A double whammy for the Australian behemoth- Woodside Petroleum Limited (ASX: WPL) - A down trending Crude oil prices and a poor half-year result, dragged the share prices of the company, which witnessed a 2% gap down opening yesterday before closing the dayâs trade 6.7% lower. Today, 16 August 2019, WPL has taken a breather and trading marginally lower by 0.128% at A$31.140 (as at AEST-12:57 PM).

WPLâs First Half of the Year:

During the H1 2019, the overall production volume observed a decline of almost 12 per cent, and 2019 stood at 39.0MMboe, as compared to the production volume of 44.3MMboe during the previous corresponding period (or pcp).

The CEO of the company attributed the decline to the operational disruption caused by the Tropical Cyclone Veronica in the Pilbara region coupled with planned maintenance at Pluto LNG and a drop in production in the first half due to the storage and offloading facilities going offline.

WPL also suggested that the company completed the first major turnaround at Pluto LNG, which in turn, would support the safe, reliable and continued production.

The fall in average realised price coupled with production decline seems to have exerted pressure on the operating revenue of the company, which fell to A$2,260 million during the first half of the year 2019, down by over 5.30 per cent as compared to pcp.

The increased operating cost coupled with higher taxes reduced the net profit after tax of the company, and the net profit after tax (or NPAT) stood at A$419 million during the first half of the year 2019.

The NPAT fell by over 22.50 per cent during the first half of the year 2019 against the NPAT of A$541 million during the previous corresponding period.

The company targets an annual production of approx. 100MMboe by in the year 2020.

WPL also declared an interim dividend of US$0.36 along with the reactivation of the dividend reinvestment plan which was suspended in 2016. The dividend would be paid to the eligible shareholders on 20 Sep 2019.

LNG market and WPL:

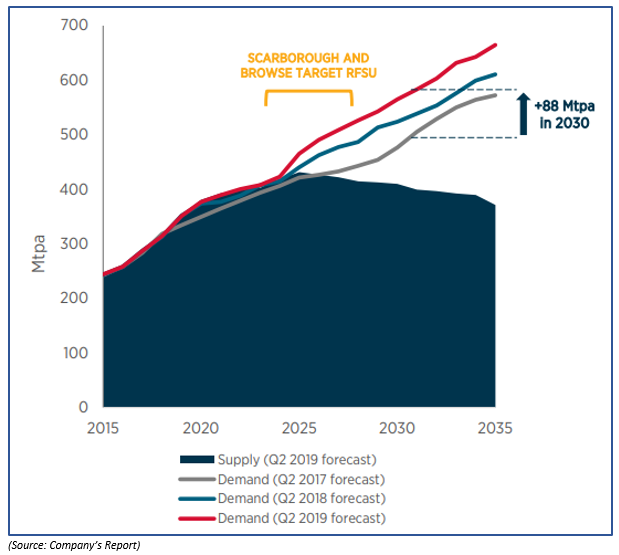

WPL is relying heavily on the LNG markets, as per the company, the global demand is forecasted to grow, which in turn would support the WPLâs growth opportunities.

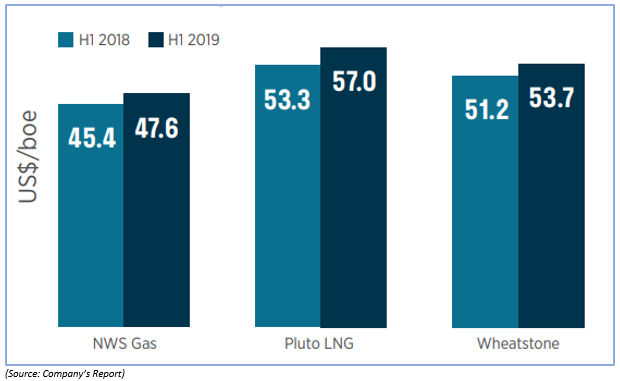

While the company remains positive over the global LNG outlook, WPL realised higher prices during the first half of the year 2019 as compared to the first half of the previous corresponding period.

The prospects of the company, such as NWS, Pluto LNG, and Wheatstone all witnessed an increase in realised price.

While one fossil fuel producer on the Australian Securities Exchange posted loss, another fossil fuel or a significant coal producer- Whitehaven Coal Limited (ASX: WHC) posted strong numbers for the financial year 2019.

