Undoubtedly, financial sector of Australia, especially the banking institutions form the crux of the economy, with every sector circling around them. This fact is proven as in entirety , the stature of banks in Australia has remained unchanged and strong over past century, with major banks accounting for a large share of the economyâs output, employment as well as driving equity market performance.

Australia has a competitive and advanced financial network with a robust regulatory system governing the banking industry. Currently, the banking institutions have been a hot topic of discussion for market experts and governing bodies, as the economy deals with The Royal Commission, consecutive RBA interest rate cuts and the constant housing bubble bursting.

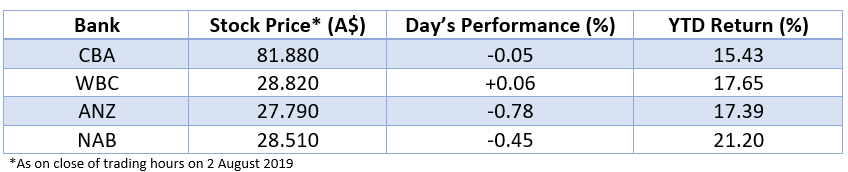

Post close of the market trade on 2 August 2019, S&P/ASX 200 Financials Sector was down by 0.4 per cent or 26 basis points to 6,454.4.

Challenging Outlook for Retail banks?

Market experts are largely concerned about the declining profitability in retail banking. The bleakness of the Australian banking sector continues to prevail as the UBS Group and JP Morgan Chase & Co, have devalued one of Australiaâs biggest bankâs ratings. The Commonwealth Bank of Australia (ASX: CBA) has been downgraded to the status of âsellâ and âunderweightâ by the two financial giants. Experts believe that the regulatory uncertainty and prevailing profit pressures due to the low interest rates have triggered the move.

Whatâs worrisome and thought-provoking is the fact that the decision to downgrade the bankâs positioning was made at the beginning of the reporting season. CBA would be releasing its earningâs report in mid next week, while market experts eagerly await to recognise the current standing and future propositions of the bank.

Moreover, it has recently taken a leap in the digital banking space. The bank has plans to utilise the booming artificial intelligence technology to advise its customers (over 5 million) on the banking front on matters dealing with what to with their money, whether a tax return should be saved, if government subsidies can be claimed, advise on their digital subscriptions and so on. The approach is anticipated to be a step in pacing up with rising competition in the concept of neo-banks in the digital domain.

What is new in the divestment space of CBA?

On 2 August 2019, CBA pleasingly notified that it had reached a desirable milestone and had successfully completed the divestment of its global asset management business, Colonial First State Global Asset Management to Mitsubishi UFJ Trust and Banking Corporation. Subject to completion adjustments, the final sale proceeds are $4.2 billion, and the transaction would most likely deliver an increase of approximately $3.1 billion of Common Equity Tier 1 capital.

The sale is expected to be a huge leap towards the bankâs strategy to become a simpler, better bank, creating significant value for its stakeholders and proving to be an optimistic step for the CFSGAM clients and employees.

Big 4 Banking Stocks on ASX

Australiaâs Banking sector is characterised by four major banks- Australia and New Zealand Banking Group (ASX: ANZ) , Westpac Banking Corporation (ASX:WBC), Commonwealth Bank of Australia (ASX:CBA) and National Australia Bank (ASX: NAB).

