VRX Silica Limited (ASX: VRX), previously known as Ventnor Resources Limited is an Australian-headquartered mineral exploration company that holds significant silica sand projects in the Western Australia region. The companyâs projects include Arrowsmith Project, Boyatup Project, Muchea Project, Warrawanda Project and Biranup Project. The Arrowsmith and the Muchea project are the key projects of the company that are highly prospective for silica sand.

Why Silica Sand?

Evidence suggests that the countries across the world are facing sand crisis and the global shortage of the product could ruin key infrastructure projects. VRX Silica acquired highly prospective tenements for silica sand in WA, post identifying a rising global demand for high quality silica sand. The shortage of the product was primarily detected in the Asia-Pacific region by the company.

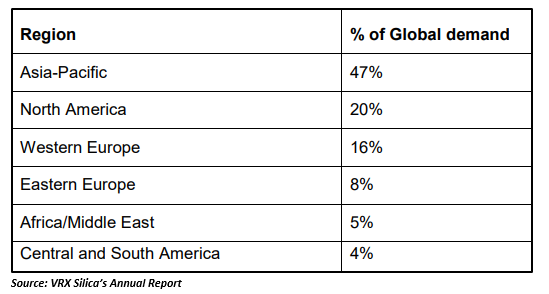

According to a US-based market research firm, Freedonia Group, 47 per cent of the global demand for silica sand comes from the Asia-Pacific region and the demand is expected to grow by 6.1 per cent to 138 mmt in 2019.

Below is the bifurcation of global demand for the silica sand across different regions:

Key Uses of Silica Sand

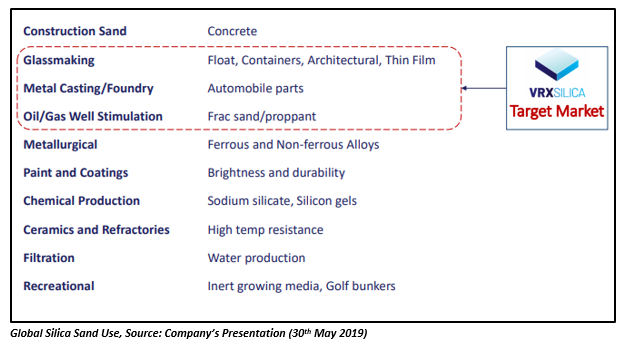

Silica sand is extensively used in the modern world for multiple purposes. The product is used as a key raw material for the industrial development of the world.

Glassmaking

Being a primary component in all types of glass manufacturing, silica sand is largely in demand in the glassmaking industry. The product can be used to manufacture high-capacity lithium-ion rechargeable batteries, container glass for foods and beverages, tableware and flat glass for buildings and vehicles.

Foundry Industries

The ferrous and non-ferrous foundry industries also use industrial sand for giving an external shape to metal parts like sink faucets and engine blocks. As the silica sand has a low rate of thermal expansion and high fusion point (1,760°C), it helps in producing moulds and stable cores that are compatible with all the pouring temperatures.

Chemical Production

The silicon-based chemicals are used for the removal of impurities from brewed beverages and cooking oil, manufacture of fibre optics, and are also used in products like household and industrial cleaners.

Construction Sand

A wide variety of building and construction products have construction sand as a key component. The whole-grain silica is mostly used in mortars, stucco, skid-resistant surfaces, flooring compounds, specialty cements, asphalt mixtures and roofing shingles to provide flexural strength and packing density, leaving the chemical properties of the binding system unaffected.

The product is a strong growth mineral due to its significant demand in the construction sector where it is used to produce glass required in double glazing, which is massively being used in Asia to reduce energy demands.

