With significant silica sand projects across Western Australia, VRX Silica Limited (ASX:VRX) is Australiaâs one of the leading silica sand exploration firms. The silica sand is witnessing a growth phase, catalysed by the growing demand from the construction space with worldwide increase in both value and volume. Between 2009-2016, the silica sand sales went up by ~8.7% in value terms (compound annual growth rate) with a market value of US$6.3 billion.

The Company focusses on adhering to this increasing demand amidst a decreasing supply of silica sand across the globe, backed by its strong Project portfolio.

While VRX Silica aims to tap other silica sand projects in the country, its strong project portfolio presently includes the Boyatup, Biranup, #, Arrowsmith and Muchea, Projects. Over time with substantial progress, the Arrowsmith and Muchea projects have proven to be VRXâs two most advanced silica sand projects, holding significant potential for high-grade silica sand.

On 18 October 2019, the Company has pleasingly notified about the details of the Bankable Feasibility Study and maiden Probable Ore Reserve pertaining to the Muchea Silica Sand Project, marking its third BFS for the two advanced silica sand projects.

With the release of exciting news, the VRX stock zoomed up by ~14.3%, trading at $0.160, with a market capitalisation of $56.6 million and ~404.32 million shares outstanding (as at 12:10 PM AEST). Interestingly, the stock has delivered a 6-month return of 129.51%.

Letâs dive right in!

Other Key Details of the BFS

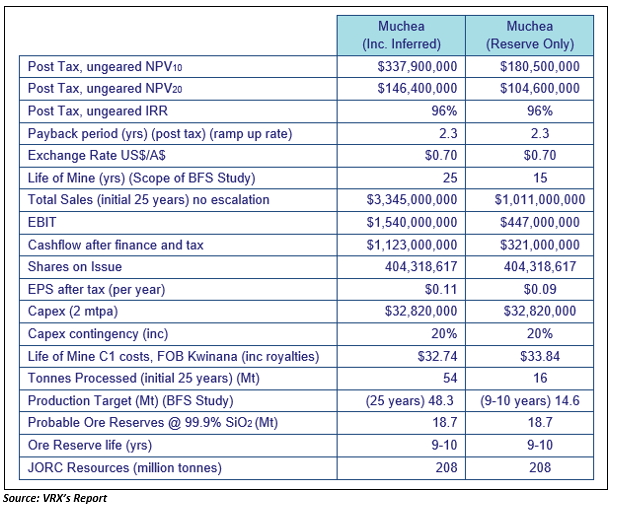

It is worth noting that the BFS conducted by the Company was based on only 25 years production from a potentially long-term +100-year mine life. The Companyâs economic analysis has been calculated at a 10% discounted ungeared post tax net present value.

VRX Silica has undertaken adequate exploration to assume metallurgical and geological continuity of the sand deposit. The related cost for assaying and exploration is evaluated to be in the region of $200k and would be required to be undertaken within the first nine to ten years of the mining operations.

Moreover, the Company has been in discussions with the Department of Premier and Cabinet and the Department of Jobs, Tourism, Science and Industry to identify options to gain access to the ground within the area of File Notation Area 12671 (proposed for the âPerth and Peel Green Growth Plan for 3.5 millionâ).

VRX has also obtained substantial support from various State and Federal Parliament Members for the project. Following preliminary environmental studies, it is also investigating with the Department of Water and Environmental Regulation to identify key issues pertaining to the project environmental approvals for mining, particularly the vegetation for potential foraging by Carnabyâs cockatoos.

