Australian mineral explorer, VRX Silica Limited (ASX: VRX) focusses on meeting the global shortage of silica sand, which is a primary ingredient in all types of glass manufacturing. The company identified looming shortage of silica sand in the Asia-Pacific region that is causing a rise in its prices. According to Freedonia Group, the Asia-Pacific region accounts for 47 per cent of global demand for silica sand, and it is anticipated to grow by 6.1 per cent to 138 million metric tonnes in 2019. To meet the global demand for the product, VRX Silica had explored some prospective sites in Western Australia.

The company holds five significant projects in Western Australia, including Muchea Silica Sand Project, Arrowsmith Silica Sand Project, Warrawanda Project, Boyatup Silica Sand Project and Biranup Project. Three of them are prospective for silica sand â Arrowsmith, Muchea and Boyatup - while the rest two are prospective for other minerals.

Let us have a look at the updates released by the company related to these projects in 2019:

Key Projects - Muchea and Arrowsmith Silica Sand Project

About Muchea Project

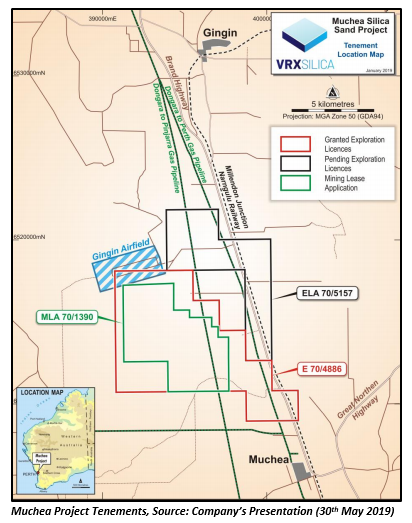

The Muchea Project is located 50 kilometres to the north of Perth and consists of one granted exploration licence, with one mining lease application and one exploration licence pending. The project contains two tenements with an area of 93 sq. km.

About Arrowsmith Project

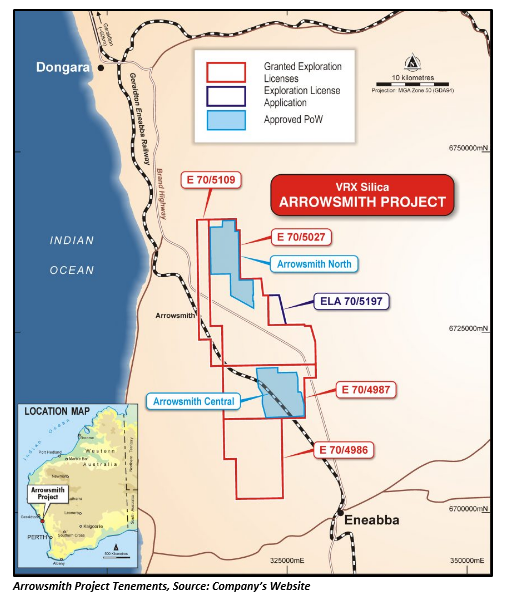

The Arrowsmith Silica Sand Project is situated 270 kilometres to the north of Perth and includes five granted exploration licences and two pending mining lease applications. The Arrowsmith Project area is categorized into Arrowsmith North, Arrowsmith Central and Arrowsmith South area that had undergone preliminary investigations in the past.

Strategic Alliance with China Southern Glass

Last week, the company notified in an ASX announcement that it has formed a strategic alliance with China Southern Glass or CSG Holding Co Ltd in connection with the Muchea Project. The key objectives of the strategic alliance included sourcing of capital finance for the construction production facilities, and sale and promotion of silica sand products in China. With the dominant global position held by Chinese glassmaking industry in the Asia-Pacific region, the alliance holds strategic importance for the company with CSG being the largest architectural Chinese glass manufacturer.

MRE Upgrade at Muchea and Arrowsmith North Project

Recently, VRX Silica announced the results of the aircore drill program concluded at the Arrowsmith North and Muchea Project under which a new Mineral Resource Estimate (MRE) was determined.

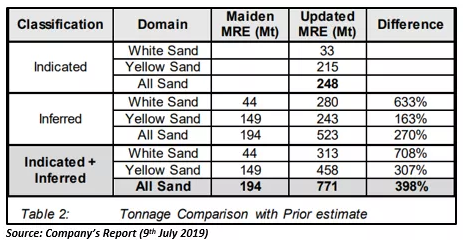

Arrowsmith North Project - The JORC 2012 MRE for the Project was upgraded to impressive 771 Mt @ 98.0% SiO2 from the previously reported Inferred maiden MRE of 193.6 Mt @ 98% SiO2. The company informed that this new Mineral Resource estimation will help them finalise the estimates of Ore Reserves that will support the approaching bankable feasibility studies, which is expected to facilitate obtaining necessary mining permits, funding and finally into commencement of mining operations.

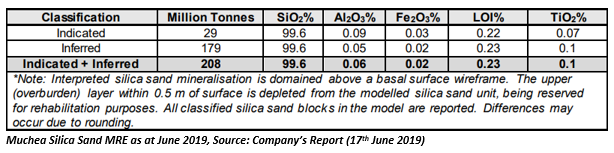

Muchea Project - The JORC 2012 MRE for the Project was upgraded to 208 Mt @ 99.6% SiO2 from the previously reported maiden MRE of 191 Mt @ 99.6% SiO2. As there was low variability of results over the Resource area, the company expects that a major part of the Indicated Resource will transform into Probable Reserves in its approaching BFS.

