Australian equity market closed in green today at 6590.3, dragged up by consumer discretionary, staples, energy and financial sector. Amidst domestic and macro developments including reporting season of ASX listed companies and ongoing global trade war concerns, investors are closely eyeing the major updates by the businesses in the market.

This article talks about the recent updates made by the three companies who have provided insights on the developments related to the strategic review, a potential merger or full-year results.

Letâs look at the updates and announcements made by these three companies.

Thorn Group Limited (ASX: TGA)

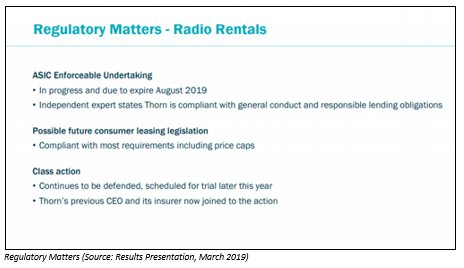

Thorn Group is involved in management of debt collection and receivable services, commercial and consumer leasing products and financial solutions. On 12 August 2019, the company provided a strategic options review & CEO update. Accordingly, the company had announced its plans related to strategic review in April 2019. As per the company, the strategic review continues to advance nearing completion, and a number of areas for improvement are underway.

Radio Rentals

Reportedly, the demand for consumer leasing continues transitioning from store origination to online. A store rationalisation process was commenced, following the review of performance & productivity of the store network & lease maturity dates. Besides, the company had closed 3 stores in the recent weeks, and an additional 5 stores are scheduled to be closed over the next 30 days.

Meanwhile, $1.1 million in one-off costs would be incurred in store closures, and the closing of the stores would reduce retail costs of doing business. Further, the company would operate 61 stores nationwide along with online capability.

CEO & Trading Update

The announcement noted that Time Luce, CEO of the company, has presented his intention to leave & pursue other interests. Besides, he continues to work with the Board through the strategic review process & recruitment of replacement before exiting.

Reportedly, the outlook of the business remains challenging with declining group revenues, fluctuating arrears and general market uncertainty in the retail sector. Besides, the company intends to provide additional updates during AGM on 30 August 2019.

Corporate Costs

Reportedly, the company is progressing with plans to reduce expenses. However, legal costs in defending the ongoing class action and advisory costs incurred due to strategic review continue to escalate the corporate costs.

On 12 August 2019, TGA was trading at A$0.25, down by 7.407% by the close of market trading.

Australian Finance Group Ltd (ASX: AFG)

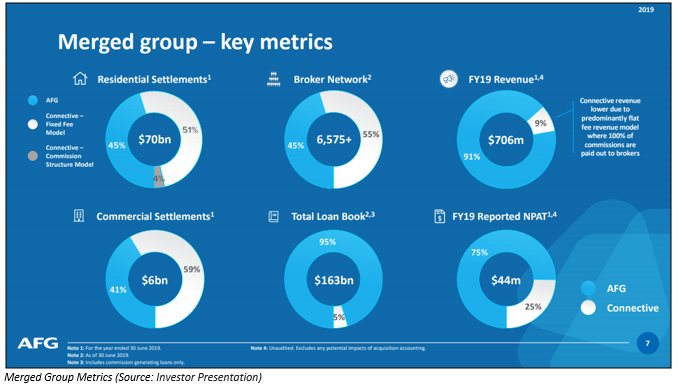

On 12 August 2019, the company released multiple announcements related to the merger & FY19 results. Accordingly, the mortgage broker had entered into a binding conditional implementation deed to merge with the mortgage aggregation business of Connective Group Pty Ltd.

Reportedly, the transaction is valued at $120 million which includes a cash payment of $60 million to Connective, and 30,886,441 AFG shares. The company would fund the cash component of the transaction through a new corporate debt facility, and it is expected that the transaction would be EPS accretive.

Meanwhile, the EPS accretive (pre-synergies) would be achieved after integration during the first full financial year. The company expects to maintain a dividend pay-out ratio in the range of 60 to 80 per cent.

As per the release, the transaction is subject to court approval, shareholder approval of Connectiveâ shareholders, an approval from the Australian Competition and Consumer Commission. Besides, the transaction might be subject to AFG shareholders on a contingency basis, and rest approvals as required for similar transactions.

Key Terms

- The shares component of the transaction is valued at $1.9426, which is the 10-day VWAP preceding 9 August 2019.

- The shares issued to Connective would be escrowed for 12 months, 25 per cent would be released post 12 months, and an additional 25 per cent would be released after 18 months from completion. After 24 months, all the pending escrowed shares will be released.

- Connective would be entitled to significant interest in AFG, executive management roles and a board seat in AFG board for the CEO of Connective.

- The Transaction presents opportunities for distribution of the companyâs securitised products through the combined network of brokers.

