Highlights

- Black Canyon has been focused on its Flanagan Bore Manganese Project, and has progressed multiple activities through recent development and exploration works.

- The highly prospective project, Flanagan Bore, sits within the Tier 1 location of East Pilbara.

- Manganese, essential for steel, is critical to a low-carbon future.

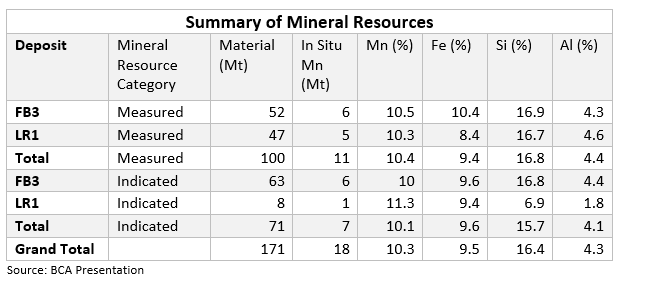

- The Mineral Resource at Flanagan Bore has been significantly expanded and upgraded to 171 Mt @ 10.3% Mn (58% Measured and 42% Indicated) containing 18 Mt of manganese.

- The Company says the Flanagan Bore scoping study highlights significant value from a future mine development.

- Additional manganese-enriched shale-hosted mineralisation has been identified with the latest drilling across the project.

- BCA remains well-funded and has several exciting works planned for 2022/2023.

Western Australia-focused Black Canyon Limited (ASX:BCA) is a manganese explorer with projects located in the premiere mining jurisdiction of East Pilbara. The region is believed to be prospective for hydrothermal as well as shale hosted styles of manganese mineralisation.

BCA’s project portfolio indicates potential for developing minerals that are used in steel manufacturing as well as emerging energy storage space for electric vehicles.

Why Manganese?

Manganese, an essential component of the steel industry, is emerging as a key electric vehicle battery component. Moreover, it is the fifth most consumed metal in the world by tonnage, with around 90% utilised in steel manufacturing.

The key market drivers for manganese are highlighted below:

Source: © 2022 Kalkine Media® | Data Source: BCA | Image Source: © Tony1 | Megapixl.com

There is a continuing baseload demand from China with the emergence of India amid the overall strong demand for manganese in the rapidly growing EV battery market.

Notably, BCA’s initial discussions with marketing specialists suggest that manganese concentrates with vital characteristics similar to ore from its flagship Flanagan Bore project would be appropriate for silicomanganese or ferromanganese alloying as feedstocks in the steel manufacturing industry.

Progress at the Flanagan Bore Project

The Company says its flagship Flanagan Bore Project delivers a large-scale, high-quality manganese mineral resource from surface. The Company expects infill drilling completed in mid-2022 to boost resource confidence and grow the MRE.

BCA has announced mineral resources at the LR1 and FB3 deposits of 171 Mt @ 10.3% Mn (58% Measured and 42% Indicated) containing 18 Mt of manganese. This represents a substantial increase of 64% or 67Mt of total tonnage and 7Mt of contained manganese from the previous mineral resource. The Company remains optimistic that there exists a substantial upside on other targets and tenements.

The mineralisation at FB3 is defined within an open southwest plunging synclinal fold and, at LR1, is associated with thick, continuous, shallowly dipping manganese-enriched shale. On the basis of drill results, the length of the LR1 footprint is 1100m and is up to 800m wide.

Positive Scoping Study – The recently released scoping study highlights that the project holds the potential generate strong financial returns over a mine life of 20 years at an average production rate of 1.8Mtpa. For detailed discussion, click here

Encouraging drill results - Discovery drilling completed between the FB3 and LR1 deposits has been successful in identifying additional manganese enriched shale hosted mineralisation. Moreover, assay results from infill mineral resource RC drilling at the LR1 and FB3 deposits at Flanagan Bore continue to confirm substantial thick zones of manganese enriched shale.

Metallurgical studies and planned works

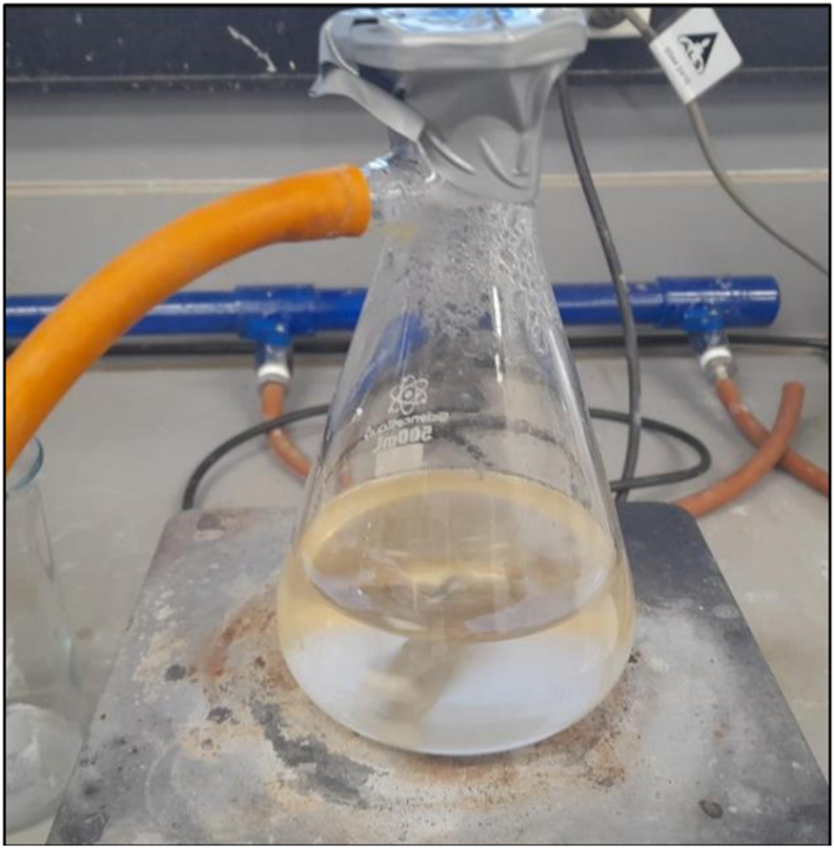

Recently, Black Canyon achieved up to 91% manganese leach extraction as the Company concluded an early-stage leaching testwork on samples from the Flanagan Bore Project. The Company believes that these results are highly encouraging at an early-stage, and the manganese-rich solution delivered from the testwork would be utilised to produce manganese sulphate crystals.

Mn leachate from the initial testwork (Source: BCA)

BCA plans a more comprehensive program to augment the physical and chemical test conditions to enhance leaching kinetics.

Under the overall strategy to add value through the potential production of High Purity Manganese Sulphate Monohydrate (HPMSM), the company has initiated further Scoping Level testwork programs.

BCA’s future plans

BCA remains well-funded, with a tight capital structure and a clear strategy to deliver value and growth via discovery, development and downstream processing. The Company looks to undertake significant exploration programs across the project during 2022/23.

The Company remains confident about its mineral resource base to possibly develop a multi-decade mining operation that indicates the potential to supply manganese oxide concentrates for downstream production of HPMSM as well as the production of steel.

Stock price information - BCA shares were noted at AU$0.275 in the early hours of 24 November 2022, up nearly 15% from the last close.