VRX Silica Ltd (ASX: VRX) is a company headquartered in Australia that owns significant silica sand projects located in Western Australia. The company primarily focusses on meeting the demand for silica sand in the Asia-Pacific region. VRX Silica has identified various project locations enriched with high-quality silica sand including: Muchea, 50 km to the north of Perth, Arrowsmith, located 270 km to the north of Perth in Western Australia, and Boyatup, 100 km to the east of Esperance.

In an announcement today, the company declared the results of a drill program concluded at the Muchea Silica Sand Project.

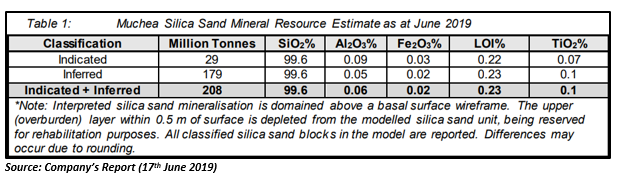

As per the results, the JORC 2012 Mineral Resource Estimate for the project has been upgraded to 208 Mt @ 99.6% SiO2 that consists of a JORC 2012 Inferred Resource estimate of 179 Mt @ 99.6% SiO2 and a JORC 2012 Indicated Resource estimate of 29 Mt @ 99.6% SiO2.

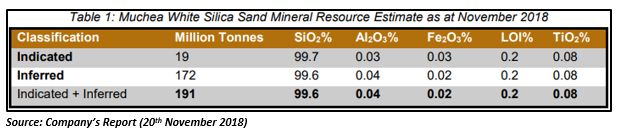

Previous MRE Results:

Let us have a look at the previously reported maiden Mineral Resource Estimate (MRE) by the company for its Muchea project:

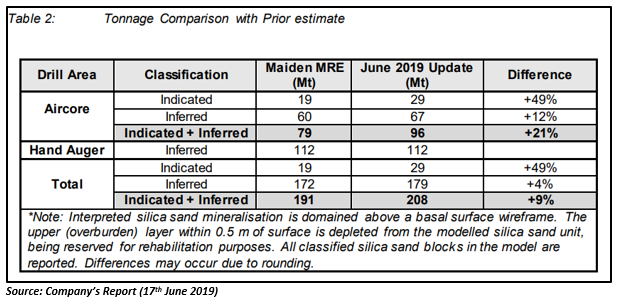

Overall, the MRE has increased by 9 per cent from 191 Mt @ 99.6% SiO2 to 208 Mt @ 99.6% SiO2, with the Indicated Mineral Resource rising by 49 per cent from 19 Mt @ 99.7% SiO2 to 29 Mt @ 99.6% SiO2 and Inferred component improving by 4 per cent from 172 Mt @ 99.6% SiO2 to 179 Mt @ 99.6% SiO2.

Details of upgraded MRE:

The upgraded Mineral Resource Estimate is based on the results of the recently conducted drilling, and a reinterpretation of the earlier modelled sand layer. Previously, the MRE was estimated purely on the SiO2 percentage instead of defining all the material compliant for producing glass and foundry grade silica sand. The reinterpretation investigated previously discounted layers of low iron sand, and higher levels of clay and organic matter; indicated as Al2O3 and LOI1000C in the assay dataset.

According to the Managing Director of VRX Silica, Mr Bruce Maluish, with low variability of results over the Resource area, the company expects that a majority of the Indicated Resource would be transformed to Probable Reserves in their impending BFS.

The drill program conducted was over an area of 217ha, which is a minor portion of the ~2,900ha Mining Lease Application area ,(MLA70/1390) which was forwarded by the company for its Muchea Project in mid-January 2019. The Mining Lease application incorporated 92 per cent of the earlier announced MRE of 191 Mt @ 99.6% SiO2. With an area of 2,918Ha, the MLA70/1390 also included a section of the Exploration Licence E70/4886 granted in March 2017.

Metallurgical testwork completed to-date has shown that a section of sand in the Resource, that was previously discounted due to colour, might be advantageous for producing high-grade silica sand products via conventional washing and screening methods. The specifications of such high-purity silica sand products are anticipated to be suitable for industries like the glass making and foundry industries.

It is also expected that a further testwork emphasizing on the recently discounted sand layers could lead to further reinterpretation and upgrades to the Muchea Mineral Resource Estimate.

Recent Updates on Muchea Project

Commencement of Drilling Program:

In March 2019, the company informed about the commencement of drill program at three of its project areas at the Central and North Arrowsmith Silica Sand Projects, and its Muchea Silica Sand Project. The companyâs drill program was targeted to increase Resources and JORC confidence at these three projects. The planned drill program consisted of a total of 57 holes at the Muchea for 887 metres, and a total of 189 holes for 1,726 metres at Arrowsmith.

Received Processing Plant Design and Cost Estimate:

By late March, three iterations of the testwork had been carried out on the Arrowsmith and Muchea projects with the final iteration concluded by a renowned testwork laboratory, CDE Global.

In March this year, an independent process design and cost estimate was received by the company for a processing plant at its Muchea Project and Arrowsmith Silica Sand Projects.

The processing plant design included features that confirmed optimum utilisation and performance, along with replicated critical pumps and flexible speed drives on all pumps. The cost of the processing plant was estimated at 18 million dollars per plant by CDE Global, with the total capital cost (incorporating plant feeder and water supply per plant) assessed at 25 million dollars per plant.

Received Strong Interest from Manufacturers Across Asia-Pacific region:

In April this year, the company received strong interest for the purchase of significant tonnages of silica sand products from its Muchea Silica Sand Project and its two Arrowsmith Silica Sand Projects subsequent to the appointment of Mr Yoonil Kim as its International Sales Manager in November 2018. VRX Silica has identified several markets in the Asia-Pacific region and met numerous potential offtake customers for the sale of silica sand products from the Muchea and Arrowsmith Projects.

Announcement of Testwork and Confirmation Assay Results:

On 2nd May 2019, the company announced the assay results of testwork and confirmation for recoveries of silica sand commercial products from its Muchea and Arrowsmith Silica Sand Projects. The company validated high recoveries of commercial silica sand products from these projects.

The following table summarises the recovered products from its Muchea Project based on the testwork and process circuit mass balance data:

What Next?

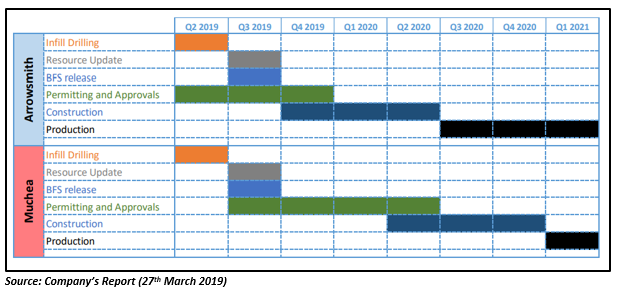

A more extensive programme of works (PoW) has been lodged to Aircore drill the area that was previously covered by hand auger drilling. The company intends to undertake the drilling activity in September quarter 2019.

Recently, the company also informed that it plans to complete bankable feasibility studies (BFS) for Arrowsmith and Muchea Projects in the September quarter 2019. The company has provided the following project timelines:

Stock Performance: VRX settled the dayâs trading at A$0.094, up by 5.62% (on 17th June 2019) with a market capitalisation of AUD 35.98 million. Around 1.09 million shares were traded today, more than annual average volume of 815,519 shares.

In the last five years, the companyâs stock has generated a huge return of 133.68 per cent. Over short term, the performance of the stock in the last one month has been tremendously well, with the return of 56.14 per cent.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.