Reportedly, the combined entity would have more than 6,575 brokers, and mortgage settled worth $75 billion in FY19. Besides, Connective had generated FY19 revenue of $63 million, and pro forma reported FY19 NPAT of $10.9 million (unaudited).

FY19 Full Year Results

As announced previously, the company would report full year results on 23 August 2019. The company expects the results to be consistent with the market consensus estimate. Accordingly, the FY19 revenue would be $642.8 million, reported NPAT to be $33 million. Besides, the residential settlements would be $31.3 billion along with commercial settlement at $2.3 billion, as per the companyâs estimates.

On 12 August 2019, AFG was trading at A$2.270, up by 11.823% by the end of market trading.

Bendigo & Adelaide Bank (ASX: BEN)

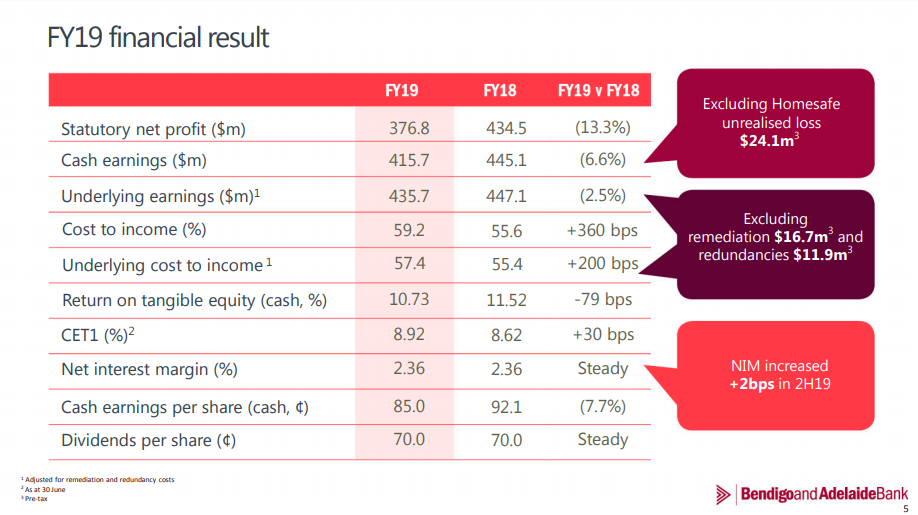

On 12 August 2019, the bank reported results for the full year ended 30 June 2019. Subsequently, the bank declared a final dividend of 35 cents per share (100% franked). The dividend has an ex-date of 2 September 2019 with the record date of 3 September 2019 and the payment date of 30 September 2019.

Reportedly, the bank recorded statutory net profit of $376.8 million in FY19, down 13.3 per cent from $434.5 million in FY18. The cash earnings post tax were $415.7 million, down by 6.6% over the prior corresponding period. Besides, the net interest margin was 2.36 per cent, unchanged over the pcp while improving 2 basis points in the second half compared with the first half. The bad & doubtful debts were down by 28.8 per cent to $50.3 million on pcp.

As per the release, the total lending improved by 1.1% to reach $62.1 billion, and better growth was achieved during the second half of the year. During the second half period, the residential lending grew by 4.3%, and agribusiness improved by 12.8 per cent due to seasonality. Besides, the bank divested Bendigo Financial Planning during the year. The net profit was impacted by the remediation, redundancy cost, unrealised losses in Homesafe underpinned by the decrease in property valuations in Melbourne & Sydney.

Reportedly, the new customer grew by almost two-thirds for the full-year while retention increased to 93.5 per cent. The bank also launched the next-gen digital bank, became the first bank to offer digital home loan application and assessment, under the brand â Bendigo Express. Meanwhile, the numbers of Mobile Relationship Managers (MRM) reached 101, and this year MRMs were responsible for writing residential loans in excess of $1 billion.

Remediation & Operating Expenses

As per the release, the remediation costs for the year were $16.7 million related TO products not operating in line with terms & conditions, and insufficient documentation costs pertaining to Bendigo Financial Planning, which was sold.

Meanwhile, the operating expenses increased by 5.9 per cent over the prior year to reach $954.5 million, which involves remediation & redundancy costs. Besides, the bank is targeting cost to income ratio towards 50 per cent in the medium term.

FY19 Results (Source: FY2019 Result Presentation)

Outlook

Reportedly, the business conditions depict slow and steady growth, and the future growth would be backed by accommodative monetary as well as fiscal policy. Despite the increase in clearance rates in Sydney & Melbourne and positive business confidence, the bank is of view that the sentiment remains somewhat inconsistent.

Besides, the bank is focused on its strategy and market opportunity with prolonged emphasis on unique prospects in key priority markets. The bank intends to invest in capabilities, people and technology. Over the past six months, the foundations have been laid, and the bank would accelerate the organisational change in the coming year.

By the end of the dayâs trading session on 12 August 2019, BEN was trading at A$11.110, up by 3.35% from the previous close.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.