When the whole world is struggling with a global sand crisis, VRX Silica Limited (ASX: VRX), formerly termed as Ventnor Resources Limited, is working towards fulfilling the looming shortage of this key resource. The broad market for silica sand in the Asia-Pacific region offers a vast opportunity for the company to address the increasing demand for the product.

Substantial Progress at VRX Silicaâs Key Projects

The company owns significant projects for silica sand exploration in Western Australia, which includes three projects prospective for silica sand namely Arrowsmith, Muchea and Boyatup; and two more projects prospective for other minerals â Warrawanda and Biranup Project. Out of these five projects, Arrowsmith and the Muchea Projects are the companyâs key projects where JORC compliant Mineral Resource Estimate have been determined.

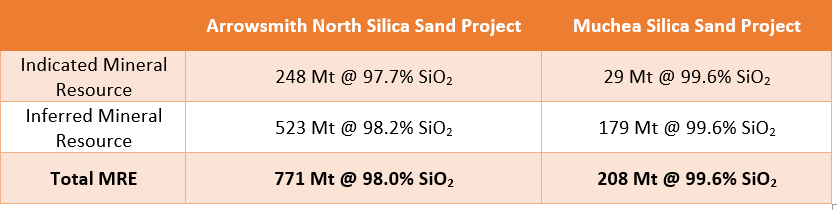

VRX Silica has recently reported a new Mineral Resource Estimate (MRE) at its Arrowsmith North Silica Sand Project and Muchea Project, post the completion of an aircore drill program at the project sites. The table below highlights the upgraded MREs (JORC 2012 compliant) at its key projects:

According to the company, the silica sand JORC compliant Mineral Resources identified at its key projects are noteworthy and are anticipated to increase further. Also, VRX Silica has the ability to generate huge quantities of silica sand from each of these projects to meet the enormous demand for the product. Currently, the company is engaged in the completion of the Environmental Approval process and the procedure of Mining Lease Applications at both the Arrowsmith and Muchea Projects.

VRX Silicaâs Strong Management Team

VRX Silica has undertaken multiple development activities at its silica sand projects to-date, supported by an experienced management team. The companyâs board majorly comprises of three skilled and qualified Directors - Mr Paul Boyatzis, Mr Bruce Maluish and Mr Peter Pawlowitsch.

Mr Paul Boyatzis - Non-Executive Chairman

(B Bus, ASA, MSDIA and CPA)

Mr Paul Boyatzis, the current Non-Executive Chairman of VRX Silica, holds over 30 years of experience in the investment and equity markets with an extensive working knowledge of public companies. Currently, he is a member of the Securities and Derivative Industry Association, the Australian Institute of Company Directors and the Certified Practising Accountants of Australia.

Mr Boyatzis has helped many emerging companies in raising investment capital both domestically and via overseas institutional investors. He has been serving as the VRX Silica Director since 24th September 2010.

Besides VRX Silica, he has held the directorships at the following listed companies:

- Aruma Resources Ltd (ASX: AAJ) - He has been serving as the Non-Executive Chairman of Aruma since 5th January 2010.

- Nexus Minerals Ltd (ASX: NXM) - Mr Boyatzis is the current Chairman and Non-Executive Director of Nexus Minerals. He was appointed for the position in October 2006.

- Transaction Solutions International Ltd (ASX: TSN) - Mr Boyatzis has also served this company from 23rd February 2010 to 30th June 2017.

Mr Bruce Maluish - Managing Director

BSc (Surv) and Dip Met Min

VRX Silicaâs Managing Director, Mr Bruce Maluish holds directorship of the company since 24th September 2010. During his 30+ years of experience in the mining industry, Mr Maluish had occupied the positions of Managing Director and General Manager in different companies including Forsyth Mining, Matilda Minerals, Hill 50, Monarch Group of Companies and Abelle. He is also on the board of Nexus Minerals Ltd since 1st July 2015.

He also possesses credentials in Project Planning, Surveying, Mining, and Finance. He has worked in multiple resource sectors including mineral sands, gold and nickel from both underground and open pits.

Mr Maluish carries management and administrative experience as well as international experience in the mining industry. His international experience incorporates identifying projects and negotiating with clients in Asian markets while his administrative and management experience includes the setup and marketing of initial public offerings (IPOs), from the beginning of exploration to complete production, to the identification, development and growth of projects comprising mergers and acquisitions.

Mr Peter Pawlowitsch - Non-Executive Director

B.Com, MBA, CPA

VRX Silicaâs Non-Executive Director, Mr Peter Pawlowitsch, holds over ten years of experience in the accounting profession with a recent experience in the evaluation of businesses and mining projects, and business management.

Mr Pawlowitsch, the director of VRX Silica since 12th February 2010, is a well-qualified board member who holds a B. Com degree from the University of Western Australia and an MBA degree from Curtin University. Currently, he is also a member of the Certified Practising Accountants of Australia and is a Fellow of Governance Institute of Australia.

Besides VRX Silica, he has held the directorships at the following listed companies:

- Dubber Corporation Limited (ASX: DUB) â Mr Pawlowitsch is serving as the director of Dubber since September 2011.

- Department 13 International Limited â He was a board member of the company from 30th January 2012 to 18th December 2015.

- Knosys Limited (ASX: KNO) â He joined Knosys in March 2015 and is currently serving as the Non - Executive Director of the company.

- Novatti Group Limited (ASX: NOV) â Appointed in June 2015, Mr Pawlowitsch is the current chairman of Novatti.

- Rewardle Holdings Limited (ASX: RXH) - Non-Executive Director at Rewardle, Mr Pawlowitsch has been associated with the company since 30th May 2017.

It can be seen that VRX Silicaâs board members have considerable experience in mine development into production and mineral exploration areas, and in the management of publicly listed exploration and mining companies. The companyâs efficient management team has been a significant contributory factor in its speedy progress.

Stock Performance: On 7th August 2019, VRX stock settled the dayâs trade higher at AUD 0.130 with a rise of 8.33 per cent relative to the last closed price. The stock has generated a return of 93.55 per cent over last one year.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.