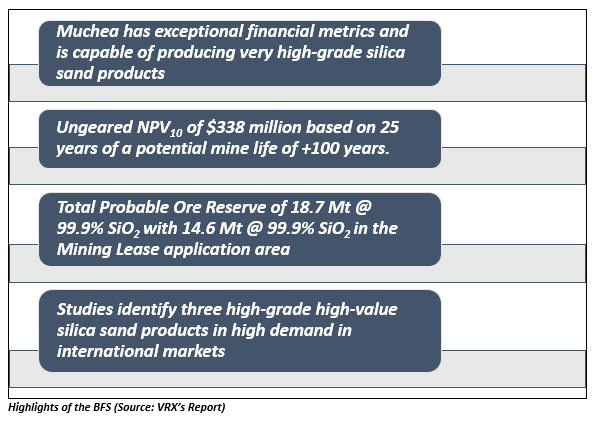

The key BFS outcomes are summarised in the below figure:

Probable Ore Reserve

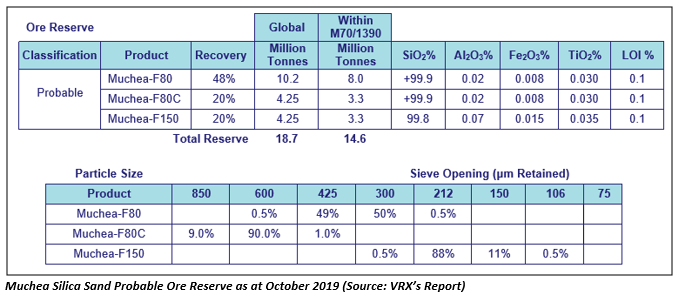

The mining method chosen for Muchea is a rubber-wheeled front-end loader, feeding into a 3mm trommel screen to remove oversize particles organics. After processing at sand processing plant, the silica sand is then loaded into railway trucks for bulk export from the Kwinana Bulk Terminal.

The BFS highlighted that a purpose-built wet sand processing plant will produce three saleable products for different markets.

The necessary work to convert the Indicated Mineral Resource to Probable Ore Reserves (located within an area of deep Bassendean sands, leached of nutrients) has finally been completed and it was notified that the Probable Ore Reserve for Muchea totals 18.7 Mt @ 99.9% SiO2 as reported in accordance with the JORC Code with 14.6Mt @ 99.6% SiO2 contained within the area of the Companyâs Mining Lease application.

Recently, the Company reported a Mineral Resource Estimate (MRE) totalling 208 Mt @ 99.6% SiO2 for Muchea project, which includes an Indicated Resource of 29 Mt @ 99.6% SiO2 and an Inferred Resource of 179 Mt @ 99.6% SiO2.

The Company notified that the maiden Probable Ore Reserve of 14.6 Mt @ 99.9% SiO2 is expected to support a 9-10 year project and is contained within M70/1390. In addition, the Company informed that the balance is from Inferred Mineral Resource in the proposed mining area which is 61.4 Mt @ 99.6% SiO2, which the Company intends to mine from year 10 onwards.

As per the Company, CSA Global reviewed the extensive metallurgical testwork, which allowed for the creation of a catalogue of silica sand products that could be produced from Muchea.

Positive Financial Metrics

- VRX Silica is confident that it can meet silica sand market specifications for the ultra-clear glass market from Muchea.

- Moreover, the Company has received a number of enquiries and expressions of interest from debt financiers for the project and as well as from organisations (who aspire to become a funding partner) across Asia for silica sand products from the project and holds signed letters of intent for substantial tonnages.

- The positive financial metrics of the BFS and feedback from potential funding partners provide encouragement as to the likelihood of meeting optimum project and corporate capital requirements.

VRX Advancing well to tap attractive market opportunity

The High-grade silica sand is a key raw material in the worldâs industrial development and is used in the specialist glass, metal casting, and ceramics industries.

Given the fact that the APAC zone accounts for 47% of the global demand for silica sand and is likely to grow by 6.1% to 138 million metric tonnes in 2019, VRX Silicaâs Arrowsmith and Muchea projects provide the opportunity for the Company to become a lead manufacturer and provider of high-grade silica sand across the Asian market. Moreover, the worldwide consumption of industrial silica sand is likely to rise by 3.2% each year through 2022.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.