On 19 August 2019, the stock of oOh!media Limited (ASX: OML) was trading down by 9.215% or A$0.27 to A$2.66 (at AEST 12: 42 PM). The company released a trading update & revised CY2019 guidance on 16 August 2019.

The marketer operates in Australia & New Zealand with an offline & online connected ecosystem of over 30,000 locations. oOh!media help the brands to engage with existing consumers & potential consumers, and its media ecosystems consist of roadside, airports, bars, cafes, universities, office towers and retail.

Meanwhile, the stock of the company is a component of numerous indices, including S&P/ASX 200, S&P/ASX 200 Communication Services (Sector), S&P/ASX 200, S&P/ASX All Australian 200.

Full-Year Results 2018

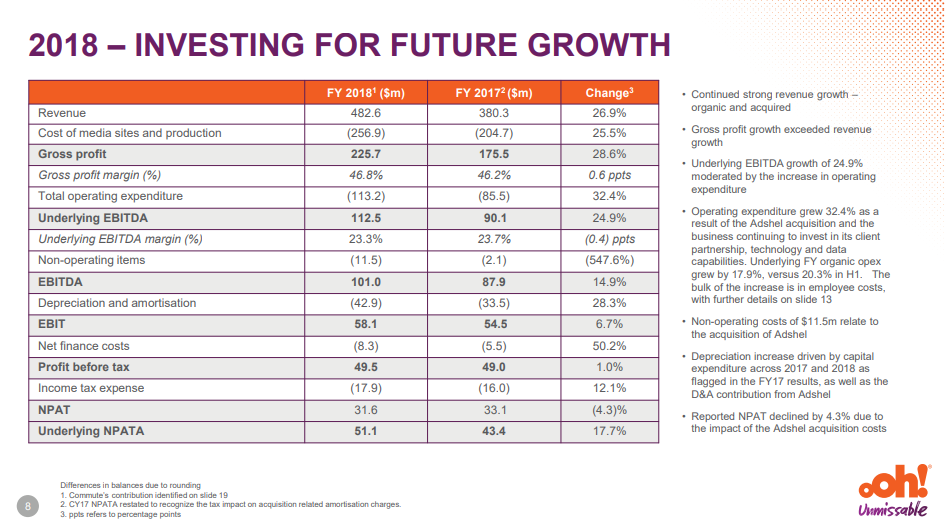

Before we discuss the latest announcement made by the company, a recap of the disclosure of the full-year results for the period ended 31 December 2018 during February this year appears meaningful. Accordingly, the companyâs revenues increased by 27% to clock $482.6 million compared to the previous corresponding period, and the total Underlying EBITDA increased by 25% to reach $112.5 million over pcp.

Full-Year 2018 Highlights (Source: OMLâs 2018 Full-Year Results Presentation)

Full-Year 2018 Highlights (Source: OMLâs 2018 Full-Year Results Presentation)

Meanwhile, the revenue through digitised assets increased by 27% to $288.1 million. Subsequently, the company declared a fully-franked dividend of 7.5 cents per share, which took the full-year dividend to 11 cents per share.

More importantly, the total dividend of 11 cents per share was down from 15 cents per share in the previous year. The company noted that the lowered revenue depict the Entitlement Offer in July 2018, which diluted the share capital by issuing further 71.7 million shares.

Reportedly, the net profit after tax was $31.61 million in the CY18 compared with $33.05 million in the CY17. The basic EPS for the CY18 period was 16 cents down from 19 cents (restated) over pcp.

Initial Guidance

Previous Guidance (Source: OMLâs Annual General Meeting - Presentation)

Previous Guidance (Source: OMLâs Annual General Meeting - Presentation)

Reportedly, the Board of the company declared that the Underlying EBITDA to be in the range of $152-162 million for the year ending 31 December 2019 (CY19). It was also noted that the reported guidance excludes the integration cost of approximately A$7 million and the changes in accounting standards to AASB16.

More importantly, the revenues and earnings were anticipated to be weighted to the second half of CY19 consistent with historical trends. Besides, the overall strategy remains emphasised on achieving long-term sustainable revenue & earning growth.

Revised CY19 Guidance

Recently, the company had notified the market regarding the half-year financial results release, which is scheduled on 26 August 2019. On 16 August 2019, the company updated the market with a trading update & revised guidance for CY19. Accordingly, the company anticipates reporting a revenue of $304.8 million for the half-year ended 30 June 2019, which represents an increase of 5% on a pro forma basis (including half-year results of Adhsel, which was acquired in the second half of CY18).

Besides, the company is now expecting to report an Underlying EBITDA of $56 million for the half-year, depicting 2% fall over the pro forma basis pcp. It was asserted that the companyâs first-half performance was consistent with previous guidance. However, the company has been facing subdued activity in the second half-year with a decline in overall media advertising spend.

Reportedly, the company has been facing a similar fate like the rest of media market, wherein the companyâs advertising bookings for the third quarter of 2019 has fallen sharply against the bookings on hand at the same time previous year.

Meanwhile, the revenues of the company are majorly weighted in the second-half of the year with much weight in the last quarter, particularly. Nevertheless, the fourth quarter bookings are showing improvement over the third quarter, but the trading in recent weeks had indicated that the ongoing improvements for the fourth quarter would not be able to completely compensate for the subdued business being experienced in the current quarter.

In accordance with the release, the persisting economic uncertainty, challenging market condition has resulted in difficulties while predicting activity. Subsequently, the company anticipates Underlying EBITDA to be in the range of $125 million to $135 million, which excludes the integration costs, the changes in accounting standards to AASB16, and market conditions.

Besides, the company confirmed that the integration of Commute is consistent with expected cost synergies of $16 million for FY19, and further anticipated synergies in 2020. Further, the growth in the operational expenditure in FY19 would be below the earlier forecast range of 5-7 per cent, and the capital expenditure is expected to be in the range of $55-70 million.

The stock of the company has given a negative return of 31.54% over the last one-month period, and a negative return of 21.87% over the last three months. Besides, it has recorded a negative return of 13.82% over the year-to-date period. The market capitalisation of the stock stands at ~A$701.21 million, with approximately 239.32 million shares outstanding.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.