Whitehaven Coal Limited (ASX: WHC)

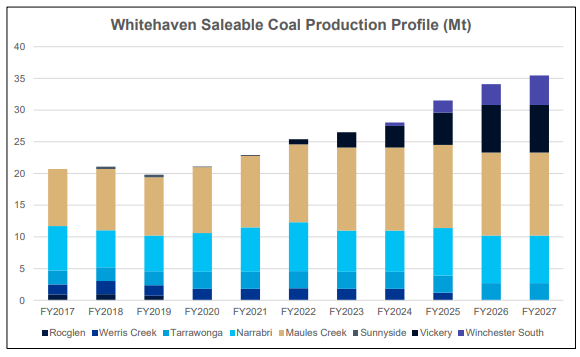

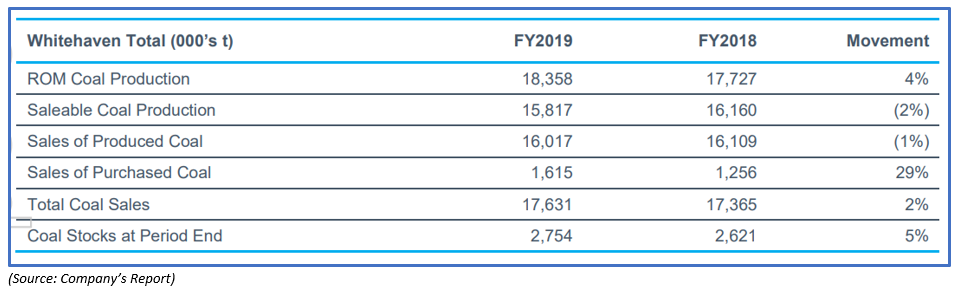

During the financial year 2019, the run of mine (ROM) coal production of the company stood at 18,358k tonnes, up by 3.5 per cent as compared to the previous financial year run of mine production of 17,727k tonnes.

(Source: Companyâs Report)

However, the saleable coal production of the year declined by 2 per cent and stood at 15,817k tonnes in FY2019 against the saleable production level of 16,160k tonnes in FY2018.

(Source: Companyâs Report)

The sales of produced coal marked a slight decline of 1 per cent during the financial year 2019 and stood at 16,017k tonnes as compared to 16,109k in FY2018.

The total coal sales marked an increase amid an increase in sales of purchased coal, and the total coal sales for the financial year 2019 stood at 17,631k, up by 2 per cent as compared to the total coal sales of 17,365k in FY2018.

Financial Front:

The revenue of the company for the financial year 2019 stood at A$2,487.9 million, up by 10 per cent against the previous financial year revenue of A$2,257.4 million. The companyâs net profit after tax (or NPAT) stood at A$527.9 million for FY2019, mostly unchanged as compared to its previous year NPAT of A$524.5 million.

Dividend:

The company has proposed to distribute a dividend of A$0.30 per share to the shareholders of the company, which would consist of a 50 per cent franked ordinary dividend of A$0.13 per share and an unfranked special dividend of A$0.17 per share.

WHC was trading at A$3.190, down by 5.621 per cent as compared to its previous close on ASX (AEST 2:32 PM, 16 Aug 2019).

The fossil fuel is gaining much attraction in the market over the estimated major contribution of the energy sector in the anticipated increase in the S&P 500; however, the lithium space in the Australian market is also capturing attention amid the independent forecast of a rise in lithium prices amid the upcoming EV drive.

While lithium space is drawing attention, the lithium miners on the Australian Securities Exchange are developing their asset and production base to leap with the lithium market.

Also Read: Whitehaven Coal Announces A Report on H1 FY2019 Result

Orocobre Limited (ASX: ORE)

ORE-an ASX-listed lithium explorer and producer is increasing the overseas exposure to leap ahead in the lithium space. In its latest announcement on 15 August 2019, ORE mentioned that the company decided to participate in a private placement of Advantage Lithium- a Canadian exchange-listed lithium player.

ORE mentioned that the company would participate in the private placement with a total investment of CAD 1,536,025 and at a price of CAD 0.41 a piece of Advantage common shares.

Advantage lithium is expected by the company to utilise the proceeds of the private placement of total CAD 1,703,100 in the development along with exploration of its lithium tenements in Argentina.

ORE seems to be interested in the Argentinian lithium tenements, and the company decided to increase its interest/ stake in Advantage Lithium to 34.7 per cent with 56,564,909 common shares of the Advantage Lithium, which would be in lock-in for 4 months.

Not just Argentina, Orocobre intends to increase its exposure across the Japanese market as well. In the recent events, the company started the construction of the Naraha Lithium Hydroxide plant in Japan with its strategic partner- Toyota Tsusho Corporation.

However, despite increased global exposure, the market has discounted the share prices of the company amid oversupplied lithium market, and the share prices of the company was trading at A$2.385 on ASX, down 1.852% as compared to its previous close on ASX (AEST: 2:32PM, 16 Aug 2019).

The stock of the company is currently at the lower end of its 52-week range of A$2.410 to A$5.050.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.