Highlights

- Black Canyon’s (ASX:BCA) recently released Scoping Study results outline a potential 20-year mine life with an NPV of $134m and IRR of 67%, showcasing the significant potential of the Flanagan Bore project.

- The Flanagan Bore Scoping Study confirmed robust economics, long life mine with low development CAPEX of less than $45m.

- Manganese, an essential component into the steel industry, is witnessing strong demand from the growing EV battery market.

Black Canyon Limited (ASX:BCA) is vying to become a globally significant producer of manganese, the fourth most consumed metal in the world by tonnage.

Manganese is an essential component used in the manufacture of steel and a critical component for EV lithium-ion batteries. As a result, manganese demand into the EV industry is expected to increase while its global supplies outside of China remain limited.

The Western Australia-focused manganese explorer is advancing projects located in the premiere mining jurisdiction of East Pilbara. The project areas are believed to be prospective for Woodie Woodie as well as Butcherbird styles of manganese mineralisation.

BCA is making headway towards its development/production goals, with the recently completed studies at the Flanagan Bore Project highlighting the economic viability of the company’s growth strategy.

Fast-tracked drill program at Flanagan Bore

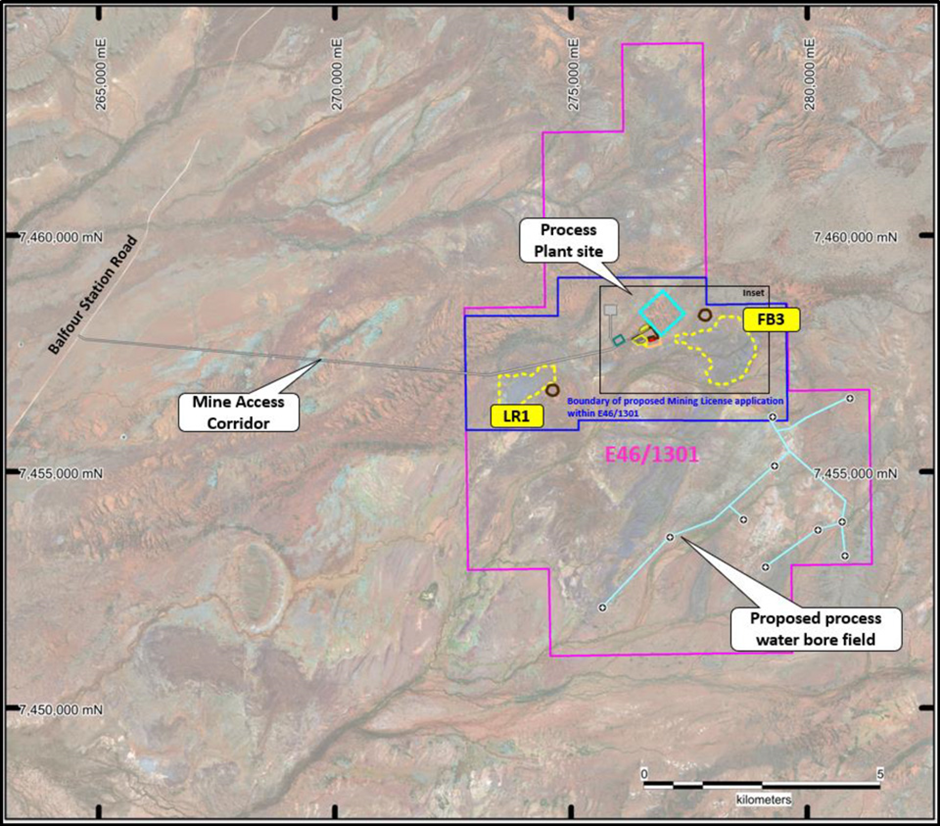

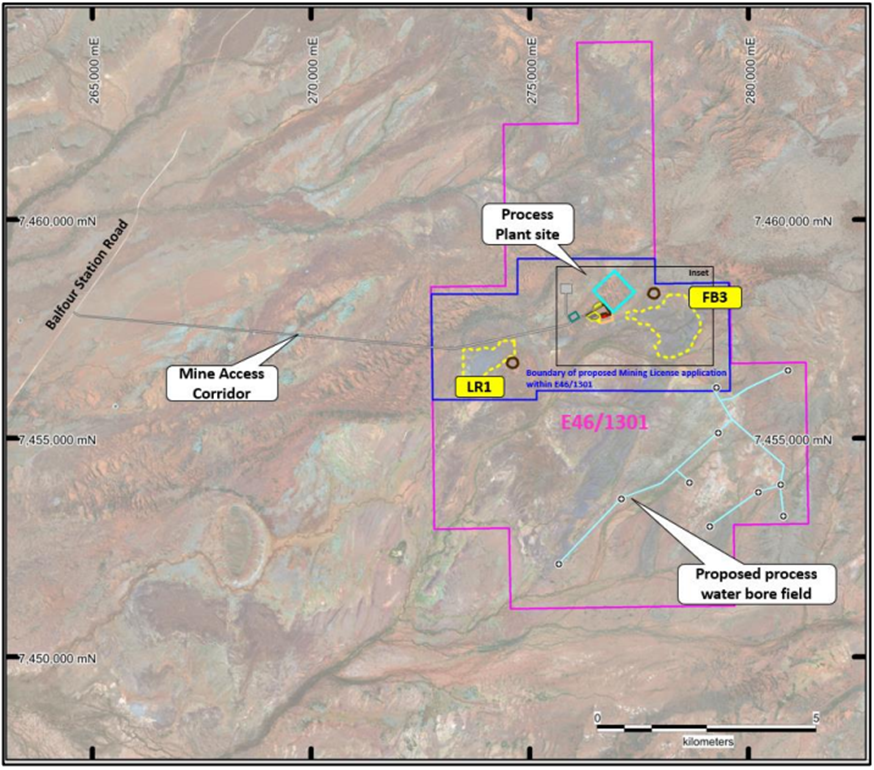

In May this year, BCA kicked off a significant infill and extensional RC drill program across the project. The program focused on an outcropping high-grade manganese subset of the Mineral Resource estimate comprising 33Mt @ 12.8% Mn across the FB3 and LR1 deposits.

Source: BCA

BCA concluded this drilling campaign in July, with the completion of 7,534m of RC drilling which focused on testing the strike potential between the LR1 and FB3 manganese deposits.

The drilling delivered encouraging results as the Company intersected further shale-enriched manganese mineralisation.

