Diversified financial services group, MyState Limited (ASX: MYS) is going to divest its retail financial planning business in Tasmania. In an announcement made on Monday, 17 June 2019, the company announced that it has entered into a sale agreement with Fiducian Group Limited (ASX:FID) under which FID will acquire MyStateâs retail financial planning business. FID is going to pay around $3.5 million to acquire the MyState financial planning client book with over $340 million in funds under advice. It is expected that the transaction will be completed before 30 June 2019.

Despite the release of this news, the stock of MyState Limited traded flat with a daily volume of 73,777 while the stock of Fiducian Group Limited witnessed an uplift of 2.708%, during todayâs intraday trade (AEST 03:38 PM).

National financial services company, Fiducian Group Limited (ASX: FID) currently has $2.7 billion funds under advice and 40 practices nationally and in this financial year, it has already completed acquisitions of financial planning clients with over $219 million in funds under advice.

By acquiring MyStateâs retail financial planning business, Fiducian Group will be able to consolidate its presence in Tasmania and will have access to quality financial planning services. Further, Fiducian Group will enjoy the benefits of Trustee and Home Lending services from MyState. It is expected that this divestment will allow MyState Group to simplify its business and invest for growth in the areas where it can have a competitive advantage.

Under the transaction, Fiducian and MyState will also enter into an ongoing referral arrangement, which will involve ongoing referrals for Financial Planning from MyState to Fiducian Group and Home Mortgage Lending and Trustee services from Fiducian group to MyState.

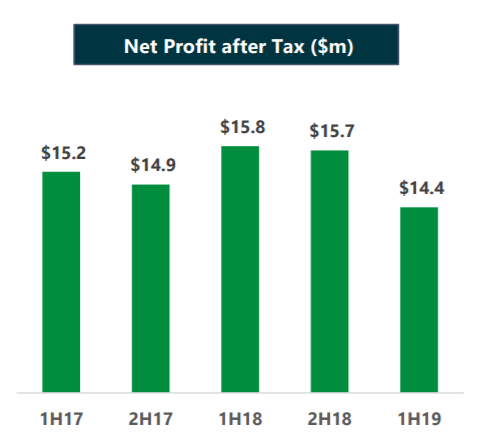

In the first half of FY19, the company reported a net profit after tax of $14.4 million compared with $15.8 million in the previous corresponding period (pcp). Further, the companyâs earnings per share decreased by 9.6% to 15.87 cents per share in H1 FY19 and return on equity decreased by 112 bps to 9.0%. The half year result for the Group was largely impacted by a decreasing net interest margin, which declined 21 bps as compared to pcp, reflecting increased competition for wholesale and retail deposits, as well as a higher Bank Bill Swap Rate, which disproportionately elevated funding costs.

NPAT Trend (Source: Company Reports)

During the half year period, the companyâs banking loan portfolio increased by 9.8% on the pcp. Moreover, the banking business continued to increase its customer base across the eastern seaboard of Australia, with the proportion of loans outside of Tasmania increasing from 54.5 percent to 56.3 percent since 30 June 2018.

In the past six months, the stock of MyState Limited has provided a negative return of 0.89% as on 14 June 2019. At the time of writing i.e., 17 June 2019 (AEST 12:36 PM), the stock of MYS was trading at $4.460 with a market capitalization of circa $406.04 million.

Now let us take a quick look at a few other financial services providers which trades on the ASX platform.

Commonwealth Bank of Australia (ASX:CBA)

Australia's leading provider of integrated financial services, Commonwealth Bank of Australia (ASX: CBA) witnessed an improvement in its share price in todayâs trading session. At the time of writing i.e., 17 June 2019 (AEST 03:38 PM), CBAâs stock was up by 0.878% on ASX as compared to last dayâs close price, trading at a price of $80.470 with a market capitalization of circa $141.21 billion.

CBA recently announced that it has reduced its total voting power in The Star Entertainment Group Limited from 7.18% to 5.61%. CBA also reduced its voting power in Sheffield Resources Limited from 6.61% to 5.69%. On 7th June 2019, CBA announced regarding entering into an agreement to sell Count Financial Limited to CountPlus Limited for a transaction value of $2.5 million.

In 2019 March quarter, CBA witnessed sustained volume growth in its core franchise and reported Common Equity Tier 1 (capital) ratio of 10.3%. During the quarter, the credit quality of the Groupâs lending portfolios remained sound, however, troublesome and impaired assets increased to $7.2 billion. CBA ended the March quarter with Net Stable Funding Ratio of 13% and Liquidity Coverage Ratio (LCR) of 134%.

CBAâs stock has a PE ratio of 15.540x and a dividend yield of 5.4%. In the past six months, the stock of CBA has provided a return of 15.93% as on 14th June 2019. Its 52 weeks high price is set at $81.250 and 52-weeks low price at $65.230 with an average volume of ~2,986,391.

Westpac Banking Corporation (ASX:WBC)

One of Australiaâs leading banks, Westpac Banking Corporationâs (ASX: WBC) stock was up by 0.646% in todayâs trading session (AEST 0.3:38 PM), trading at a price of $28.060 with a market capitalization of circa $96.12 billion.

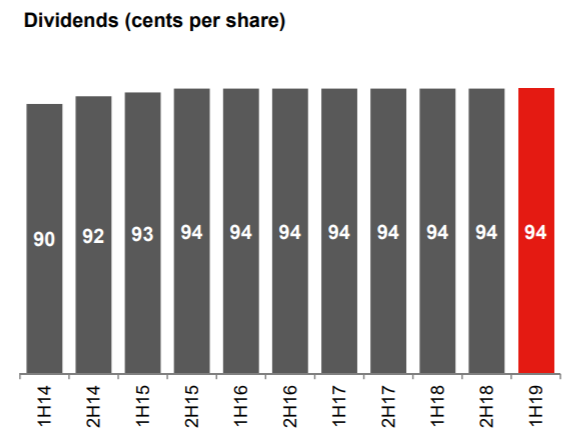

The bank recently declared a dividend of 94 cents per share, 100% franked with a record date of 17th May 2019 and Payment date of 24th June 2019.

Westpac Dividend Summary (Source: Company Reports)

In the first half of FY19, the bank reported Statutory net profit of $3,173 million and cash earnings of $3,296 million, both down by 24% and 22%, respectively, as compared to pcp. For the half year period, the bank reported Cash earnings of $3,296 million and cash earnings per share of 96 cents. During the period, the bank dealt decisively with outstanding issues, including remediation and resetting its wealth strategy, to make sure that it is efficiently and sustainably serving its customersâ financial needs. Westpac reported Common equity Tier 1 (CET1) capital ratio of 10.64% and Return on equity (ROE) of 10.4% for the half year period.

Westpac recently forecasted that RBA (Reserve Bank of Australia) will go for a total of three cash rate cuts in 2019, predicting the cash rate to go down to 0.75%.

In the last six months, Westpacâs stock has provided a return 12.06% as on 14th June 2019. WBCâ stock is trading at a PE multiple of 13.350x with a dividend yield of 6.74 percent. WBCâs stock has a 52 weeks high price of $30.440 and 52 weeks low of $23.300 with an average volume of ~7,315,471.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.