Crude oil recently gained investorsâ attention thanks to an erratic price movement weighing in the geopolitical events.

The crude oil prices are showing high volatility, which in turn, is causing heightened risk for the global stock markets, as crude oil is a mutable cost for many global sectors.

Crude Oil- A Raw Material

Crude oil captures a large tranche of the global energy sector, which typically accounts for 8 to 10 per cent of the GDP, which makes crude oil as an important raw material, and is price movement hampers the profitability of a company.

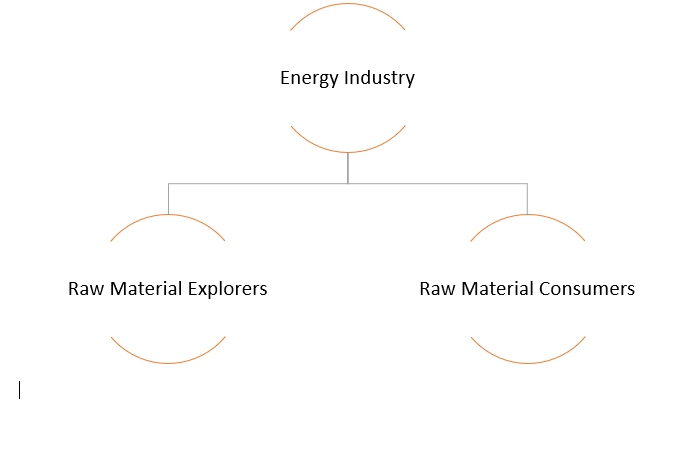

Crude Oil in the Energy Sector

Raw Material Explorers

The raw material explorers in the energy sector are oil, coal, and gas explorers engaged in the development and production of commodities from the natural resources or undeveloped lands, holding mineral exposure.

The oil & gas explorers typically lease out the mineral rights of undeveloped land to produce commodities such as oil, gas, and coal for the consumption in the energy generation sector.

The prices of commodities directly impact the share price of the raw material explorers amid their positive correlation with each other. The share price of raw material explorers tends to fall when the development cost of the commodity-option exceeds the aggregate commodity value in the market and vice versa.

Raw Material Consumers

The raw material consumers are energy generation companies (energy retailers), which utilises commodities such as oil, gas, and coal to generate electricity for the end-users. The volatility in energy raw material prices impacts the share price of such companies.

A higher commodity price tends to exert negative pressure on the stock of energy retailers as commodities such as crude oil, coal, gas, etc., act as an input cost for these companies. Thus, the raw material consumers tend to have a negative correlation with commodity prices.

To Know Recent Updates of Oil Markets, Do Read: Aramco Fire Fuelled ASX Energy Stocks; United States SPR to Rebalance the Supply Chain?

Crude Oil in Other Sectors

Airlines

The fuel cost of the global airline industry is the second-largest operative cost after labour cost. As per the data from International Air Transport Association (or IATA), the global airline industryâs fuel bill is anticipated to have aggregated to US$180 billion in 2018, which in turn, marked about 23.5 per cent of the operating expenses at an average Brent oil price of US$72.0 a barrel.

The global airline industryâs fuel cost of US$180 billion underpinned the growth of 20.5 per cent against the previous year fuel cost, while the same US$180 billion fuel cost also represents a double-fold increase in fuel cost of US$91 billion in 2005, which accounted for 22 per cent of operating expenses at an average Brent oil price of US$54.5 a barrel.

The industry experts and market analysts anticipate the global fuel cost to stand at $206 billion in 2019, which in turn, will mark an increase of over 14 per cent from 2018 global airline fuel bill of US$180 billion. The fuel cost of US$206 billion would account for 25 per cent of operating expense at an average Brent oil price of US$70 a barrel.

Over the increased average crude oil price and increased operating cost, the International Air Transport Association anticipates the global airline industryâs net profit to stand at US$28 billion in 2019, down by 12.5 per cent from an estimated net profit of US$32 billion in 2018.

To Know Future Oil Forecast, Do Read: EIA Forecast Brings More Shock Waves For ASX-listed Oil & Gas Explorers

Automobile

The automobile and tyre sectors are negatively related to the crude oil price, as a fall in crude oil price brings the transportation cost (per km) lower, which in turn, promotes higher sales of vehicle in the global market.

The higher vehicle sales support the share prices of automobile players and increase the sales of tyre manufacturers as well, thus, benefits both the segments. Likewise, a rise in crude oil price exhibit opposite actions and drag the automobile and tyre segments down.

Likewise, many other sectors such as FMCG, paints, etc., respond to the fluctuation in crude oil prices, thus, understanding variability in crude oil prices and associated factor is important for smart investing across any sector in an economy.

Factors Influencing Oil Market

There are many factors, which decides the demand and supply dynamics of the oil market, thus, directly impacting the crude oil prices in the global market. Some of the major factors which influence the oil markets are as below:

- OPEC production and supply

OPEC controls about 40 per cent of the worldâs crude oil as major players of OPEC are in the middle east- a region with a significant amount of oil reserve (approx. 48 per cent). Thus, OPEC decisions over the supply and production influence the crude oil market to a large extent.

To Know More, Do Read: OPEC And Russia To Curb Output And Crude Jumps Over Speculations; BPT Under Pressure

- Changing demand scenario of emerging and developed economies

As crude oil is the major source for the energy sector-which contributes substantially to an economy, its demand depends upon the economic growth of a country. A slower economy translates to lower oil demand, and a growing economy translates to higher oil demand.

To Know More, Do Read: Crude Oil As An Economic Indicator and Its Trend Analysis

- The United States crude production and inventories

The United States contains the second largest oil reserve (North America region), which allows the United States to influence the crude oil prices in the global market through production and supply dynamics.

To Know More, Do Read: How Is The United States A Significant Contributor In The Recent Oil Spill?

- Refinery utilisation rate

The refinery utilisation rate depicts the capacity of an oil refinery to produce refined petroleum products such as petrol, diesel, bunker oil, gasoline, kerosene, propane, etc. The higher the utilisation rate of the global refineries, the higher would be the demand for crude oil. Thus, the utilisation rate influences the crude oil prices in the global market.

The refinery utilisation also depends upon the global petroleum demand, which again takes its input from the global economic conditions. Thus, on the broader line, global economic conditions substantially influence oil markets.

- Speculative buying and selling

Speculative buying and selling take place in the global market over the events such as OPEC production cut announcement, fire incidents, middle east tensions, etc., which can influence the crude oil market over the short-run. The speculation in oil future contact is popular among traders to generate some quick and large returns.

To Know More, Do Read: Is The Crude Oil Event Driven Bull Run Likely To Stay?

- Surge in Electric Vehicle Sales

With stricter emission norms being implemented across the globe to fight against the ticking bomb- global warming, both new and incumbent auto manufacturers are actively pursuing other greener alternatives such as electric vehicles. The global sales of EV vehicles are accelerating at a rapid pace, and the demand for oil is likely to be negatively influenced by this trend.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.