Highlights

- Black Canyon (ASX:BCA) has achieved up to 91% manganese leach extraction in early-stage leaching test work for the Flanagan Bore Project.

- The Company looks to apply the learnings from these tests to ongoing detailed leaching, purification and crystallisation test work.

- BCA has now initiated further Scoping Level test work programs, aimed at producing high purity manganese sulphate monohydrate.

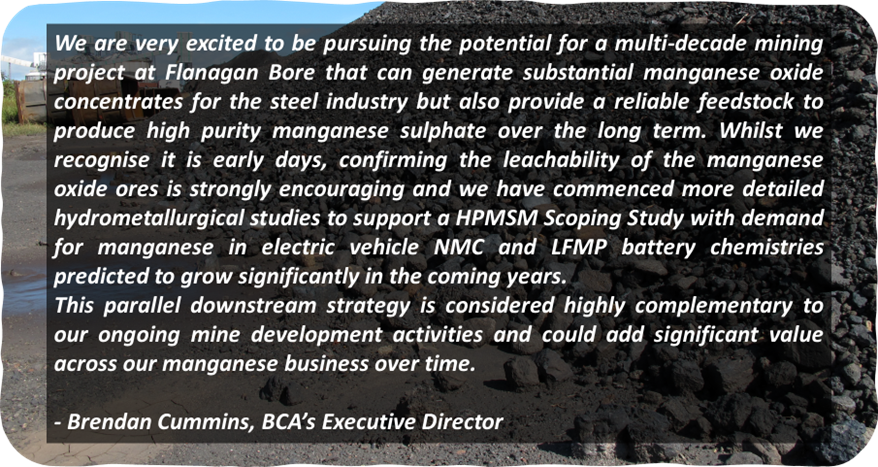

- The Company believes that it is pursuing the potential for a multi-decade mining project at Flanagan Bore.

Western Australia-focused manganese explorer Black Canyon Limited (ASX:BCA) has announced highly promising results, achieving up to 91% manganese leach extraction under early-stage leaching test work. This test work was undertaken on a global composite sample from the Flanagan Bore Manganese Project.

The success of the leaching test work comes after the finalisation of the favourable Scoping Study on the Flanagan Bore development project.

BCA conducted these initial leach tests as part of initiating a High Purity Manganese Sulphate Monohydrate (HPMSM) Scoping Study using manganese oxide ores.

Successful manganese extraction in early-stage tests

The Flanagan Bore Project is part of BCA’s Carawine JV and remains subject to a farm-in and JV agreement with Carawine Resources Limited (ASX:CWX).

BCA’s projects are located in the premier mining jurisdiction of East Pilbara. The projects suggest a potential for developing minerals that are further used in steel manufacturing as well as emerging energy storage space.

BCA believes that the latest set of results is highly encouraging. Further, the Company remains confident that a more comprehensive program proposed would help in elevating the physical and chemical test conditions to enhance leaching kinetics.

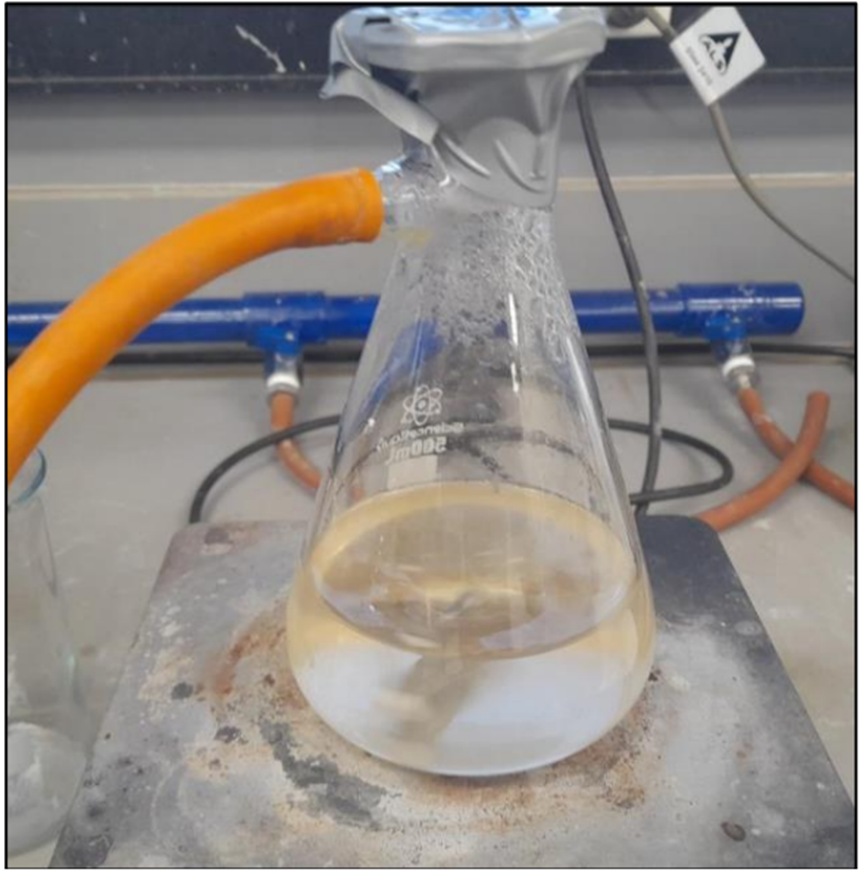

Mn leachate from the initial test work completed using manganese oxide ore (Source: BCA)

The manganese-rich solution produced from this test work is expected to help deliver manganese sulphate crystals. Besides this, the solutions would also offer a detailed chemical analysis of the product, which is vital to understand the overall manganese purity and contaminant levels required to achieve HPMSM.

Additional scoping level test work programs

BCA believes that the initial leach and crystallisation test findings can further be applied to the ongoing detailed leaching, purification and crystallisation test work to support an HPMSM Scoping Study.

The Company has initiated the second stage of a hydrometallurgical test work program with the preparation of appropriate manganese oxide materials from the LR1 and FB3 deposits.

BCA’s strategy is focused on adding value via the possible production of HPMSM as a precursor material for cathodes that are used in the booming electric vehicle battery market. As part of this overall strategy, the Compay has now initiated further Scoping Level test work programs.

© 2022 Kalkine Media®

The Company also looks to investigate manganese sulphate solution purification and production alternatives as part of the second stage test work program to support the HPMSM Scoping Study.

BCA remains confident that it has the mineral resource base to potentially develop a multi-decade mining operation that can possibly supply manganese oxide concentrates for steel production and downstream production of HPMSM.

Global manganese market scenario

In the present scenario, China leads the high purity manganese market, accounting for more than 90% of global manganese production.

Just like other cathode precursor materials, the need for security and diversification of manganese supply is likely to emerge as a critical factor, encouraging the establishment of a supply outside of China for the American and European car manufacturing industries.

© 2022 Kalkine Media® | Data Source: BCA

Besides this, HPMSM pricing is substantially greater than producing a manganese oxide concentrate product with prices up to US$1,500 (AU$2360) per tonne FOB believed to be attainable.

BCA remains optimistic that its quest for HPMSM production can possibly help in significantly enhancing the already favourable economics of its project portfolio and emerge as a vital contributor to emission reduction via the transition to EVs.

BCA shares were trading at AU$0.230 midday on 11 October 2022.