High Recoveries of Commercial Silica Sand Products

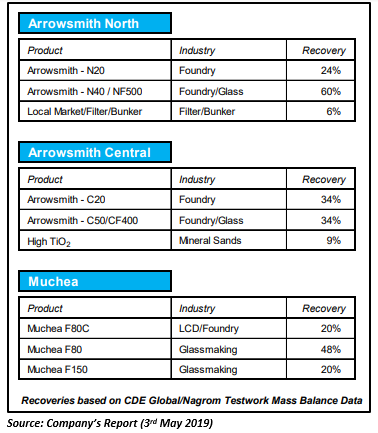

In early May, the company reported that the testwork and the confirmation assay results confirmed high recoveries of silica sand commercial products from its Muchea and Arrowsmith Silica Sand Projects.

Enquiries Received for Silica Sand Products from Muchea Project

In April this year, twenty manufacturers across the Asia-Pacific region showed strong interest in purchasing huge tonnages of silica sand products from VRX Silicaâs Muchea Project and its two Arrowsmith Silica Sand Projects. As per the company, it is strongly positioned to produce huge quantities of silica sand from all these projects to meet the growing demand.

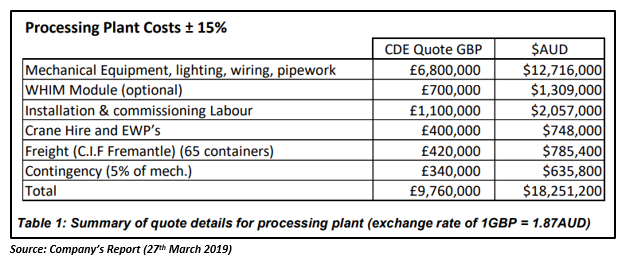

Received Plant Design and Costs Estimate

In March 2019, CDE Global provided VRX Silica with a cost estimate of $18m per plant for processing plants for its Muchea and Arrowsmith Silica Sand Projects, along with an independent process design and engineering estimate. The total capital expenditure was estimated at $25m per plant that included the cost of plant feeder and water supply per plant.

Commencement of Drill Program

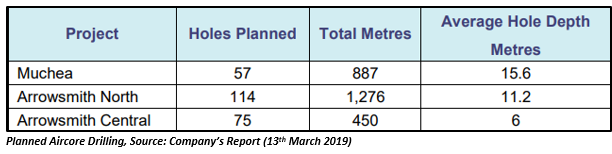

The company reported about the commencement of the aircore drill program at its two Arrowsmith Silica Sand Projects and Muchea Project on 13th March 2019. At Muchea Project, the aircore drilling program was initiated with an intention to raise the tonnage of sand within the area of Indicated Resource, and JORC confidence within the area applied for Mining Lease. At the Arrowsmith project areas, it was launched to increase the JORC confidence and tonnage of sand within the Mining Lease applications.

Testwork and Product Catalogues from Muchea & Arrowsmith

VRX Silica announced the testwork program results to produce silica sand products from its Muchea and Arrowsmith Silica Sand Project in February 2019. The testwork results were a culmination of 3 iterations conducted during 2018 and highlighted improved results from all the companyâs projects with grades reaching:

- Arrowsmith North: 99.7% SiO2

- Muchea: +99.9% SiO2 (<80ppm Fe2O3)

- Arrowsmith Central: 99.6% SiO2

The product catalogue produced included 4 products from Arrowsmith for the foundry industry and two products from each of Muchea and Arrowsmith Project for the glassmaking industry.

Submitted Mining Lease Applications

VRX Silica submitted second of the three Mining Lease applications MLA70/1390 for its Muchea Project in January 2019 while it submitted an application for its third silica sand Mining Lease MLA70/1392 for Arrowsmith Central Prospect in February this year.

Updates on VRX Silicaâs Other Projects

Biranup Project

The company informed on 13th March 2019 that it has received a written notice from Metalicity Limited or MCT that it has decided not to progress with the proposed transaction of acquiring 40 per cent interest in the VRX Silicaâs Biranup Project and a farm-in and JV arrangement for the balance of the Project. Since the company is exclusively focusing on silica sand projects, it intends to look out for JV arrangements to explore the major anomalies highlighted on the project.

Warrawanda Project

On 5th March 2019, VRX Silica notified about the results of rock chip samples from its project located at 40 kilometres to the south of Newman, Warrawanda Project. The results highlighted that the project has the potential to produce a high purity quartz product that can be supplied to the silica market by the company. The company acknowledges significantly higher value with prices up to US$300 per tonne for crushed and bagged high purity quartz, even though it is relatively smaller than the core silica sand opportunity. VRX intends to undertake a diamond drill exploration initiative this year to evaluate the scope and quality of the deposits post an Aboriginal Heritage survey.

Boyatup Silica Sand Project

The company acquired 100 per cent ownership of the Boyatup Project from Silatec Pty Ltd in February 2019. For the acquisition, the company issued $10,000 in full consideration and issue 2m of VRX Silicaâs ordinary fully paid shares. The company intends to add on to its existing product line with the Boyatup project, remarkably complimenting Muchea and Arrowsmith projects.

Stock Performance

The companyâs stock is currently trading at AUD 0.135 by the end of trading session on 16th July 2019. The stock has delivered a substantial return of 141.67 per cent and 61.1 per cent in the last three months and one month, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.