The below mentioned financial stocks have come up with significant updates today (i.e., 23 August 2019). Letâs take a closer look at these updates and how these stocks have performed lately.

Commonwealth Bank of Australia (ASX:CBA)

One of the leading banks of Australia (in terms of market cap), Commonwealth Bank of Australia (ASX: CBA) is currently in the process of divesting its Australian life insurance business (CommInsure Life) to AIA Group Limited.

In an update provided on 23rd August 2019, the bank announced that it has entered into further agreements to progress the planned divestment which has been subject to ongoing regulatory approval processes.

From this transaction, CBA expects to receive proceeds of around $2,375 million. This amount is $150 million lesser than the original sale price. The revised transaction path which is comprised of a joint co-operation agreement, reinsurance arrangements, partnership milestone payments and a statutory asset transfer, is subject to various Australian regulatory approvals, the entry into reinsurance arrangements as well as life insurance entity board approvals.

Under the joint co-operation agreement, the full economic interests associated with CommInsure Life will be transferred to AIA, and this agreement is expected to be implemented before the end of 1H FY20.

It is expected that the revised transaction will result in a pro forma increase of around 35 â 40 basis points in the Groupâs CET1 ratio as at 30 June 2019.

On 23 August 2019, CBA announced the appointment of highly experienced Ms. Carmel Mulhern for role of Group Executive Group General Counsel and Governance and Mr. Scott Wharton for the role of Group Executive, Program Delivery. With these two announcements, CBA has further increased the capability and capacity of the Executive Leadership Team.

Ms. Carmel Mulhern is a lawyer with more than 25 years of experience and currently she is working for Telstra corporation where she is the Group General Counsel and Group Executive Legal and Corporate Affairs.

Scott Wharton has more than 20 years of experience in the financial services industry globally, and he is currently the Chair of the University of Technology Sydneyâs Business Schoolâs Advisory Board, a board member of Supply Nation.

The bank has recently released its FY19 results in which it has reported a cash NPAT of $8,492 million in FY19.

Stock Performance: CBAâs stock has provided a return of 5.36% in the last six months as on 21 August 2019. The stock is trading at a PE multiple of 15.880x with an annual dividend yield of 5.59%. Its 52 weeks high price is $83.990 and its 52 weeks low price is $65.230 with an average volume of 3,210,975. At the time of writing i.e., 23 August 2019 (1:43 PM), the stock was trading at a price of $77.250 with a market capitalisation of circa $136.49 billion.

Australian Finance Group Ltd (ASX:AFG)

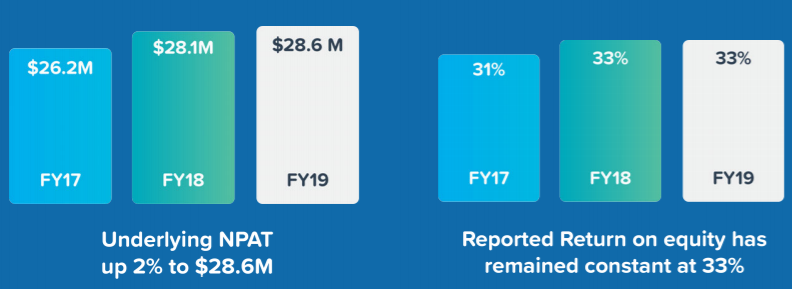

Financial services group, Australian Finance Group Ltd (ASX: AFG) has unveiled its FY19 results today. Despite significant pressures on the wider financial services industry, AFG was able to deliver a solid full-year profit in FY19. The groupâs underlying NPAT increased by 2% to $28.6 million while its reported return on equity remained constant at 33% in FY19.

Underlying NPAT and Reported return on Equity Snapshot (Source: Company Reports)

Underlying NPAT and Reported return on Equity Snapshot (Source: Company Reports)

During the year, the total revenue of the group increased by 7% to $660 million, driven by growth in AFG Securities and longer loan lives.

