Best known for its 100% owned Kvanefjeld rare earth project, Greenland Minerals Limited (ASX:GGG) is an Australian metals and mining company. Since 2007, GGG has been operational in Greenland, which hosts several natural resources within its rich realm in North America.

In this article, we would glance through the various studies and assessments conducted by GGG in 2019, towards the Principal Activity of 2019- mineral exploration and project evaluation. (According to its half-yearly report for the period ending 30 June 2019)

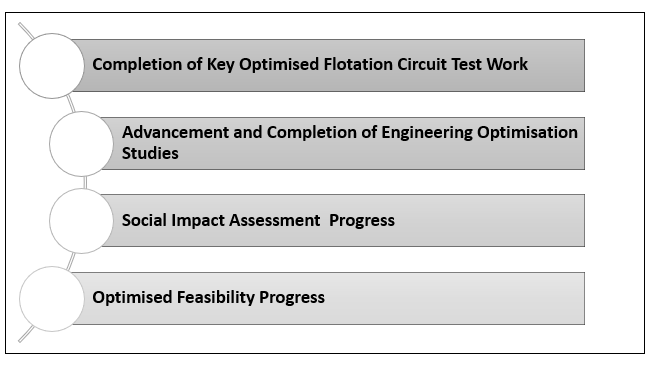

Completion of Key Optimised Flotation Circuit Test Work

Managing Director Dr John Mair said that the âThe progress made through 2018 on technical optimisation was excellent, with extensive test work completed in both Australia and China.â

2019 began on a progressive note for GGG when Chinaâs BTMR Laboratories was cherry-picked to complete the technical optimisation of Kvanefjeld flotation circuit, which helped in developing and further testing new simpler project configurations.

Assisted by GGGâs s largest shareholder, Shenghe Resources Holding Co Ltd, the test work resulted in outstanding simplifications which depict the below:

- The circuit operates consistently over a broad temperature range;

- No regrinding or de?sliming circuits were required;

- The reagent consumption was reduced via improvements to the water chemistry (no increase in capital expenditure);

- The reagent consumption was reduced assisted by the removal of 80% of fluorine in process water with positive impacts on environmental management.

Advancement and completion of Engineering Optimisation Studies

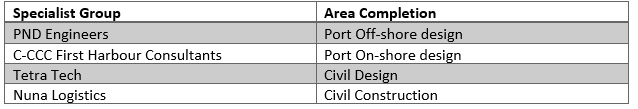

Nuna Logistics, PND Engineers, Tetra Tech and China Communications Construction Co were the leading industry specialist groups involved in advancing and eventually completing the Engineering Optimisation Studies (to optimise civil design and construction) pertaining to the Project.

The civil construction costs reduced by 44% to US$175 million (including indirect costs and contingencies) aiding, Kvanefjeld to be on track to become a long?life, low?cost producer of rare earth products, critical to clean energy technologies.

Social Impact Assessment Progress

March was a milestone month for Greenland Mineralsâ when its Social Impact Assessment met the standards required for public consultation in Greenland, as per the Ministry of Industry and Energy of the country.

Pleased by the achievement, Dr Mair stated

Later in June, GGG lodged an application for an exploitation (mining) license for the Project with the Government of Greenland, and submitted an environmental impact assessment, a social impact assessment and a navigational safety investigation study for the Project, as supporting documents required by the Government (in Greenlandic, Danish and English).

In July, the key findings of the Projectâs social and environmental impact assessments were presented to the Mayor of Kommune Kujalleq, the municipality of South Greenland, as the company had entered a Memorandum of Understanding in early March to conclude a Participation Agreement supporting and supplementing the Impact Benefit Agreement, which would be part of a successful mining licence application for the Project.

Optimised Feasibility Progress

The performance of the optimised rare earth refinery circuit for the Kvanefjeld Project, and the positive economic implications have been an icing on the cake for every study and assessment done towards paving the Project to eventually become a cornerstone to global rare earth supply.

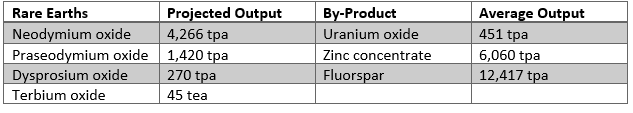

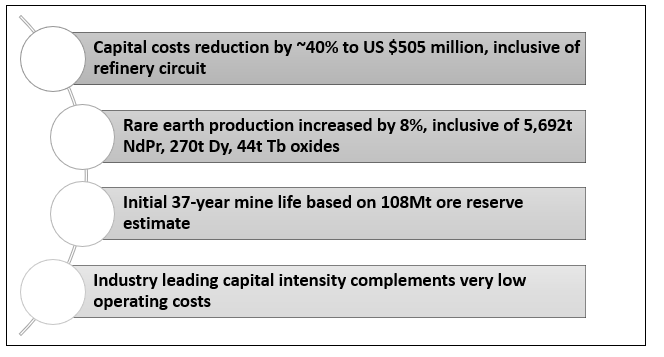

Below are the highlights of the Optimised Feasibility Study, as notified by GGG in July 2019:

Moreover, it was concluded that the Project has a smaller footprint and lower impacts, while producing more rare earths, along with reduced reagent consumption, and reduced power requirements.

The tests and assessments would be incomplete without discussing the improved rare earth recoveries, and the projected output of commercially important rare earths:

Share Price Information

At the time of writing on 2 October 2019, the GGG quoted $0.130 (2:27 PM AEST), with a market capitalisation of $154.83 million and 1.19 billion shares outstanding. The stock has generated a YTD return of 91.18%.

Given the rapid progresses made by Greenland Mineralsâ towards the Kvanefjeld project, investors, mining enthusiasts and share market experts are keeping a close watch towards the companyâs moves and growth, which seem to be in the right direction.

For more insight towards GGGâs recently released half-yearly report for the year ended June 30 2019, we encourage you to READ HERE

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.