VRX Silica Limited (ASX: VRX) is an Australian-headquartered silica sand exploration and development company that focuses on the development of silica sand assets in Western Australia. The company holds three notable silica sand projects in Western Australia (WA), including Arrowsmith, Muchea and Boyatup Project. The company also owns two other projects in WA, including Warrawanda and Biranup Project, that are prospective for other minerals, such as nickel sulphides, gold, base metals and high purity quartz.

VRX Silicaâs Key Projects

Out of all the five projects possessed by the silica sand explorer, Arrowsmith and Muchea projects are the two that have witnessed significant developments so far.

Let us take a quick look at the two projects below:

Arrowsmith Project

Arrowsmith Silica Sand Project, acquired by VRX Silica in October 2017, comprises of Arrowsmith North, Arrowsmith Central and Arrowsmith South Project. In its preliminary reconnaissance work, the project was found to hold considerable potential for sand used in construction and glassmaking industry.

Recently, the company released the details of the BFS (Bankable Feasibility Study) at its Arrowsmith North Project, demonstrating exceptional financial metrics of the project. The company also reported a Probable Ore Reserve totalling 223 Mt @ 99.7% SiO2 for Arrowsmith North in line with the JORC Code 2012 edition, with 204 Mt @ 99.7% SiO2 included within the VRX Silicaâs Mining Lease application (MLA70/1389) area.

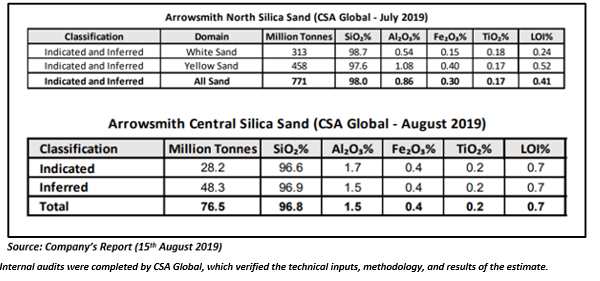

The BFS followed VRX Silicaâs earlier announcement of an upgraded Mineral Resource Estimate (MRE) for the project. In July this year, the company had notified about the increase in the total MRE of Arrowsmith North to 771 Mt @ 98% SiO2 (marking an uptick of 398% of the maiden estimate), comprising an Indicated Resource of 248 Mt @ 97.7% SiO2 and Inferred Resource of 523 Mt @ 98.2% SiO2.

In August 2019, VRX Silica had updated about an increase in total MRE of Arrowsmith Central to 76.5 Mt @ 96.8% SiO2 (marking an uptick of 273% of the maiden estimate), comprising an Indicated Resource of 28.2 Mt @ 96.6% SiO2 and Inferred Resource of 48.3 Mt @ 96.9% SiO2.

Muchea Project

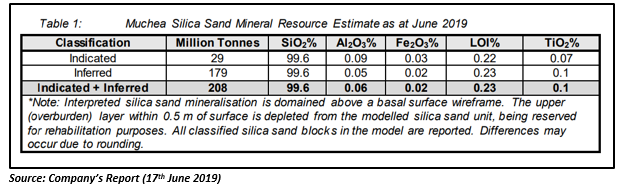

VRX Silicaâs Muchea Silica Sand Project comprises of two tenements with an area of 93 square kilometres. Recently, the company reported the results of a close spaced aircore drill program concluded at the Muchea Project, highlighting an increase in total MRE of Muchea to 208 Mt @ 99.6% SiO2, marking an overall increase of 9%. The total MRE included an Indicated Resource of 29 Mt @ 99.6% SiO2 and an Inferred Resource of 179 Mt @ 99.6% SiO2.

Opportunities in the Silica Sand Market

VRX Silica has made significant progress in its key silica sand projects located in Western Australia. Now, the question arises that âWhy the company is targeting the silica sand marketâ? And the answer lies in huge opportunities offered by the silica sand markets worldwide, especially in Asia-Pacific region.

As per VRX Silica, the silica sand sales have witnessed a compound annual growth rate of ~8.7% cent from 2009 to 2016 in value terms, with a market value of USD 6.3 billion. This was particularly due to the application of silica sand across multiple industries, including foundry casting, glass making, chemicals and metals, water filtration, along with the hydraulic fracturing process.

Silica Sand Demand in Asia-Pacific Region

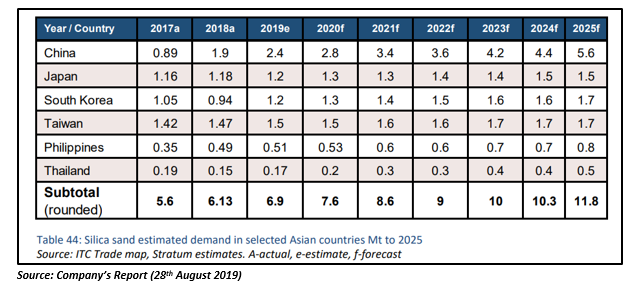

The demand for silica sand remains strong in the Asia-Pacific region, where the container glass industry is expected to drive silica sand sales further. According to the company, the Asia-Pacific consumption of industrial silica sand is expected to climb 5-6% per year through 2022, driven by ongoing economic and infrastructure development in the region. In fact, the region is likely to remain the leading regional consumer of industrial sand through 2025, backed by the strong Chinese market.

Recently, VRX Silica received expressions of interest from 20 manufacturers over the Asia Pacific region for numerous silica sand products in its published catalogue. The company has also achieved a major milestone this year by entering into a strategic alliance with China-based largest agricultural glass maker, China Southern Glass.

As per VRX Silica, the following factors are likely to drive the demand for silica sand further in Asia-Pacific region:

- Increase in Automobile Production

- Strong Demand for Fabricated Flat Glass Products

- Rising Demand for Energy Efficient Windows

- Rebound in Building Construction Activity

- Increasing Demand for Glass Products with Impact Resistance and Solar Control Features

- Expanding Applications of Glass in Healthcare and Electronics Sectors

- Use of Glass in Solar Thermal Panels and Photovoltaic Modules

Within Asia-Pacific region, foundry activity has shown strong growth in India, driven by manufacture of metal castings and production of sand moulds. Indonesia is also expected to deliver strong growth through 2022, with an increase in hydraulic fracturing activity, along with rapid advances in the output of glass products and metal castings.

Silica Sand Demand Outside Asia-Pacific Region

VRX Silica believes that the global consumption of industrial silica sand is likely to experience a growth of 3.2% per year through 2022. The silica sand demand in North America is projected to increase at a more rapid annual pace relative to any other regional market. The expansion in the hydraulic fracturing segments is expected to drive the regional growth in the US and Canada.

The company also anticipates a rebound in the consumption of silica sand in Western Europe, from the declines registered during 2008 to 2015 to more modest annual gains through 2020. As per VRX Silica, a turnaround in flat glass output and recoveries in manufacturing and building construction activity will promote renewed demand for industrial sand in Western Europe.

It can be inferred that the demand for silica sand remains strong across the world owing to its multiple advantages and applications. Amidst this market full of opportunities, VRX Silica holds huge potential to produce sizable quantities of silica sand to meet global demand from its key projects.

Stock Performance: On 12th September 2019, VRX is trading at AUD 0.140 (as at 3:31 PM AEST). The stock has delivered a massive return of 53.06 % during the last six months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.