The result was underpinned by the following:

- AFG Securities loan book growing by 50% to $2.06 billion and 108% increase in settlement volumes in the securitisation programme to $1.06 billion;

- Offset by higher BBSW being absorbed by the business for a period to focus on AFG Securities loan book growth;

- Increased residential trail book of 7% to $147.4 billion and longer loan lives;

- Decreased residential settlements of 11% to $31.3 billion; and

- Decreased commercial settlements of 11% to $2.33 billion.

The increased AFGS loan book is providing a strong platform to generate increased ongoing cashflow and earnings in future years. The group has reported excellent returns from the investment in Thinktank and solid growth in AFG Business platform settlements. FY19 results are demonstrating the robust nature of the companyâs business in a challenging market.

Net cash flows from operating activities were $27.8 million in FY19. At the end of FY19, AFG had a strong debt-free balance sheet which is providing the platform for future investment in organic or inorganic growth opportunities.

The group declared a final dividend of 5.9 cents per share fully franked, taking the total dividends for FY19 to 10.6 cents per share.

In FY19, the company successfully priced its $500 million AFG 2019-1 Trust RMBS issue. After receiving strong oversubscription, the deal was upsized from $350 million.

Recently on 12 August 2019, AFG announced that it has entered into a binding conditional implementation deed to merge with Connective Group Pty Ltd, demonstrating the companyâs ambition of growing its business.

Stock Performance: AFGâs stock has provided a return of 77.60% in the last six months as on 22 August 2019. The stock is trading at a PE multiple of 14.340x with an annual dividend yield of 4.68%. Its 52 weeks high price is $2.390 and its 52 weeks low price is $0.840 with an average volume of 480,271. At the time of writing i.e., 23 August 2019 (1:43 PM), the stock was trading at a price of $2.205, down by 0.676% intraday, with a market capitalisation of circa $476.88 billion. It is to be noted that the stock is trading near to its 52 weeks high price.

MyState Limited (ASX:MYS)

National diversified financial services group MyState Limited (ASX: MYS) has also released its FY19 results today.

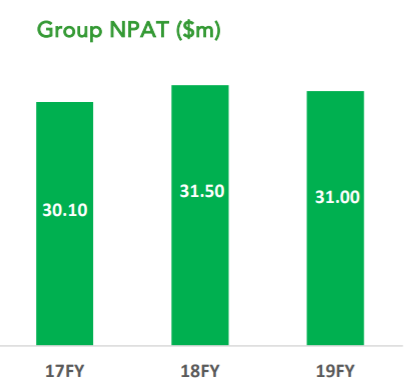

For FY19, the company reported a NPAT of 30.987 million, a decrease of 1.5% on last year. The earnings per share of the company decreased by 2.31% to 34.17 cents per share as compared to the pcp while return on equity decreased 35bps to 9.70%. Following the release of the FY19 results, the companyâs stock was uplifted by 1.965% during the intraday trade as on 23 August 2019 (AEST: 1:43 PM).

Group NPAT Graph for Last three years (Source: Company Reports)

FY19 results were impacted by a decrease in the net interest margin (NIM), which declined 17bps on the prior year. The decline in net interest margin was due to the competitive pressures as well as due to the increase in the Bank Bill Swap Rate (BBSW) benchmark in the first half.

Although the company struggled in the first half of FY19 due to challenging conditions, the second half was benefitted due to the above system lending growth, ongoing disciplined cost management and lower funding costs.

MyState Bankâs total loan book exceeded $5 billion in FY19. The company achieved a lending growth of close to $500 million in FY19.

While providing the outlook, the company informed that itâs business is now realising the benefits from an extended period of significant investment in digital technology platforms. In FY2020 the company will keep its focus on building customer advocacy and grow the customer base nationally, as well as it will try to pursue further operating efficiencies.

Stock Performance: MYSâs stock has provided a negative return of 1.93% in the last six months as on 22 August 2019. The stock is trading at a PE multiple of 13.760x with an annual dividend yield of 6.28%. Its 52 weeks high price is $4.940 and its 52 weeks low price is $4.020 with an average volume of 86,413. At the time of writing i.e., 23 August 2019 (1:43 PM), the stock was trading at a price of $4.670, up by 1.965% intraday, with a market capitalisation of circa $416.97 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.