Highlights

- Resolution Minerals is acquiring the USA-based Horse Heaven Antimony-Gold-Silver-Tungsten Project.

- The project sits next to the Stibnite Gold-Antimony Project owned by NASDAQ-listed Perpetua Resources.

- Horse Heaven includes two highly prospective and drill-ready zones: the Antimony Ridge Fault Zone (1.2 km strike length) and the Golden Gate Fault Zone (3.5 km strike length).

- Drilling at Horse Heaven is expected to begin in 2025.

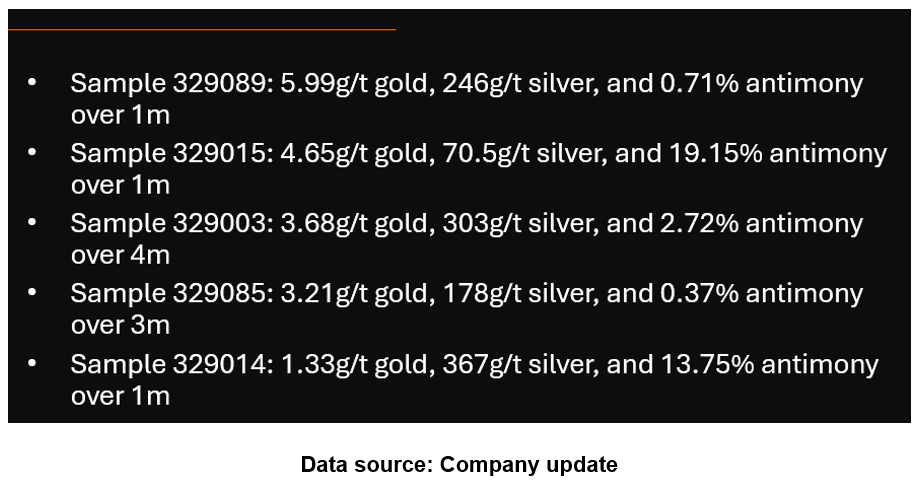

- Historical rock chip sampling has returned high-grade results, including up to 5.99 g/t gold, 367 g/t silver, and 19.15% antimony.

- The AUD 1.9mn placement will help fund exploration and advance development at the Horse Heaven Project.

Resolution Minerals Ltd (ASX:RML) has expanded its USA exploration footprint by entering into a binding agreement to acquire the Horse Heaven Antimony-Gold-Silver-Tungsten Project. Situated in Valley County, the USA, the Horse Heaven Project shares its eastern boundary with one of the largest antimony resources in the US, Stibnite Gold-Antimony Project, owned by Perpetua Resources. The transaction comes at a time when global prices for antimony, tungsten, and gold are surging due to tightening export controls by China.

This acquisition complements the company’s recent acquisition of Australian Au-Sb-Cu projects to build a dynamic portfolio highly leveraged for gold and antimony.

Additionally, the company is raising AUD 1.9mn before costs in a placement.

Drill-ready Targets

The project encompasses two high-potential prospects - the Antimony Ridge Fault Zone (ARFZ) and the Golden Gate Fault Zone (GGFZ). These zones are characterised by the presence of gold, antimony, silver, and tungsten mineralisation, hosted in hydrothermally altered and sheared granodiorite. The project is also host to 10-15km additional strike length of potentially mineralised faults and shears traversing favourable host rocks.

The ARFZ extends over a 1.2 km strike length and hosts known gold, silver, tungsten and antimony mineralisation. Meanwhile, the GGFZ stretches for approximately 3.5 km and hosts the Golden Gate Hill target, which has a track record of tungsten production dating back to the 1950s through to the 1980s.

Resolution Minerals confirmed that the project is drill-ready, with drilling scheduled to commence in 2025.

Historical Sampling Highlights Project’s Potential

Historical systematic sampling and preliminary drilling have yielded encouraging results, highlighting large-tonnage mining potential.

Significant past rock chip results from the ARFZ include:

Historical drilling data from Horse Heaven include:

- Hole 87-GGR-31: 85.34m @ 0.937g/t gold, including 38.10m @ 1.459g/t

- Hole 86-GGR-10: 105.16m @ 0.787g/t gold, including 51.82m @ 0.990g/t

- Hole 86-GGR-01: 30.48m @ 1.354g/t gold

Additionally, historical (non-JORC compliant) resource estimates suggest:

- 216,000 ounces of gold at Golden Gate Hill in 7.26 Mt grading 0.93g/t

- 70,000 ounces of gold at Antimony Hill in 3.17 Mt grading 0.69g/t

RML plans to apply an Intrusion Related Gold System (IRGS) exploration model to the project, using Perpetua’s adjacent Stibnite Mine as a geological analogue.

AUD 1.9mn Capital Raise Secured

The company has secured firm commitments to raise AUD 1.9mn (before costs) via a share placement to sophisticated and professional investors, including S3 Consortium Holdings Pty Ltd. A total of 146,153,846 shares will be issued at AUD 0.013 per share, with one free RMLOC option attached for every two shares, subject to shareholder approval.

The funds will support exploration activities across existing projects, cover acquisition costs for the Horse Heaven Project, and provide working capital.

Oakley Capital Partners acted as Lead Manager and Corporate Advisor, and will receive a facilitation fee and capital raising fees, including cash and securities, subject to shareholder approval.

RML Share Rally

RML shares were trading 22% higher at AUD 0.022 per share at the time of writing on 11 June 2025.