividend of 80 cents franked at 70%. Going forward, the company intends to maintain its focus on capital efficiency.

Stock Performance

On 4 November 2019, the stock of ANZ was closed the dayâs trade lower at $25.980 on ASX down by 0.916% from its previous closing price. The company has a market cap of around $74.24 billion and a $2.83 billion outstanding shares. The 52-week low and high value of the stock is at $22.980 and $29.300, respectively. The stock has generated a negative return of 5 per cent in the last six months and a positive return of 10 per cent on a year-to-date basis. Its dividend yield stands at 6%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.