The drilling program further reduced the overall drill spacing at FB3 and LR1. The drill spacing was decreased from 200m spaced lines with 100m centred holes to 100m spaced lines, and 100m centred holes, at both the LR1 and FB3 deposits.

Scoping Study confirms technical and economic viability

In the latest critical development, BCA confirmed robust key financial metrics for the Flanagan Bore Project based on favourable Scoping Study results. The study outcomes are in line with the strategy of discovering and delivering via de-risking the project as the Company progresses the development schedule.

Key metrics highlighted by the study include the following:

- 20 years of mine life at an average production rate of 1.8Mtpa

- Pre-tax NPV of AU$134 million (8% discount rate) and pre-tax IRR of 67%

- Low development CAPEX of AU$44 million with a payback period of less than 2 years

- Life of mine (LOM) revenue of AU$2,282 million and EBITDA of AU$420 million

Source: BCA Announcement

Way ahead

Black Canyon believes it is well placed to not only evaluate the processing of manganese ores to produce a manganese concentrate for sale into the steel alloying industry but also downstream processing of the concentrate into manganese sulphate used in the cathode of lithium-ion batteries with nickel and cobalt.

Moreover, based on the results of the Scoping Study and the estimated CAPEX of around AU$44 million, BCA has a reasonable expectation that the funding required to build the mine may be sourced from traditional bank loans, government funding, equity raisings and strategic offtake partners. On this basis, the Company remains optimistic that the necessary financing for project development will be available when needed.

The optimism is supported by the extensively experienced Board and management team as well as the robust key metrics delivered through the scoping study.

BCA shares traded at AU$0.260 on 30 August 2022.