Silica sand is utilized in many other industries besides the above-mentioned verticals, as indicated in the figure below:

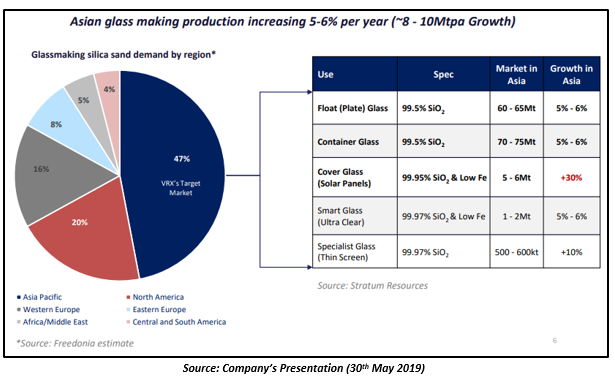

Opportunities for VRX Silica in Asia-Pacific Region

The sand has been declared as a strategic resource by the Asian regional governments because of its supply deficits. The growing shortage of the product in the region has led to an increase in prices, making Australian prospects more competitive. The booming demand for sand in the production of concrete, particularly in Vietnam, India and China, has put pressure on suppliers and subsequently on prices.

In Singapore, around one million tonnes of concrete is used in a month for building construction that requires around 300,000 tonnes of construction sand. The countryâs principal sources currently include Cambodia, Malaysia, Myanmar and Philippines. Over its concern towards unreliability of the current sources, Singapore had placed a requirement for the import of 5 per cent of construction sand from ânon-traditionalâ sources including Australia.

In Asian regions, the environmental damage frequently caused by illegal mining activities is creating social pressure, and a rise in coastal developments has also lowered the access to resources. The illegal dredging of rivers had led to public scrutiny of the long-term environmental impacts in India. However, the country is a significant market for construction sand due to the large demand for concrete for its building expansion program.

VRX Silicaâs Achievements

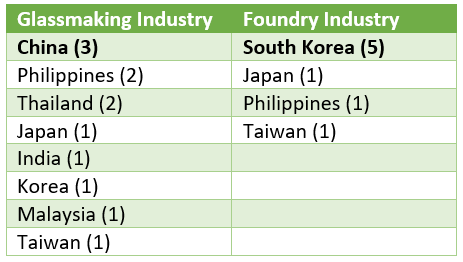

The company informed in April 2019 that it has received strong interest from twenty manufacturers within the Asia-Pacific region for the purchase of large tonnages of the silica sand products from its two key projects - Arrowsmith and Muchea Project. VRX Silica met with several prospective offtake customers interested in buying the silica sand products from Arrowsmith and Muchea. The enquiries and expressions of interest were received from the manufacturers, organisations and purchasing agents associated with the glassmaking and the foundry industry.

VRX Silica has identified potential annual silica sand sales to-date of 900k tonnes for the foundry industry and over 1.6 million tonnes for glassmaking industry.

The table below demonstrates the number of enquiries received for glassmaking and foundry industries from different regions in Asia-Pacific:

As indicated in the table above, the highest level of demand was from China in the glassmaking industry and from Korea in the foundry industry. The glassmaking industry of China is also the most dominant one in the Asia-Pacific region as the country has more than 270 glassmaking facilities.

In another achievement, VRX Silica has entered into a MOU with the largest architectural glass manufacturer of China, CSG Holding Co Ltd recently, to form a strategic alliance related to the companyâs Muchea Project. The key objectives of the alliance included promotion and sale in the Peoplesâ Republic of China of silica sand products and exploring the potential sources of capital finance for production facilities.

The enormous demand for the silica sand across the Asia-Pacific region has given a huge opportunity to VRX Silica which is eyeing to become a leading supplier and producer of high-grade silica sand. Also, the preliminary testwork has indicated that the companyâs Arrowsmith and Muchea Project have substantial potential for silica sand that is compatible for use in both the glassmaking and construction industry.

Stock Performance

The companyâs stock is currently trading at AUD 0.140 on ASX by the close of trading session on 23rd July 2019. The stock has delivered a return of 15.38 per cent on a YTD basis and a substantial return of 111.27 per cent in the last one year.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.