Australian Banking Sector

The banking & finance sector plays an important role in developing the financial life of a society, as it deals with cash, credits and other financial transactions. In Australia, the banking system is transparent and reliable; however, there are differences in terms of structure and operations from the banking system in the United States.

The Reserve Bank of Australia is the central bank, which sets monetary policies and regulates payment system in the country. While the four largest retail banks in Australia are

- Commonwealth Bank of Australia

- Australia and New Zealand Banking Group Limited

- Westpac Banking Corporation

- National Australia Bank Limited.

Over the last 20 years, consistent GDP growth and technology advancements have resulted in growth and value creation in the countryâs banking system. Banks across the country are working on becoming simpler and more connected to their customers.

Trends in Australian Banking System

- Artificial Intelligence

AI plays an important part in the banking & finance sector. Machine learning in the banking sector can get into human interaction by making decisions as well as encouraging customers in a convincing way. The main aim of AI is to get customer preferences, which helps the banking sector to customise products according to the current trend in the market.

- Blockchain Adoption

In the year 2019, many of the big banks are gearing up to introduce blockchain platform across their various services such as trade finance, supply chain, and retail and corporate banking in order to ease their operations and become more efficient.

- Cloud Computing

More and more banks are migrating into a cloud network. Cloud computing is generally defined as delivery of hosted services over the internet. It helps to create an opportunity for bankers to connect with their users directly. The technology helps the banking system to decrease operational cost as well as increase overall efficiency. In recent times, more and more fintech companies are adopting the cloud computing network.

Let us discuss two Australian banking sector stocks that currently have an annual dividend yield of more than 6%.

MyState Limited

Company Overview

ASX-listed national diversified financial services group, MyState Limited (ASX: MYS) is a provider of banking, trustee and wealth management services to customers. The company was established in September 2009 after a successful merger of MyState Financial and Tasmanian Perpetual Trustees. The retail brands of MYS are i) Tasmanian Perpetual Trustees and ii) MyState Bank.

The company is scheduled to hold its annual general meeting on 17 October 2019.

FY2019 Results

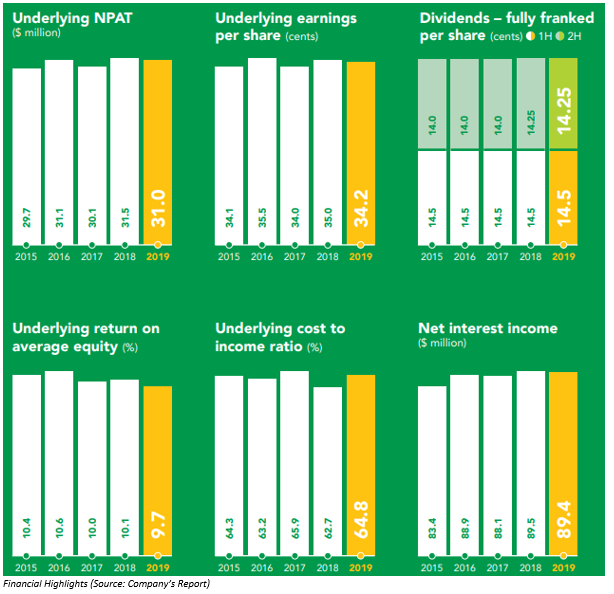

On 13 September 2019, the company released its annual report for the period ended 30 June 2019. Few highlights of the financials from the report have been given below:

- Net profit after tax decreased by 1.5% to $30.987 million in FY2019, compared with $31.461 million in the previous corresponding year (PCP)

- Earnings per share of the company declined by 2.31% to 34.17 cents per share on the PCP

- Operating costs increased by 2.9% year-on-year

- Banking Loan portfolio grew by 10.72% to a total portfolio of $5 billion

- Board of Directors declared a fully franked final dividend of 14.5 cent per share, which is scheduled for payment on 25 September 2019.

- Capital adequacy ratio decreased from 13.5% in FY2018 to 12.9% in FY2019

- Funds under management (wealth management business) reached $1.17 billion, reflecting a strong year for the business

- Number of banking customers grew to 136,500

- The company divested its Retail Financial Planning Business

Outlook

Outlook

The companyâs brand - MyState Bank is expecting to continue to be able to attain above system growth while maintaining a high quality of loan book. During FY2020, the brand would maintain its focus on building customer advocacy and growing domestic customer base. Moreover, it would continue to pursue further operating efficiencies.