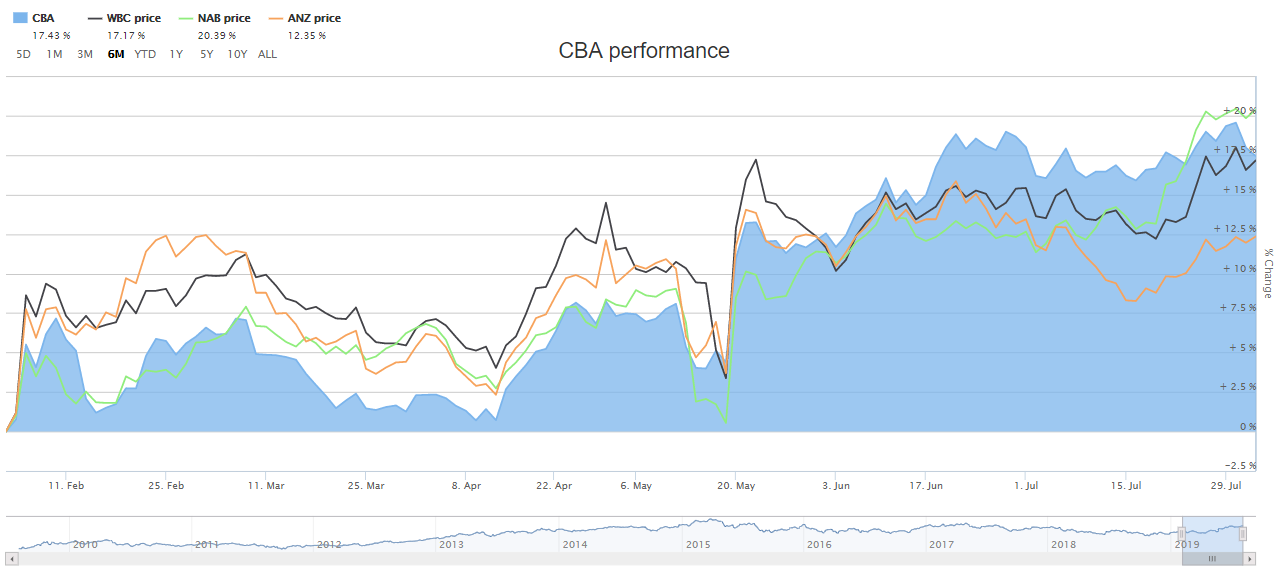

Big 4 Banking Stocks Returns over last 6 months (Source: ASX)

The above graphs depict the 6-month performance of the stocks of these banks, and strikingly depicts a similar pattern. After a downfall in mid-May, the stocks have improved their performance.

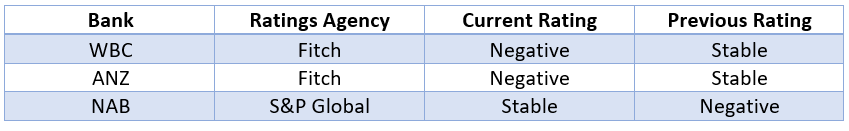

The Rating Game of the Big Four Banks

Besides the CBA, the other three big banks have also witnessed revised ratings from global agencies. Let us screen through the same:

The S&P Global Ratings has revised its outlook for all the four banks and a range of their strategically important subsidiaries to âStableâ from âNegativeâ, depicting that the Morrison Government is in support of APRAâs release on loss absorbing capacity.

Let us now look at two other banks, apart from the major four, and understand their performance and updates:

Bank of Queensland Limited (ASX: BOQ)

BOQ is a leading regional bank in the country and has over 180 branches across Australia. It is in the business since 1874 and was listed on the ASX in 1971.

Stock Performance: Post trading hours on 2 August 2019, the BOQ stock was valued at A$9.190, down by 0.86 per cent relative to its last trade. The market capitalisation of the company is A$3.76 billion with ~406 million outstanding shares. The stock has generated a YTD return of -1.89 per cent.

APRA Prudential Standard APS 330- Public Disclosure: On 26 July 2019, the company notified that the Board had set the Common Equity Tier 1 Capital target range between 8.25 and 9.5 per cent and the Total Capital target range between 11.75 and 13.5 per cent. As at 31 May 2019, the Common Equity Tier 1 Capital Ratio was 8.9 per cent and the Total Capital Ratio was 12.3 per cent.

New Executive on Board: On 25 July 2019, the company welcomed Mr Peter Sarantzouklis as its Group Executive BOQ Business, with his term effective 12 August 2019.

MyState Limited (ASX: MYS)

Company Profile: Formed in 2009 due to a merger of MyState Financial and Tasmanian Perpetual Trustees, MYS is the non-operating holding company of a diversified financial services group. Its retail segments include Tasmanian Perpetual Trustees and MyState Bank.

Stock Performance: Post trading hours on 2 August 2019, the MYS stock was valued at A$4.590, down by 1.08 per cent, relative to its last trade. The market capitalisation of the company is A$422.43 billion with ~91 million outstanding shares. The stock has generated a YTD return of 3.11 per cent.

FID to acquire MYSâs financial planning business: On 17 June 2019, the company notified that it had signed a sales agreement with Fiducian Group Limited (ASX:FID), end-to-end financial services company, for the sale of its retail financial planning business in Tasmania. As per the agreement, it was to be paid $3.5 million by FID for the sale of the financial planning client book with more than $340 million in funds under advice.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.