The Australian market has just surpassed the much-anticipated reporting season and witnessed a lot of action on the shares front, of the companies declaring the results to the market. Investors and market experts ideally consider the reporting season to be the driving factor behind their decision to cherry pick lucrative stocks and invest in them to gain profit. One of the vital components of the reporting season, which often surpasses the present valuation and performance of the companies, is the outlook or guidance that is often released with the results. This is one of the most crucial elements to determine the future trajectory of the company.

In this article, we would discuss the importance of guidance, and oversee a few outlooks that have been laid down this reporting season:

Breaking down Guidance

A guidance or outlook, in simple terminology refers to a future view or a probable prospect. It is the statistical data that is circulated by companies to the stakeholders and market with the objective of expressing their probable future execution in the market. It is a forward-looking statement, inclusive of revenue estimates, earnings forecast and expenditure assessments. An outlook can be expressed as a theoretical tool used by companies which is fed to the market and investors to keep them enticed with the company in the short and long run. There is no mandate, per say, for companies to release a guidance as a mandate, but this has been a common practice with the Australian publicly listed companies. The guidance is ideally a part of the earnings report and is a key discussion metric in the companyâs investors, AGM and analyst meet ups.

The Importance of Guidance

Guidance can often be a concrete guide to the company. It has a hoard of vitalities associated with it, few of which are listed below:

- Guidance report can meaningfully influence a stock analyst's ratings of shares and impact the reports.

- The report has a direct impact on the investorâs decision to buy, hold or sell a security.

- Guidance report educate investors about short-term results versus long-term initiatives and gives vital clues about where the company is headed.

- Companies attain the marketâs confidence when they disclose non-mandate but crucial information to the public.

- As per present regulations, it is the only lawful way a company can convey its anticipations to the market.

The Recent Reporting Season

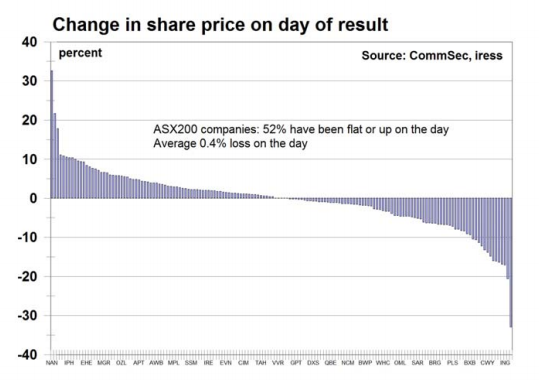

According to CommSec, a 100 percent owned subsidiary of one of the big four banks, Commonwealth Bank of Australia (ASX: CBA), 138 of the ASX200 index group reported full-year results, while 31 companies reported interim results in the August reporting season. In a nutshell, the Australian companies have suffered this season, as only 52.2 per cent of the 92 per cent profit-oriented companies were able to lift profits. On the bright side, the Aggregate statutory profits were up by 17 per cent over the past decade. Moreover, amid the volatility and tough market situation, companies issued dividends and nine companies elected to pay special dividends to shareholders. The Aggregate dividends of full-year reporting companies were lifted by 4.9 per cent.

The ongoing US-China trade war, the delay in the UKâs exit from the European Union (Brexit), fear of US recession, uncertainty about the outcome of the Australian Federal Election, low wage growth and lower home prices in capital cities were the major concerns that the Australian economy encompassed, but as the prover goes- when the going gets tough, the tough gets going. The Australian companies are still making money and the revenues were up by 6 per cent on a year ago basis to $609.6 billion. The expenses rose by 6.8 per cent to $507.7 billion while the profits surged up by 17 per cent to $63.7 billion. A great and probably the much-anticipated result for investors, the dividends in the season were lifted up by 4.9 per cent.

(Source: CommSec)

Experts Take on Guidance

Market experts believe that the shares movement on the stock exchange is not solely a conclusion of the resultant profits and earnings of the company. Even though the reasons for share price reaction has been an arguable subject, a set of experts believe that guidance statements have a pivotal role to play in sparking up and shunning down the stockâs performance. If a company is successful in meeting its last stated guidance, it naturally and effortlessly wins the confidence of investors who choose to invest more on it, as they perceive it to be a reliable source to fill in their pockets. On the flip side, if the guidance fails to meet, the situation is an obvious disappointment for the investor and consumer confidence is lost, leading to a slump in the stockâs performance.

One key factor to be noted here, which is extremely important for companies, is that a company should frequently update its revised guidance, if the need be, and not let the stale figures linger in the investorsâ mind. The concept of providing an outlook lies in the essence of providing a future figure and establishing expectations, which should be as accurate and revised as possible. To adhere to the same, the Australian Securities Exchange has changed its guidance around how companies discuss consensus forecasts, so that any redundancy and false flow of information in the market can be duly avoided.

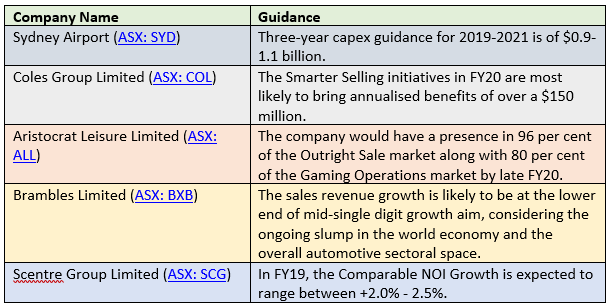

A Sneak Peek on the guidance of ASX-listed companies

Let us now look at the guidance provided by some of the largest companies (based on their market capitalisation) listed and trading on the ASX:

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.