Meanwhile, the other brand of the company - Tasmanian Perpetual Trustees would continue to provide further revenue diversity, as the group strengthens its platform for funds management and rolls out new services for investors as well as better returns.

Successful Pricing of ConQuest Series 2019-2 Trust RMBS

On 10 September 2019, MyState announced the successful pricing of MyState Bank Limitedâs ConQuest Series 2019-2 Trust RMBS, which is attracting strong and broad investor support. Securities would be issued in eight tranches with a total value of $400 million. The securities would be aided by Australian prime residential mortgages that are originated by MyState Bank Limited.

The sole arranger of the transaction was National Australia Bank. Moreover, it was joint lead manager along with Macquarie Bank and Westpac.

Stock Performance

The stock of MYS was trading at a price of $4.570 on 17 September 2019 (AEST 02:03 PM), down 0.868%from its previous close. The company has a market cap of $419.78 million and ~91.06 million outstanding shares. The 52-week high and low value of the stock is at $4.870 and $4.020, respectively. The stock has generated a positive return of 5.25% in the last six months and 2.44% on a year-to-date basis. Its annual dividend yield stands at 6.24%.

Bendigo and Adelaide Bank Limited

Company Overview

Bendigo and Adelaide Bank Limited (ASX: BEN) is the fifth largest retail bank in Australia, providing a broad range of banking and other financial services such as business, residential, consumer, rural and commercial lending, payments services, deposit-taking, foreign exchange services, wealth management and superannuation. The company has more than 110,000 shareholders and over $71.4 billion in assets under management (AUM).

Dividend Distribution

On 16 September 2019, the company announced an update to a 100% franked dividend of $0.350 per fully paid ordinary security related to a period of six months ended 30 June 2019. The update to dividend announcement made in August 2019 was released due to DRP and BSS price. The dividend is scheduled for payment on 30 September 2019.

Also, on the same day, the bank announced a $0.8343 distribution amount with a payment date of 13 December 2019. The distribution would be paid on security - BENPG - CNV PREF 3-BBSW+3.75% PERP NON-CUM RED T-06-2.

Change in Directorâs Interest

In another market update on 9 September 2019, the company announced a change to the interest of director (Vicky Carter). The director acquired 4,473 ordinary shares. Mr Vicky Carter now holds 4,977 ordinary shares in the company.

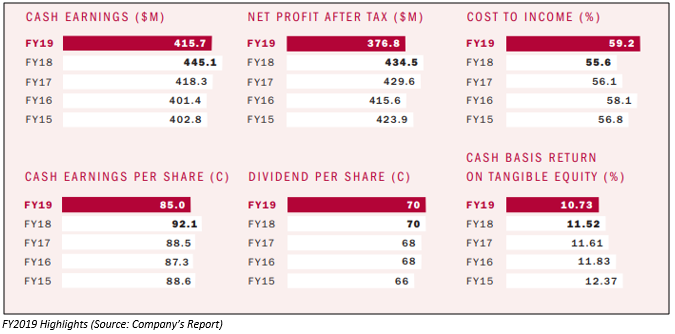

FY2019 Highlights

Financial & Operating Highlights for FY2019:

- Statutory net profit decreased by 13.3% to $376.8 million

- Cash earnings decreased by 6.6% to $415.7 million

- Operating expenses increased by 5.4% compared to FY2018

- Cash and cash equivalents stood at $1,072 million

Segmental Performance

The Consumer Division is focused on engaging with and servicing customers. The segmentâs cash earnings decreased by 14.3% to $271.7 million compared to pcp. The division achieved growth in deposits of $1.2 billion and mortgages of $1.3 billion.

The Business Division is focused on servicing business customers, particularly small and medium businesses. The segmentâs cash earnings increased by 1.0% to $62.8 million. Underlying earnings also grew by 3.2% to $64.9 million.

The Agribusiness Division includes all the banking services provided to agribusiness customers. Cash earnings for the division went down by 1.6% to $68.6 million and underlying earnings decreased by 1.1% to $69.0 million.

Stock Performance

The stock of BEN was trading at $11.385 on 17 September 2019 (AEST 02:27 PM), down 0.044% from its previous closing price. The company has a market cap of $5.6 billion and approx. 491.58 million outstanding shares. The 52-week high and low value of the stock is at $11.740 and $9.370, respectively. The stock has generated a positive return of 18.49% in the last six months and 9.34% on a year-to-date basis. BEN has an annual dividend yield of 6.15%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.